Atal Pension Yojana

The Atal Pension Yojana (APY), introduced in 2015, is an Indian government-backed pension system aimed at providing financial stability to workers in the unorganized sector.

The plan is designed to ensure that everyone has a respectable retirement at the age of sixty by guaranteeing a minimum pension.

Enrolment

To apply, follow the steps below:

- Step 1: The first step is to visit the branch where you have a savings bank account. If you do not have one, open an account.

- Step 2: Fill out the APY registration form with assistance from the bank staff and provide the bank account number, the form can be received online.

- Step 3: The next step is to submit your Aadhaar and mobile phone details. While not mandatory, sharing this information helps with communication and updates.

- Step 4: Lastly, you need to ensure that your savings account has enough funds to cover the monthly/quarterly/half-yearly contributions.

Download The APY Registration Form Online

If you don't have the application form, you can download it online by following these steps:

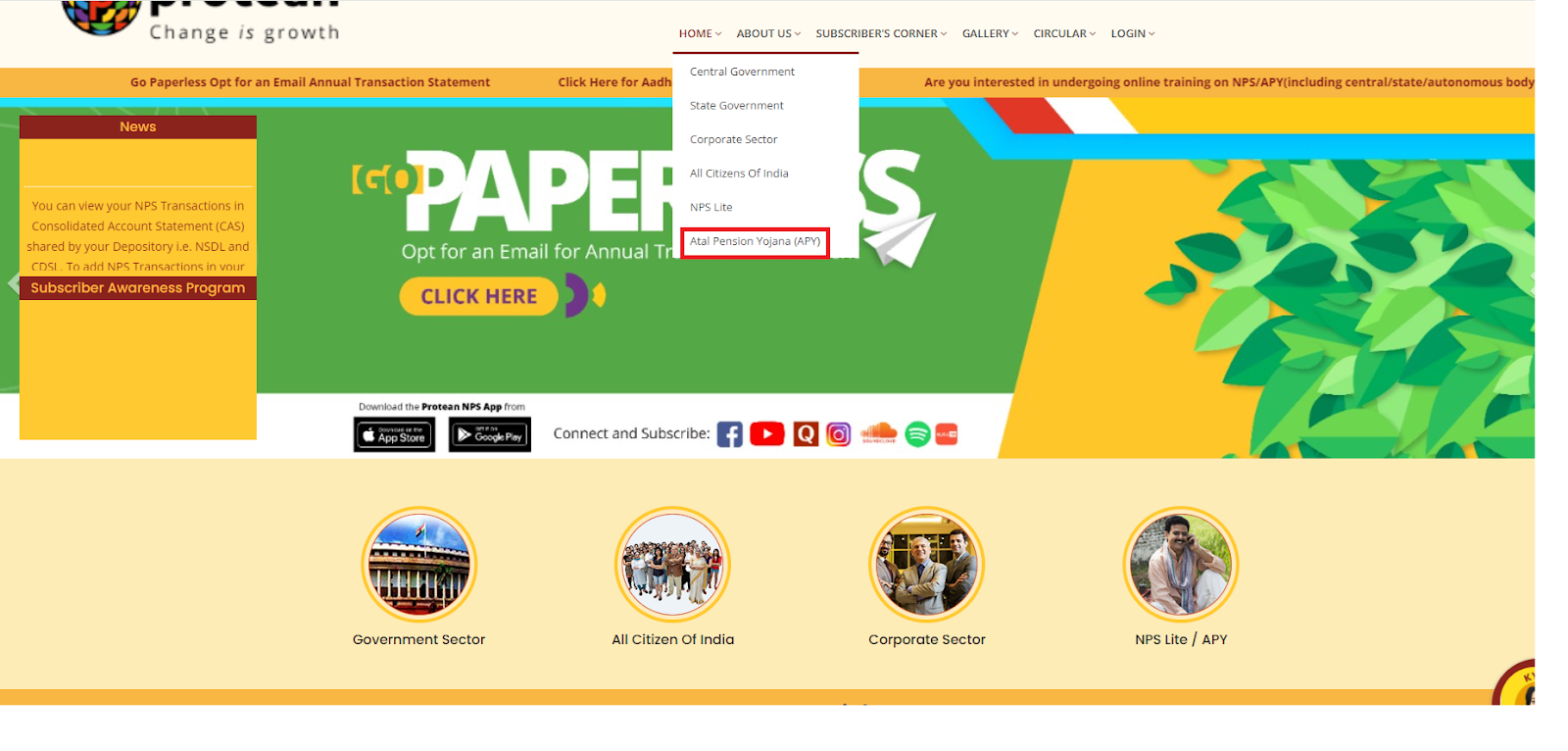

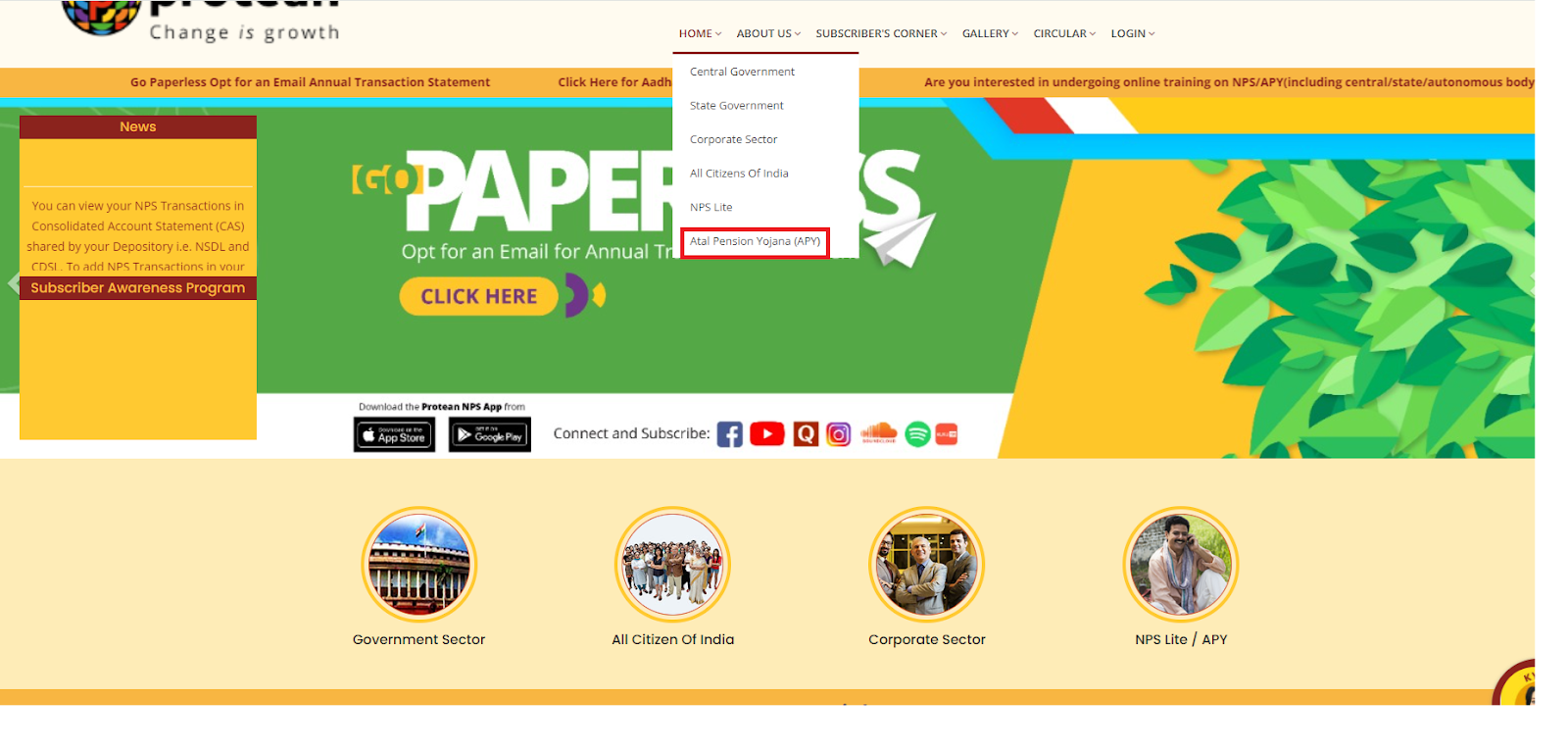

- Step 1: Initially, you need to go to the NPS official website.

- Step 2: Click on home on the homepage, dropdown options appear. From them, click on Atal Pension Yojana (APS).

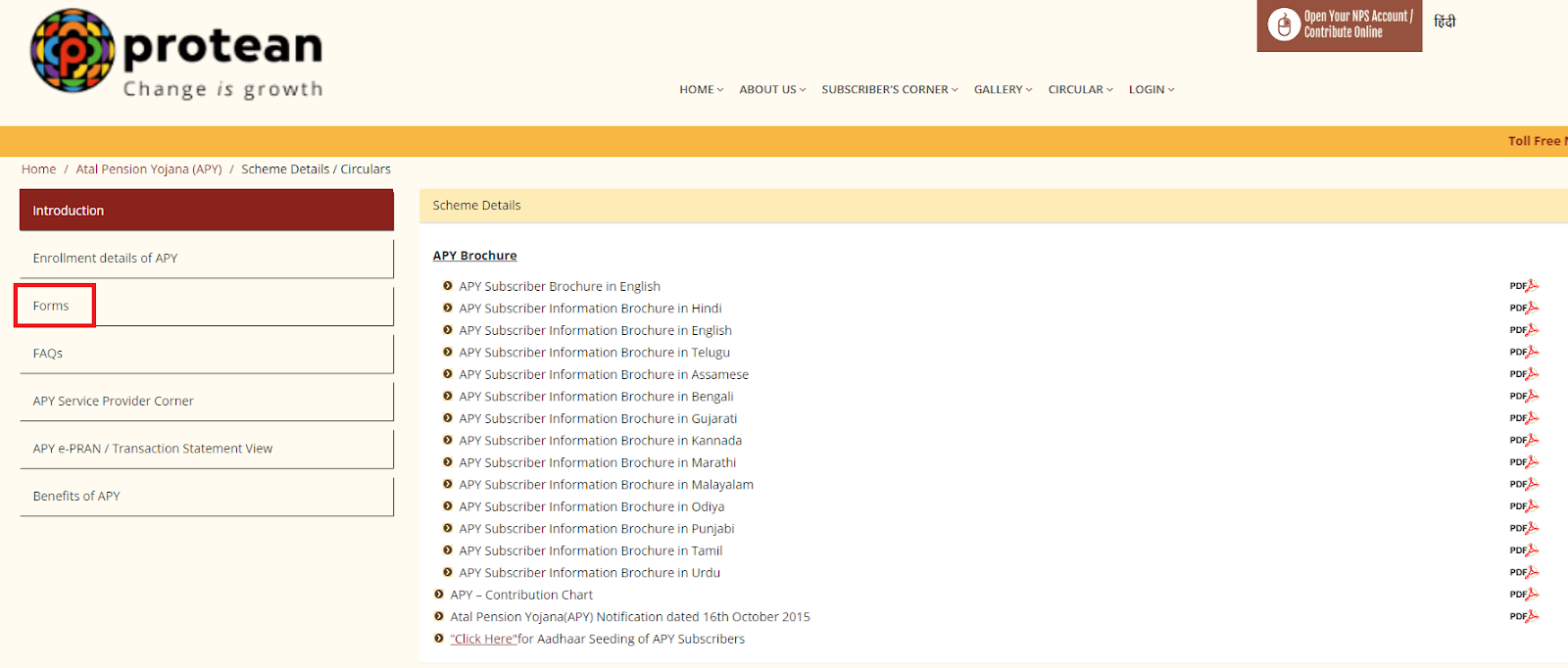

- Step 3: A new window opens, from it click on Forms.

- Step 4: After clicking, you will see a new window with the registration form in PDF format and in different languages. You can download APY Subscriber Form as per choice.

- Step 5: Complete the form accurately and submit it to your bank or post office branch.

Check your Enrollment Details

There are several ways to check your enrollment details for the Atal Pension Yojana:

Online Through the NPS CRA Website

- Step 1: Go to the NPS CRA website: npscra.nsdl.co.in.

- Step 2: Now, under the home menu, click on APY.

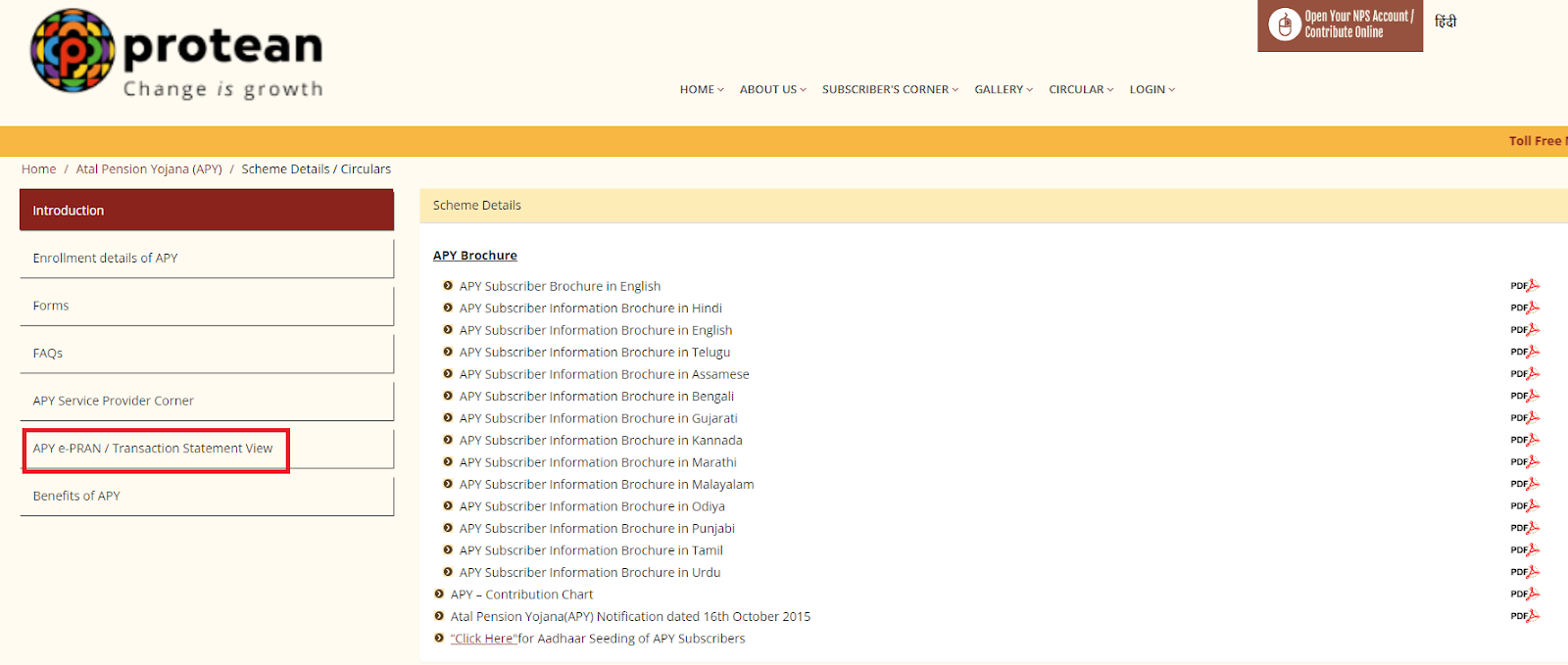

- Step 3: Next, click on "APY e-PRAN/Transaction Statement View."

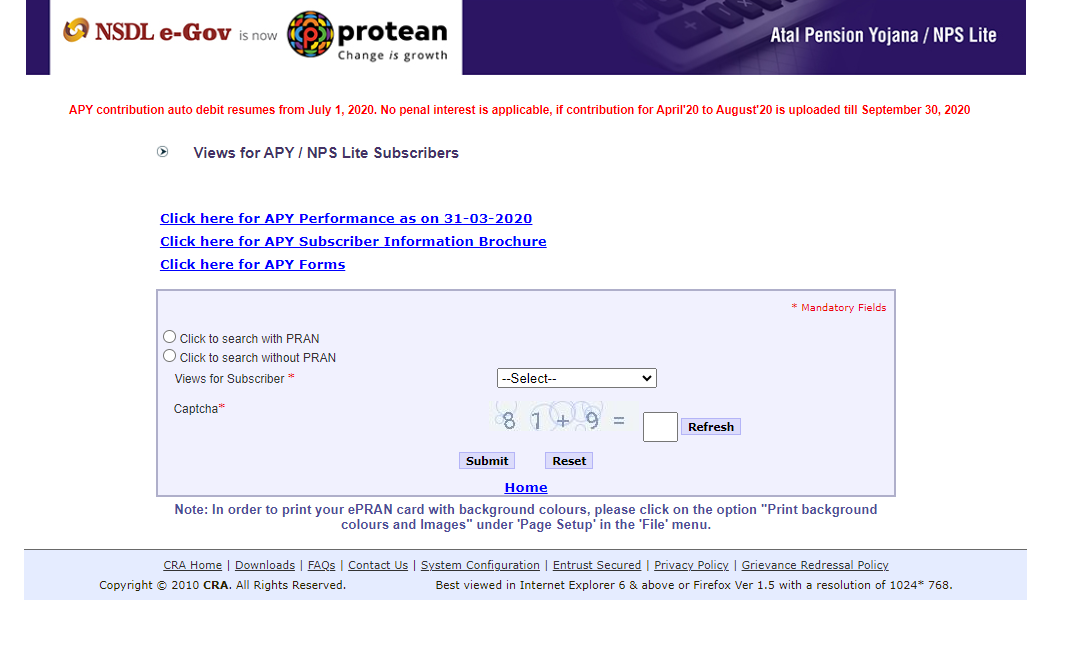

- Step 4: A new window opens, where you have two options:

- With PRAN:

- Enter your 12-digit Permanent Retirement Account Number (PRAN).

- Provide your bank account details.

- Without PRAN:

- Enter your bank account number.

- Provide your name.

- Enter your date of birth.

- With PRAN:

- Step 5: Choose either "Statement of Transaction View" or "APY e-PRAN View" under the "Views for Subscriber" section.

- Step 6: Enter the captcha code and submit to view your enrollment details and transaction history.

Through the APY Mobile App

- Step 1: Download the "APY and NPS Lite" mobile application from the App Store.

- Step 2: Log in with your PRAN details and the OTP received on your registered mobile number.

- View your transaction statement, total holdings, asset allocation, and other account details on the homepage.

By Contacting Your Bank or Post Office

- Step 1: Visit the branch where you enrolled in APY.

- Step 2: Request the bank/post office staff to provide you with your enrollment details and transaction history.

By Calling the APY Toll-Free Number

- Step 1: Call the toll-free number 1800 889 1030 to inquire about your enrollment details.

- Step 2: Provide the required information for verification.

Modes of Contribution and Due Dates

You can set up an auto-debit from your savings account to make monthly, quarterly, or half-yearly contributions to your APY account.

The amount of the contribution is determined by the age at enrollment and the anticipated pension. To prevent fines, make sure your account has a sufficient balance on the due dates.

Withdrawal and Exit Options

Withdrawal and exit options are provided below; you can check them out.

Attaining 60 Years:

- You will receive the guaranteed minimum pension amount you chose when enrolling.

- If the actual investment returns are higher than the assumed returns, you'll receive a higher pension.

- After your demise, your spouse receives the same pension until their death.

- After the death of both you and your spouse, the nominee receives the accumulated pension wealth.

Other Exit Options:

- Voluntary Exit Before 60: You will receive your contributions and net accrued income, but the government co-contribution won't be returned.

- Death Before 60: Your spouse can continue contributing or receive the accumulated corpus.

New Features for APY Subscribers

- Upgrade/Downgrade: Change your chosen pension amount once a year, starting from July 1st, 2020.

- PRAN Card Printing: Download and print your PRAN (Permanent Retirement Account Number) card online.

- Continuation by Spouse: Spouses can continue the account if the subscriber passes away.

- Digital Onboarding (APY@eNPS): Enroll online through eNPS for wider access.

- Grievance Module: Raise and track queries or complaints online.

- Mobile App: Download the APY mobile app to view your account details, transaction history, and recent contributions.

APY Contribution Status

You will receive periodic updates via SMS alerts on your registered mobile number. You can also access your APY account details through the mobile/APY app launched by NSDL or check your physical Statement of Account, which is sent annually to your registered address.

What is Atal Pension Yojana?

The Atal Pension Yojana (APY), formerly known as the Swavalamban Yojana (Self-Support Scheme), is a pension scheme supported by the Indian government, mainly aimed at the unorganized sector.

Announced during the 2015 budget speech by Finance Minister Arun Jaitley, the scheme was officially launched by Prime Minister Narendra Modi on May 9, 2015, in Kolkata.

Its primary goal is to provide economic security to individuals who are no longer working and have retired from their professional careers.

Eligibility Criteria

The APY primarily targets people who work in the unorganized sector, which includes small business owners, drivers, gardeners, and domestic staff. These workers frequently do not have access to official pension schemes.

- Age: Between 18 and 40 years.

- Bank Account: Must have a savings bank account or a post office savings bank account.

Government Contribution

The government offers qualified subscribers a co-contribution to promote early enrollment and offer further assistance. This co-contribution is ₹1,000 a year or 50% of the subscriber's contribution, whichever is less, for the first five years of the scheme.

This is applicable to members of the program who enrolled between June 1, 2015, and March 31, 2016, provided they are either income tax-exempt or do not qualify for coverage under another social security program.

Benefits

- Guaranteed Minimum Pension: You'll receive a minimum monthly pension of ₹1,000, ₹2,000, ₹3,000, ₹4,000, or ₹5,000 at the age of 60, depending on your chosen contribution amount and age of joining.

- Higher Returns: If the actual investment returns exceed the assumed returns, you'll receive a higher pension amount.

- Government Co-Contribution: Eligible subscribers receive government co-contributions, enhancing their pension corpus.

- Tax Benefits: Contributions made to the APY are eligible for tax deductions under Section 80CCD(1) of the Income Tax Act.

- Benefits for Spouse and Nominee: In the event of your death before age 60, your spouse can continue contributing or receive the accumulated pension wealth as a lump sum. After you turn 60, your spouse receives the same pension as you until their death, and the nominee receives the accumulated pension wealth thereafter.

APY Subscriber Contribution Chart

Anyone can access the Subscriber Contribution Chart by visiting the provided link or checking the table below:

| Age of Entry | Years of Contribution | Monthly Pension of ₹1,000 (Indicative Corpus: ₹1.70 lakhs) | Monthly Pension of ₹2,000 (Indicative Corpus: ₹3.40 lakhs) | Monthly Pension of ₹3,000 (Indicative Corpus: ₹5.10 lakhs) | Monthly Pension of ₹4,000 (Indicative Corpus: ₹6.80 lakhs) | Monthly Pension of ₹5,000 (Indicative Corpus: ₹8.50 lakhs) |

|---|---|---|---|---|---|---|

| 18 | 42 | 42 | 84 | 126 | 168 | 210 |

| 19 | 41 | 46 | 92 | 138 | 183 | 228 |

| 20 | 40 | 50 | 100 | 150 | 198 | 248 |

| 21 | 39 | 54 | 108 | 162 | 215 | 269 |

| 22 | 38 | 59 | 117 | 177 | 234 | 292 |

| 23 | 37 | 64 | 127 | 192 | 254 | 318 |

| 24 | 36 | 70 | 139 | 208 | 277 | 346 |

| 25 | 35 | 76 | 151 | 226 | 301 | 376 |

| 26 | 34 | 82 | 164 | 246 | 327 | 409 |

| 27 | 33 | 90 | 178 | 268 | 356 | 446 |

| 28 | 32 | 97 | 194 | 292 | 388 | 485 |

| 29 | 31 | 106 | 212 | 318 | 423 | 529 |

| 30 | 30 | 116 | 231 | 347 | 462 | 577 |

| 31 | 29 | 126 | 252 | 379 | 504 | 630 |

| 32 | 28 | 138 | 276 | 414 | 551 | 689 |

| 33 | 27 | 151 | 302 | 453 | 602 | 752 |

| 34 | 26 | 165 | 330 | 495 | 659 | 824 |

| 35 | 25 | 181 | 362 | 543 | 722 | 902 |

| 36 | 24 | 198 | 396 | 594 | 792 | 990 |

| 37 | 23 | 218 | 436 | 654 | 870 | 1,087 |

| 38 | 22 | 240 | 480 | 720 | 957 | 1,196 |

| 39 | 21 | 264 | 528 | 792 | 1,054 | 1,318 |

APY Calculator

Easily calculate your monthly contribution for the Atal Pension Yojana (APY) scheme. Simply enter your age of enrollment and select your desired monthly pension amount to instantly see how much you'll need to contribute each month. This tool helps you plan your retirement savings effectively by providing accurate and quick calculations.