PMEGP Scheme

The Prime Minister's Employment Generation Programme, launched on August 15, 2008, aims to create self-employment opportunities by providing financial assistance to establish micro-enterprises in rural and urban areas.

It offers subsidies of 15%-35% of the project cost, targeting unemployed youth, traditional artisans, and self-help groups.

PMEGP merges the Prime Minister’s Rojgar Yojana (PMRY) and the Rural Employment Generation Programme (REGP) to enhance earning capacities and foster entrepreneurship.

Application Process

You can submit your application for the PMEGP scheme both online and offline. Below, we have provided a step-by-step guide to help you through the process.

Online Process

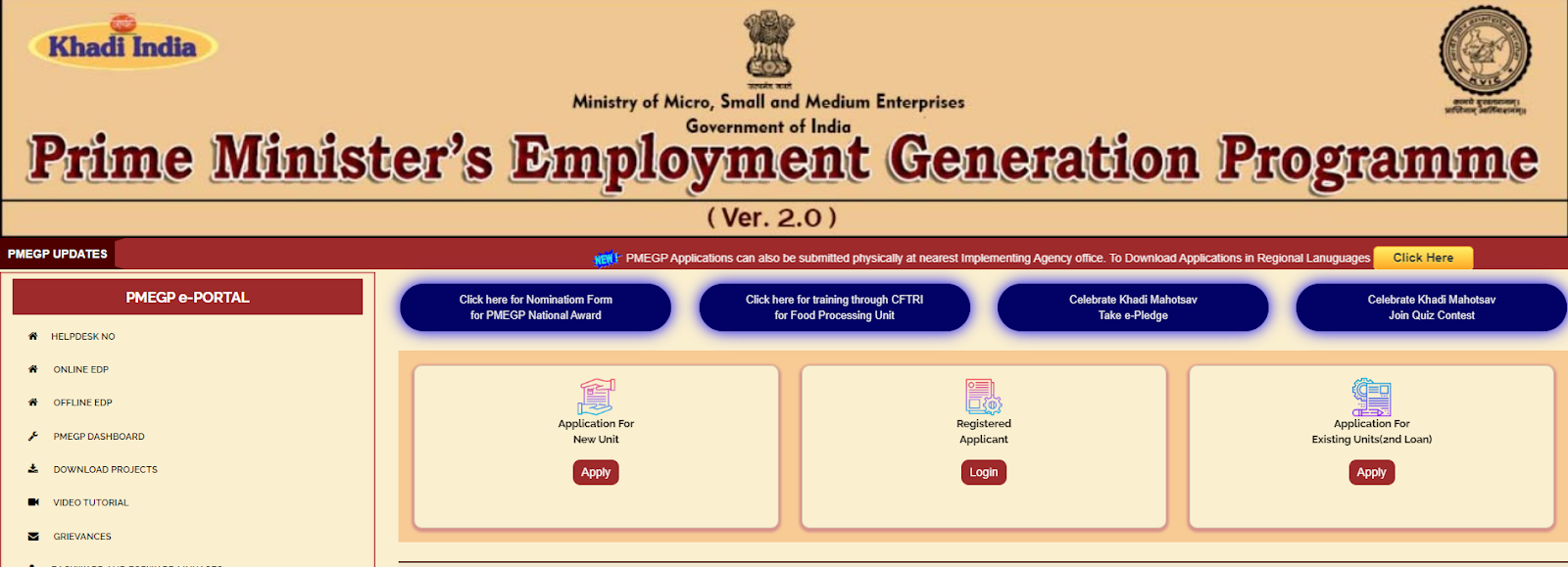

- Step 1: Visit the PMEGP e-portal and access it.

- Step 2: Depending on your situation, select the appropriate application tab:

- Application For New Unit: This option is for those seeking to establish a new micro-enterprise.

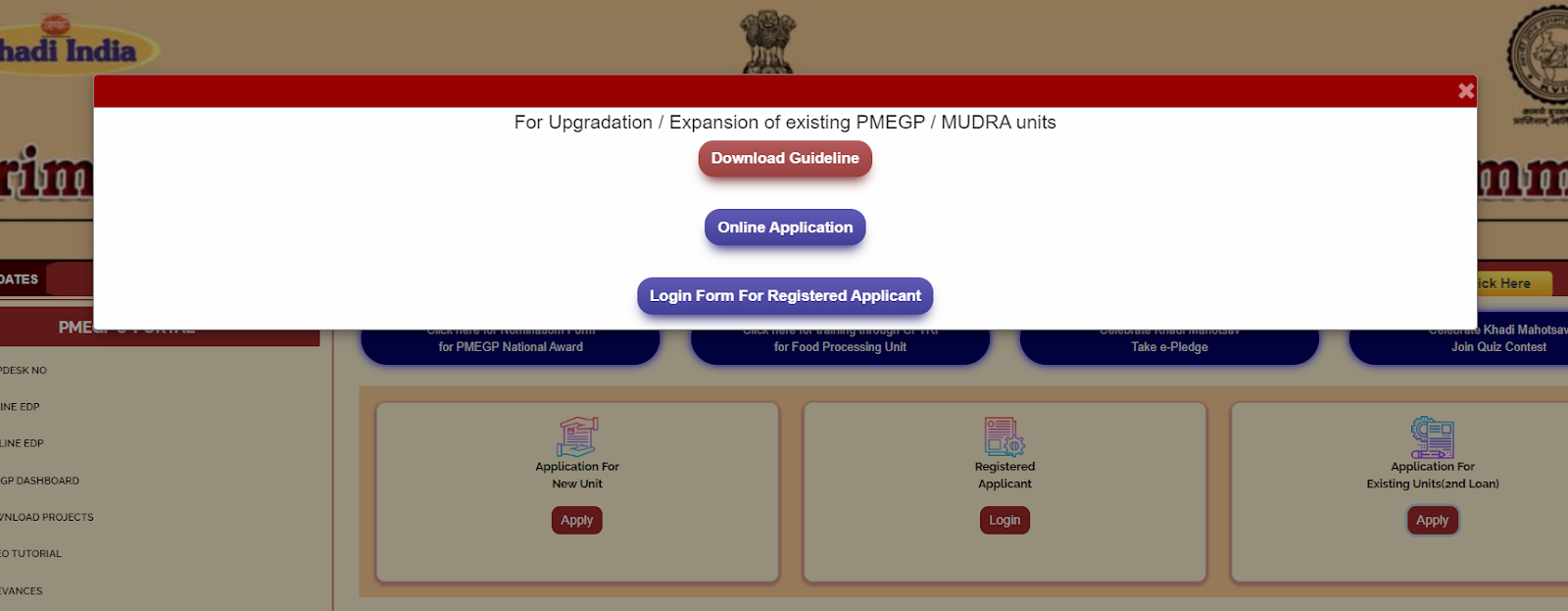

- Application For Existing Units (2nd Loan): This option is for existing PMEGP/REGP/MUDRA unit holders seeking a second loan for upgradation.

- Registered Applicant: This option is for those who have already registered and need to log in.

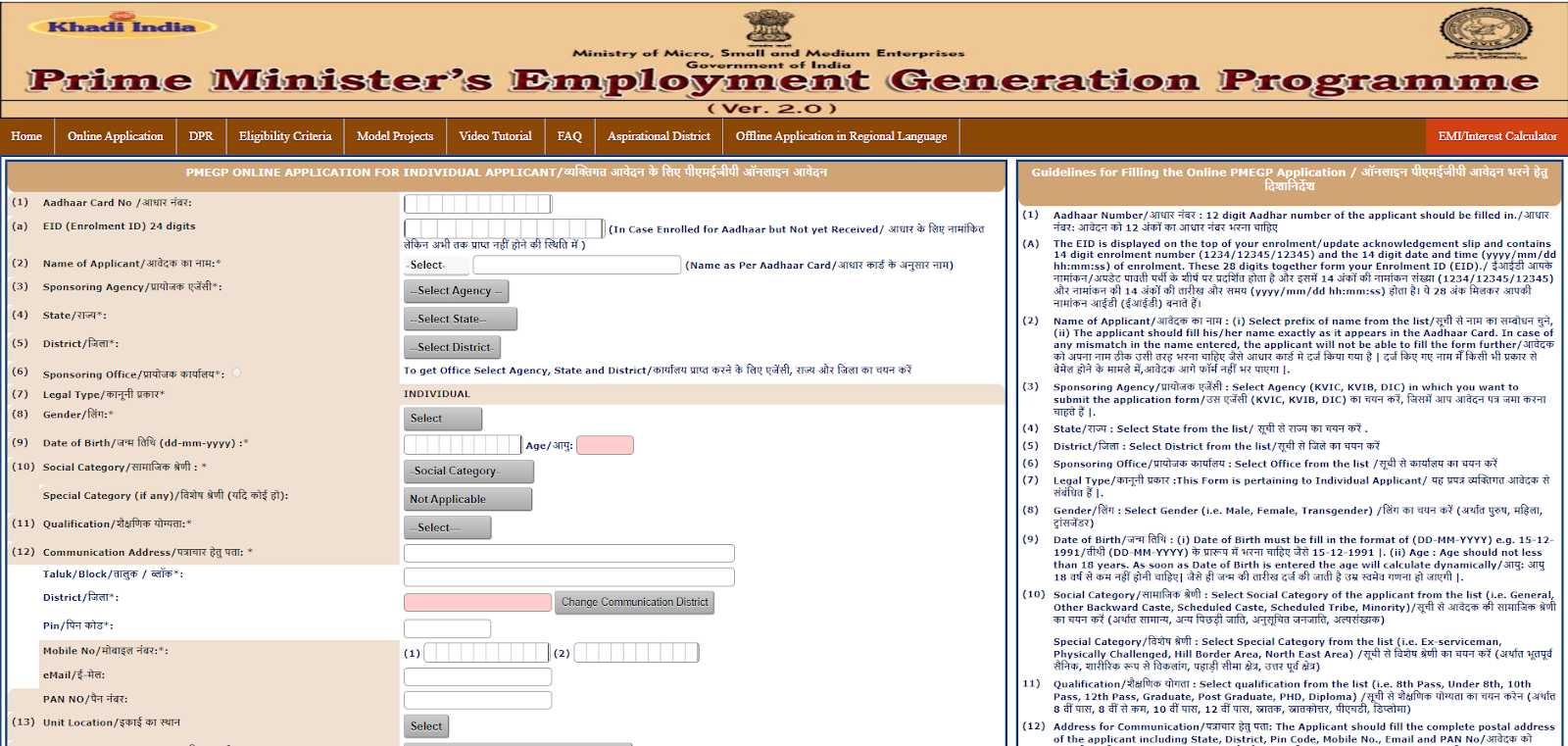

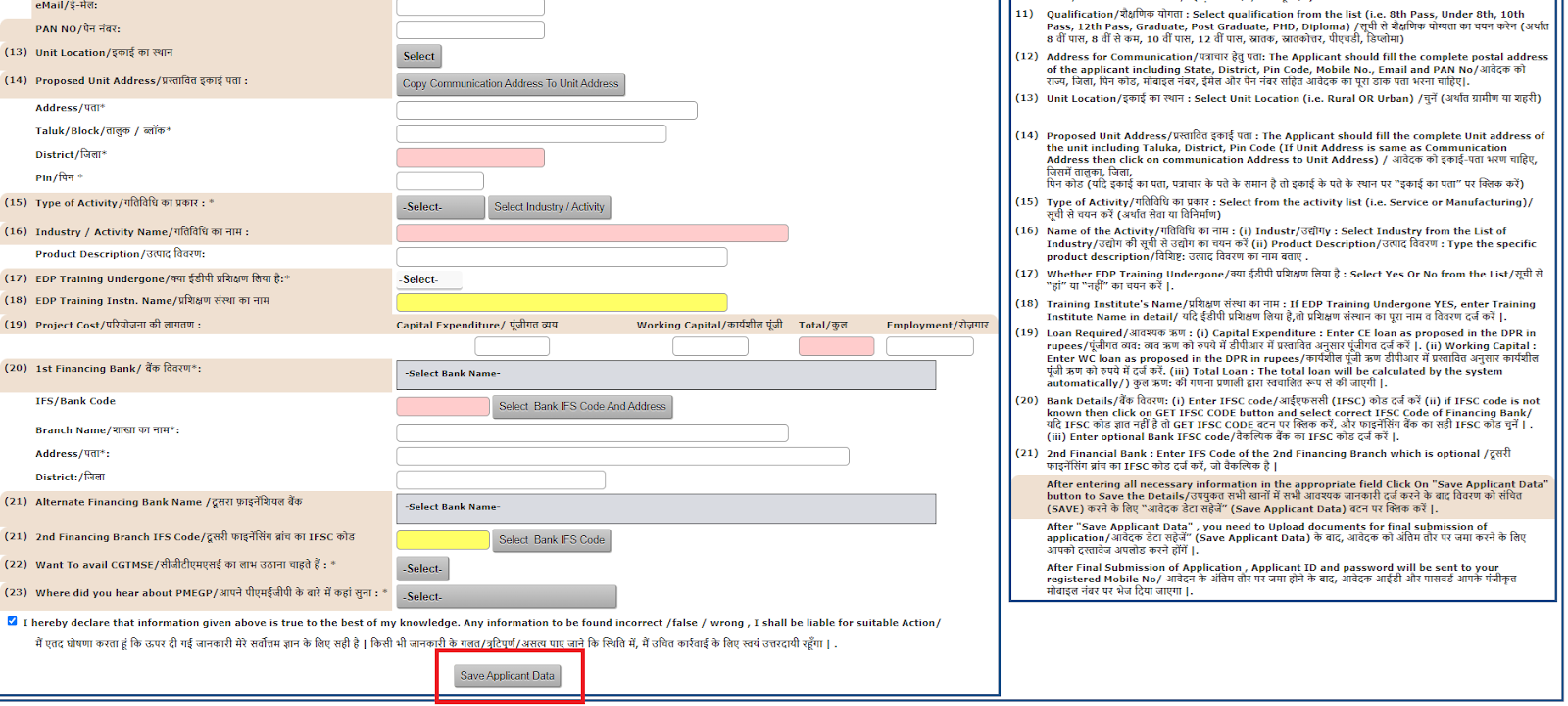

- Step 3: Carefully fill out the online application form, providing all the necessary information. This may include details about yourself, your proposed project, and your background.

- Step 4: Once you have entered your information for the application, click the "Save Applicant Data" button. This will save your progress and allow you to return to the application later if needed.

- Step 5: After saving your data, proceed to the document upload section. Here, you will need to upload scanned copies of all the required documents (explained in the "Documents Required" section below). Ensure the documents are clear, legible, and in the specified format.

- Step 6: Once you have completed all sections and uploaded the documents, submit your application electronically. You will receive a confirmation message or email upon successful submission.

Offline Application

While the online application process is preferred, you can inquire about applying offline for the scheme. Here's what you can do:

- Step 1: Locate the nearest KVIC (Khadi and Village Industries Commission) or DIC (District Industries Centres) office in your area. You can find their contact information on government websites or directories.

- Step 2: Explain your interest in applying for the PMEGP scheme and inquire about submitting an offline application.

- Step 3: The representative will provide details about the offline application process, including:

- Required Documents (These may differ slightly from the online application)

- Submission Procedures

- Contact details for any further assistance

Documents Required

- Identity Proof (Aadhaar Card)

- Address Proof (Ration Card, Utility Bill)

- Caste Certificate (if applicable)

- Educational Qualification Certificate (if applicable)

- Project Report (a detailed plan outlining your business idea)

- Skill Development Training Certificate (if applicable)

- Rural Area Certificate (if applicable)

- Any other documents mandated by the website

Why PMEGP?

Prime Minister’s Employment Generation Programme is run by the Khadi and Village Industries Commission (KVIC) as the main agency at the national level.

At the state level, it's managed by State KVIC Directorates, State Khadi and Village Industries Boards (KVIBs), District Industries Centres (DICs), and banks. KVIC sends the government subsidy through selected banks, which then directly disburse the funds into the beneficiaries' or entrepreneurs' bank accounts.

The PMEGP scheme rests on four pillars, each contributing to its success:

- Employment Generation: PMEGP generates long-term job prospects through promoting the creation of microenterprises, especially for aspiring business owners and traditional craftspeople. This promotes grassroots economic growth in addition to empowering individuals.

- Self-Employment Support: PMEGP believes that everyone has potential and works to provide them with the tools they need to be independent. With the help of the program's financial support and mentoring, participants can turn their ideas into successful microbusinesses.

- Micro-enterprise Promotion: PMEGP fosters the expansion of microenterprises, which are the foundation of any thriving economy. Through providing subsidies and easing loan availability, the initiative promotes creativity and new product and service development.

- Enhanced Credit Flow: One of the key challenges faced by aspiring entrepreneurs is access to adequate funding. PMEGP bridges this gap by acting as a bridge between banks and budding entrepreneurs. The program's subsidy component reduces the financial burden on lenders, making them more likely to extend credit to micro-enterprises.

Scheme Beneficiaries

The PMEGP program welcomes a broad range of individuals to participate. Here's a breakdown of who can apply:

- Individuals: Anyone above 18 years of age can apply.

- Educational Qualification: A minimum educational qualification of Class 8th pass is required for projects exceeding specific cost limits:

- ₹10 lakh (manufacturing).

- ₹5 lakh (services/business).

- Groups and Institutions:

- Self-Help Groups (SHGs).

- Institutions registered under the Societies Registration Act.

- Production Co-operative Societies.

- Charitable Trusts.

Important Points

- No Income Ceiling: There's no restriction on your income to start projects under this scheme.

- Focus on New Ventures: Only new projects seeking establishment qualify for assistance. Existing units or those receiving government subsidy under other schemes are not eligible.

- Project Cost Limits:

- The maximum project cost is ₹50 lakh for the manufacturing sector.

- The maximum project cost is ₹20 lakh for the services/business sector.

- Subsidy Variations: The percentage of the margin money subsidy you receive varies depending on:

- Category: General Category or Special Category (including SC/ST/OBC, minorities, women, and others).

- Location: Rural or Urban Area.

- Implementation Channels: The program is implemented through a collaborative effort between:

- National Level: Khadi and Village Industries Commission (KVIC) acts as the nodal agency.

- State Level: State KVIC Directorates, State KVIBs, DICs, and the Coir Board (for coir-related activities) handle implementation.

What is not covered?

While PMEGP offers a wide range of possibilities, there are certain activities that are not supported by the program. These are listed under the Negative List and include:

- Meat Processing and Related Businesses: Processing, sale, or businesses related to meat (slaughtered animals) are not permitted.

- Intoxicant Items: Production or sale of intoxicant items like beedi, pan, cigarettes, etc. is prohibited. Establishments serving liquor are also excluded.

- Agricultural Activities: Cultivation of crops/plantation like tea, coffee, rubber, etc. is not covered. However, value addition to agricultural products is allowed.

- Specific Sectors: Sericulture (cocoon rearing), horticulture, and floriculture are not directly supported. However, off-farm/farm-linked activities related to these sectors (e.g., processing) are allowed.

- Environmentally or Socially Sensitive Activities: Activities prohibited by local government/authorities due to environmental or socio-economic factors are not eligible for assistance.

Benefits

- Margin Money Subsidy: The government provides a subsidy on the loan amount, reducing your financial burden and making it easier to start your business.

- Term Loans from Banks: PMEGP facilitates access to bank loans, providing the capital you need to establish or upgrade your micro-enterprise. This financial assistance is crucial for purchasing equipment, raw materials, and other necessities to get your business off the ground.

- Skill Development Training (Optional): The program encourages entrepreneurs to enhance their skill sets by offering training opportunities. This training can help you develop essential business management skills, marketing strategies, and financial literacy, empowering you to run your venture effectively.

Helpline

| Helpline | Contact Details |

|---|---|

| State Director, KVIC | Address available at KVIC Online |

| Dy. CEO (PMEGP), KVIC, Mumbai | Ph: 022-26711017 Email: ykbaramatikar[dot]kvic[at]gov[dot]in |