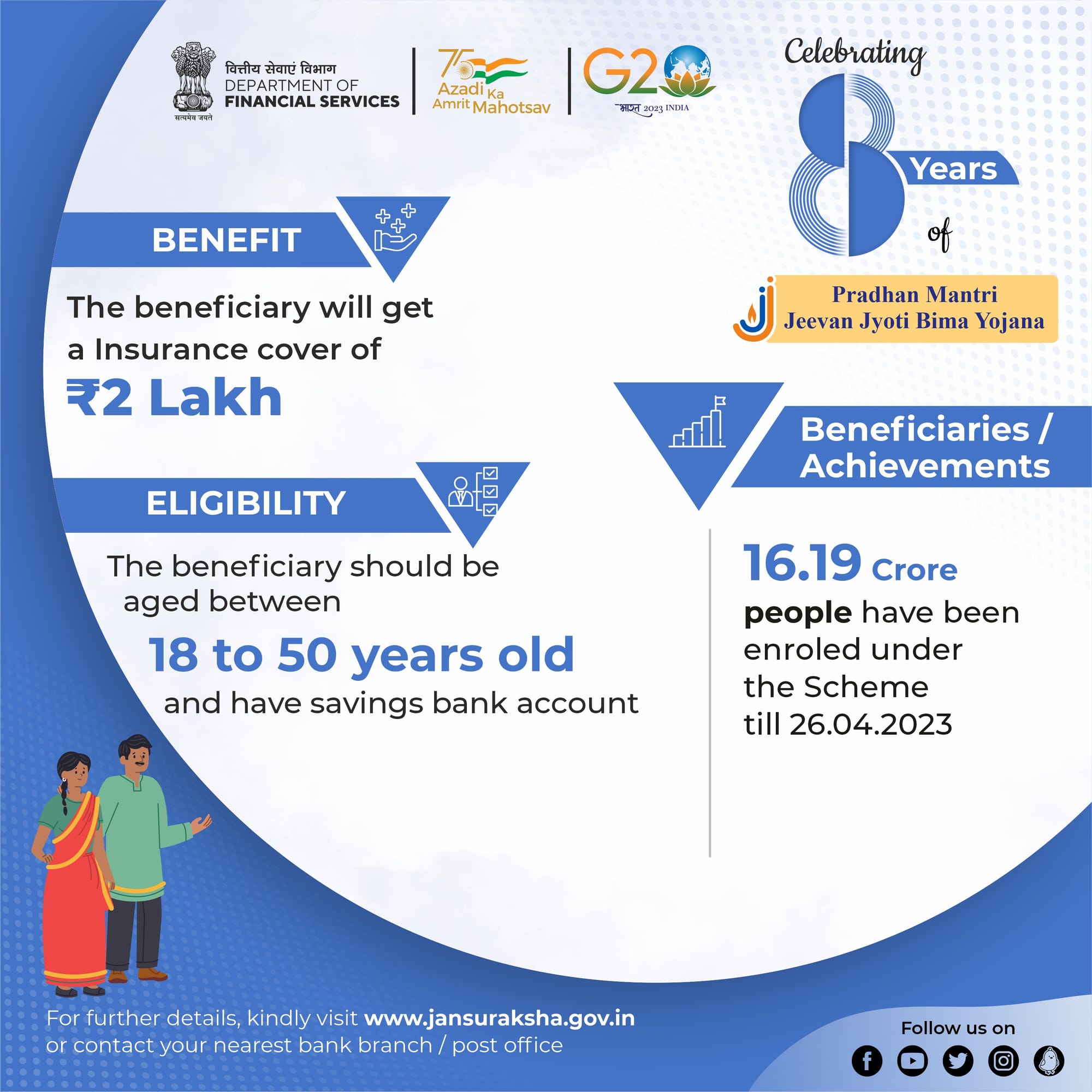

Pradhan Mantri Jeevan Jyoti Bima Yojana

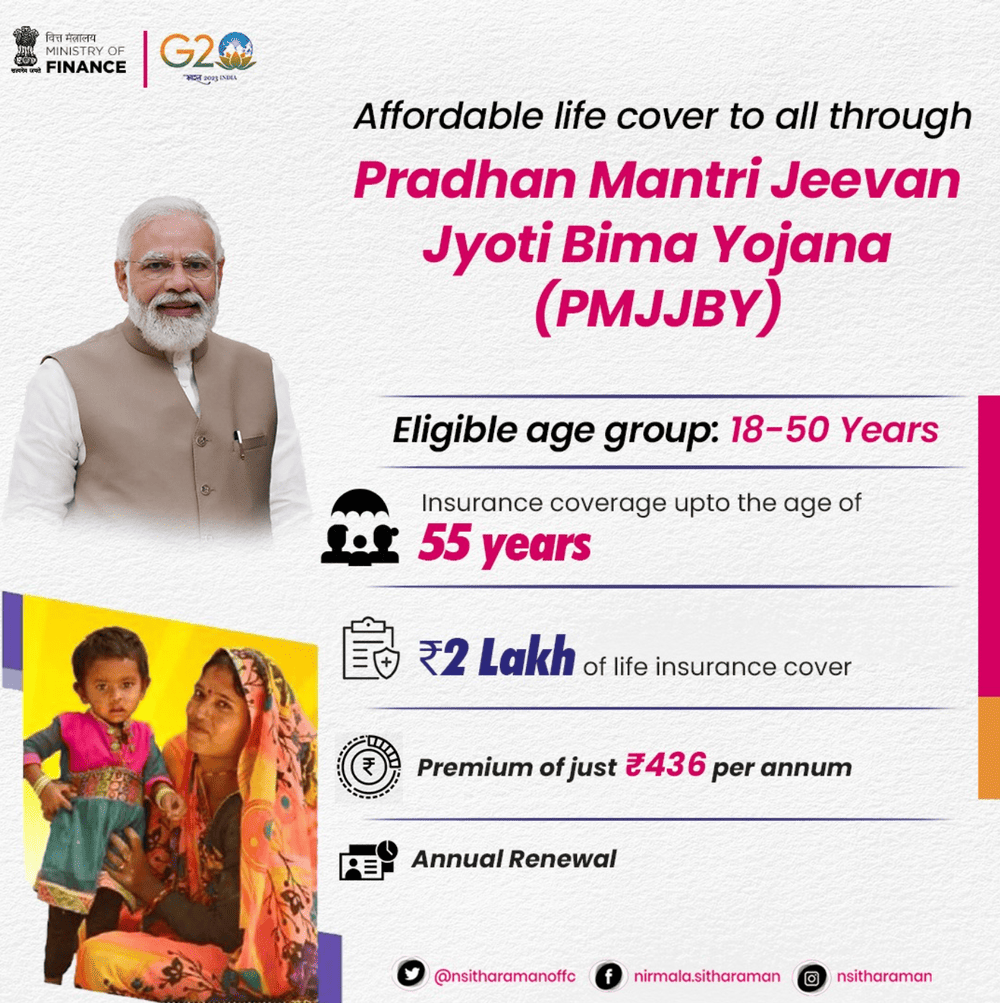

The Pradhan Mantri Jeevan Jyoti Bima Yojana (PMJJBY) is a government-backed life insurance scheme in India aimed at providing affordable life insurance coverage to individuals.

Launched on May 9, 2015, by Prime Minister Narendra Modi, the scheme targets the economically weaker sections of society to ensure financial security for their families in case of the insured's untimely death.

What is PMJJBY?

The Pradhan Mantri Jeevan Jyoti Bima Yojana (PMJJBY) is a government-backed term life insurance scheme launched on 9th May 2015. It is a one-year renewable policy that provides a life cover of ₹2 lakhs to the nominee in the event of the insured person's death due to any reason.

The scheme is offered through participating banks and post offices, making it easily accessible to a large segment of the population.

Eligibility

- Age: 18 to 50 years (age nearer birthday).

- Savings Bank Account: Must have a savings bank account with a participating bank or post office.

- Aadhaar: Aadhaar is the primary KYC for the bank account.

Coverage and Benefits

- Life Cover: ₹2 lakhs payable to the nominee upon the policyholder's death due to any reason.

- Policy Term: One year cover, renewable annually.

- Premium: ₹436 per annum (auto-debited from the savings bank account in one installment).

- Renewal: The policy is renewable annually by giving consent for auto-debit before May 31st each year.

Eligibility Criteria

To be eligible for PMJJBY, you must meet the following criteria:

- Age: You must be between the ages of 18 and 50 years (age nearer birthday) on the date of enrolment.

- Savings Bank Account: You must have a valid savings bank account with a participating bank or post office. The premium amount will be auto-debited from this account annually.

- Aadhaar: You must have an Aadhaar card for KYC verification and linking with your bank account.

Enrolment Process

- Step 1: The initial step is to visit your branch with your Aadhaar card.

- Step 2: Fill in the application form and provide accurate personal and nominee details in the PMJJBY application form.

- Step 3: Give consent for auto-debit of the premium from your savings bank account.

- Step 4 :Receive the policy document/certificate as confirmation of your enrolment in the form of “ACKNOWLEDGEMENT SLIP CUM CERTIFICATE OF INSURANCE”.

Claim Process

- Intimation: Inform the bank or post office of the policyholder's death.

- Document Submission: Submit the required documents, including:

- Death certificate of the insured.

- Claim form (available at the bank/post office).

- Original policy document/certificate.

- Identity proof of the nominee.

- Bank account details of the nominee.

- Verification: The bank or post office verifies the documents and submits the claim to the insurance company (LIC or another participating insurer).

- Settlement: Upon approval, the claim amount of ₹2 lakhs is directly credited to the nominee's bank account.

Exclusions

- Suicide: Death due to suicide within 12 months of enrolment is not covered.

- Pre-existing Conditions: Death due to pre-existing conditions within the first 45 days of risk cover (lien period) is not covered.

Appropriation of Premium

Of the full premium (₹436), ₹395 goes to the insurance company, ₹30 to agents for new enrolments, and ₹11 to administrative expenses.

Termination of Coverage

The insurance cover will terminate in the following scenarios:

- Age: Upon reaching 55 years of age.

- Account Closure/Insufficient Balance: If the linked bank account is closed or has insufficient balance to maintain the policy.