EPF Passbook

The Employees' Provident Fund (EPF) passbook is a digital record of your retirement savings, detailing all transactions made in your EPF and Employees' Pension Scheme (EPS) accounts.

What is an EPF Passbook?

The EPF passbook, also known as an e-passbook, is an electronic version of your traditional EPF account statement. It serves as a detailed statement of an individual's EPF transactions, similar to a bank passbook. It provides a detailed overview of:

- Monthly Contributions: Both yours and your employer's.

- Interest Accrued: The interest earned on your contributions.

- Current Interest: The ongoing interest accumulation.

- Withdrawals: Any partial or complete withdrawals made from your account.

Who Can Access?

All EPF members registered on the EPFO portal can access their passbooks online. However, the facility is not available for:

- Inoperative Members: Members who have not contributed to their EPF for 36 months or more.

- Settled Members: Members who have already received a final settlement of their EPF balance.

- Exempted Establishment Members: Members who are part of establishments exempted from EPF schemes.

Features

- Members registered on the Unified Member Portal can access their Member Passbook through this service.

- The Passbook becomes accessible 6 hours after completing registration on the Unified Member Portal.

- Any updates to credentials on the Unified Member Portal will reflect here after 6 hours.

- The Passbook will only show entries that have been verified at EPFO field offices.

- This Passbook service is not available to members of Exempted Establishments.

- Claims for a member's death can be submitted online, offering a paperless and faster settlement process.

Benefits

- Anytime, Anywhere Access: View and download your passbook anytime, from anywhere, through the EPFO website or the UMANG app.

- Error Rectification: Verify the accuracy of your EPF details and rectify any errors.

- Change of Employment: Update your passbook with your new employer's details in case of a job change.

- Permanent Record: The e-passbook serves as a permanent record of your EPF contributions and withdrawals.

- Financial Planning: Utilize the passbook data for retirement and financial planning.

Passbook contains the following information:

- Establishment ID and Name

- EPFO Office Name and Type

- Member ID and Name

- Contributions

- Withdrawals and Deposits

- Pension Contribution

- Date and Time of Download

Download / EPF Passbook

EPF passbook can be downloaded in four methods. Below, we have discussed each method in detail.

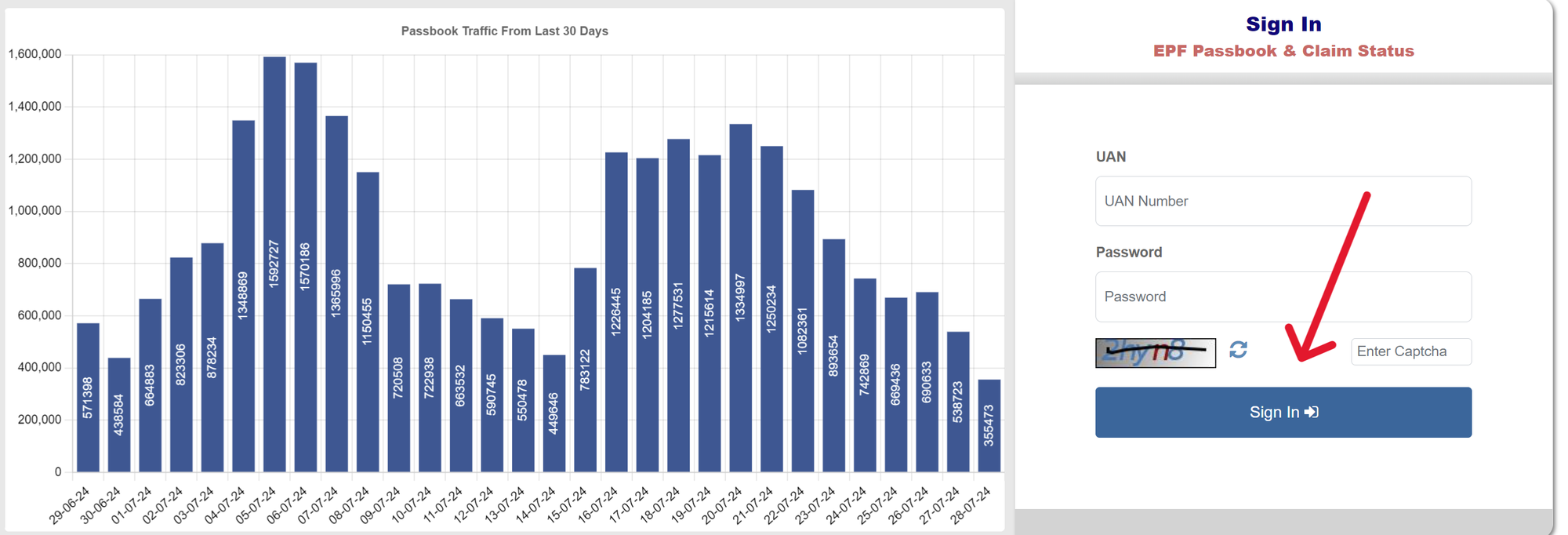

EPFO Website

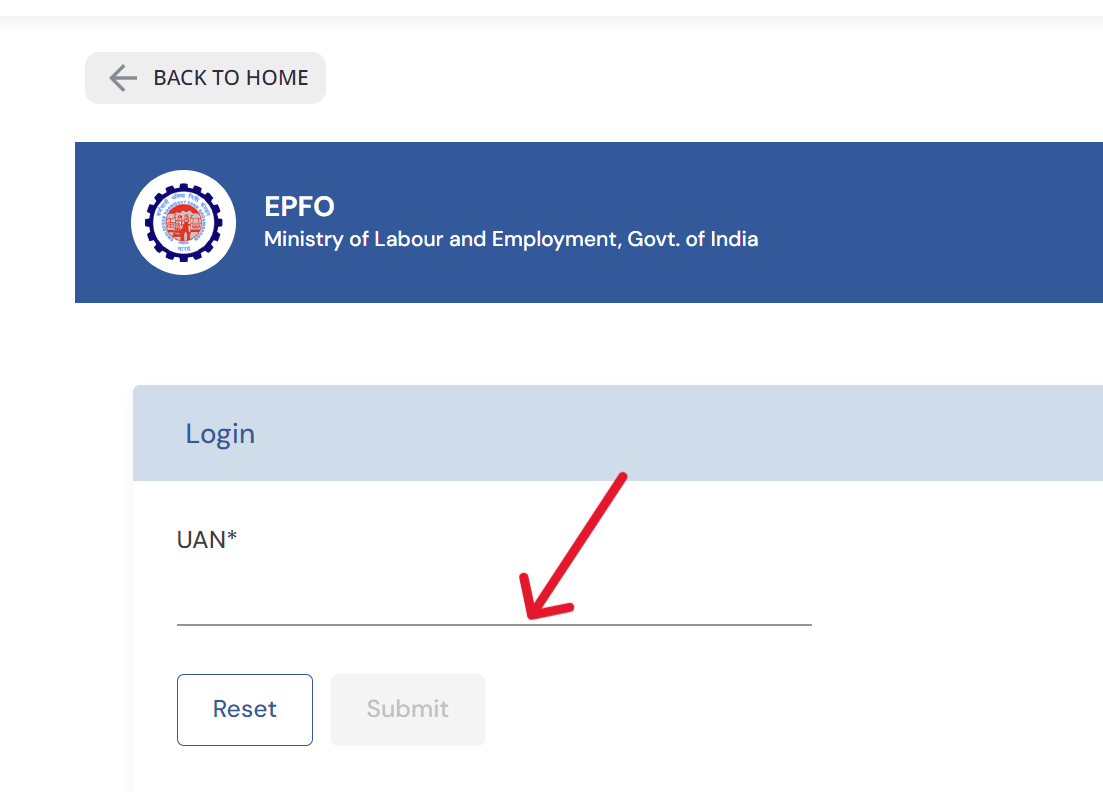

- Step 1: Visit the EPFO website: Go to the official EPFO website. And click on the e-passbook option.

- Step 2: Enter Your UAN and Password: Log in using your registered Universal Account Number (UAN) and password, with the captcha code and click on sign in option.

- Step 3: You will be asked to input the OTP sent to the registered mobile number for verification purposes.

- Step 4: Select Member ID: If you have multiple Member IDs, choose the one for which you want to view the passbook.

- Step 5: View/Download Passbook: Your EPF passbook will be displayed on the screen, showing detailed transaction history. You can download it as a PDF for your records.

EPFO Member e-Sewa Portal

Downloading your EPF passbook via the EPFO e-Sewa portal is a straightforward process. Here’s a detailed guide on how to do it:

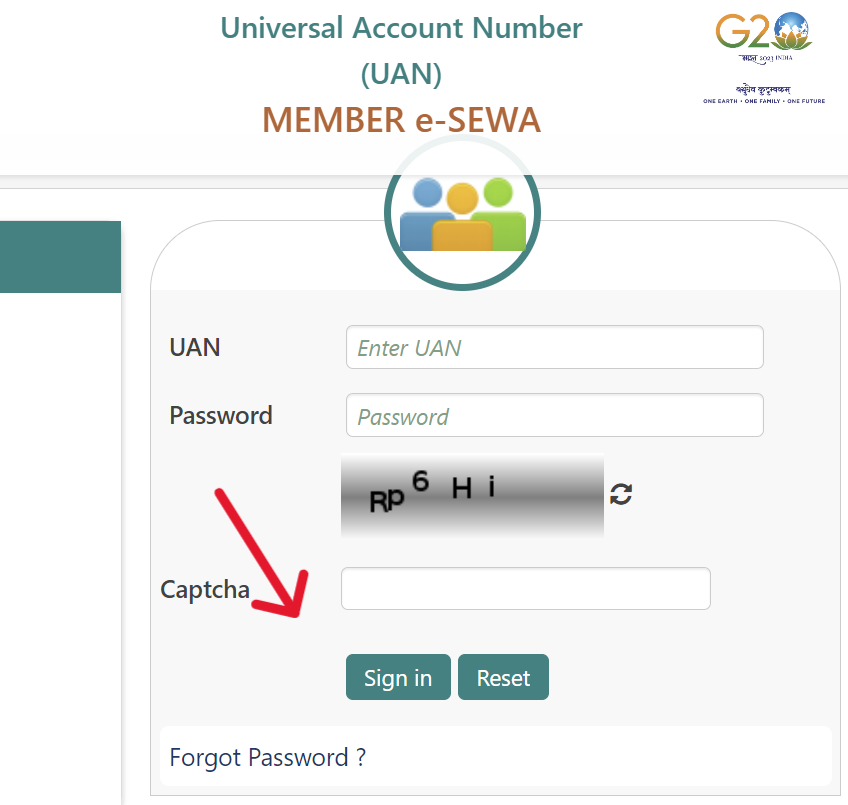

- Step 1: Visit the EPFO e-Sewa Portal

- Open your web browser and go to the official EPFO e-Sewa portal by entering the following URL: unifiedportal-mem.epfindia.gov.in.

- Step 2: Log in with Your UAN and Password

- On the homepage of the e-Sewa portal, you will see a login section.

- Enter your Universal Account Number (UAN). This unique number is assigned to every EPF member and links multiple EPF accounts.

- Enter your password. This password is set by you when you activate your UAN.

- Type the captcha code displayed on the screen for verification purposes.

- Click on the 'Sign in' button to log in to your account.

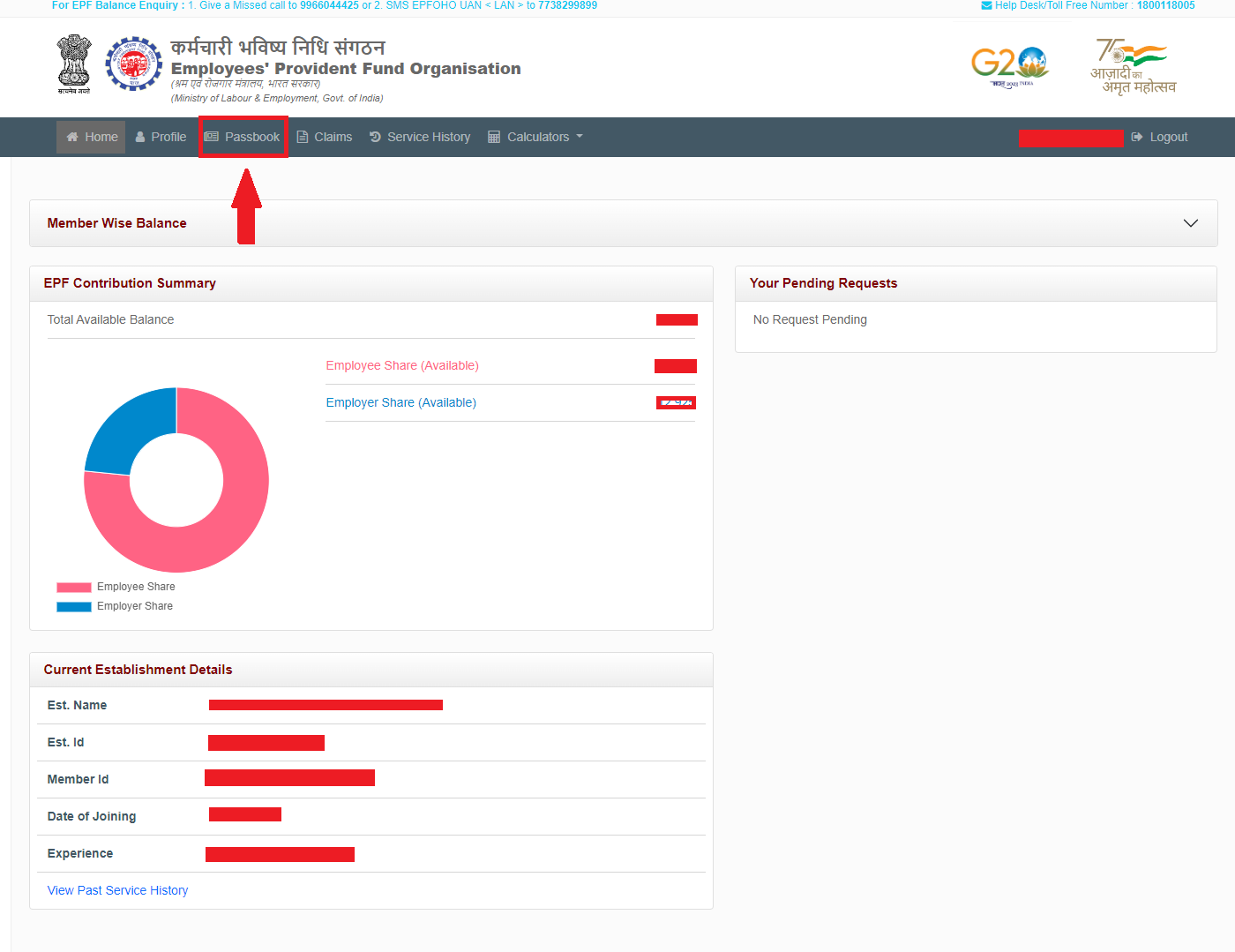

- Step 3: Navigate to 'Download Passbook'

- Once you are logged in, you will be directed to the member dashboard.

- Look for the 'View' option in the menu.

- Under the 'View' menu, select 'Passbook'.

- You will be redirected to a new page where you can view and download your EPF passbook.

- Step 4: Download Your EPF Passbook

- On the passbook page, select the EPF account for which you want to download the passbook.

- Your passbook will be displayed on the screen, showing all your transactions, contributions, and interest accrued.

- To download the passbook, click on the 'Download' button or the PDF icon typically provided on the page.

- The passbook will be downloaded to your device in PDF format, which you can save for future reference.

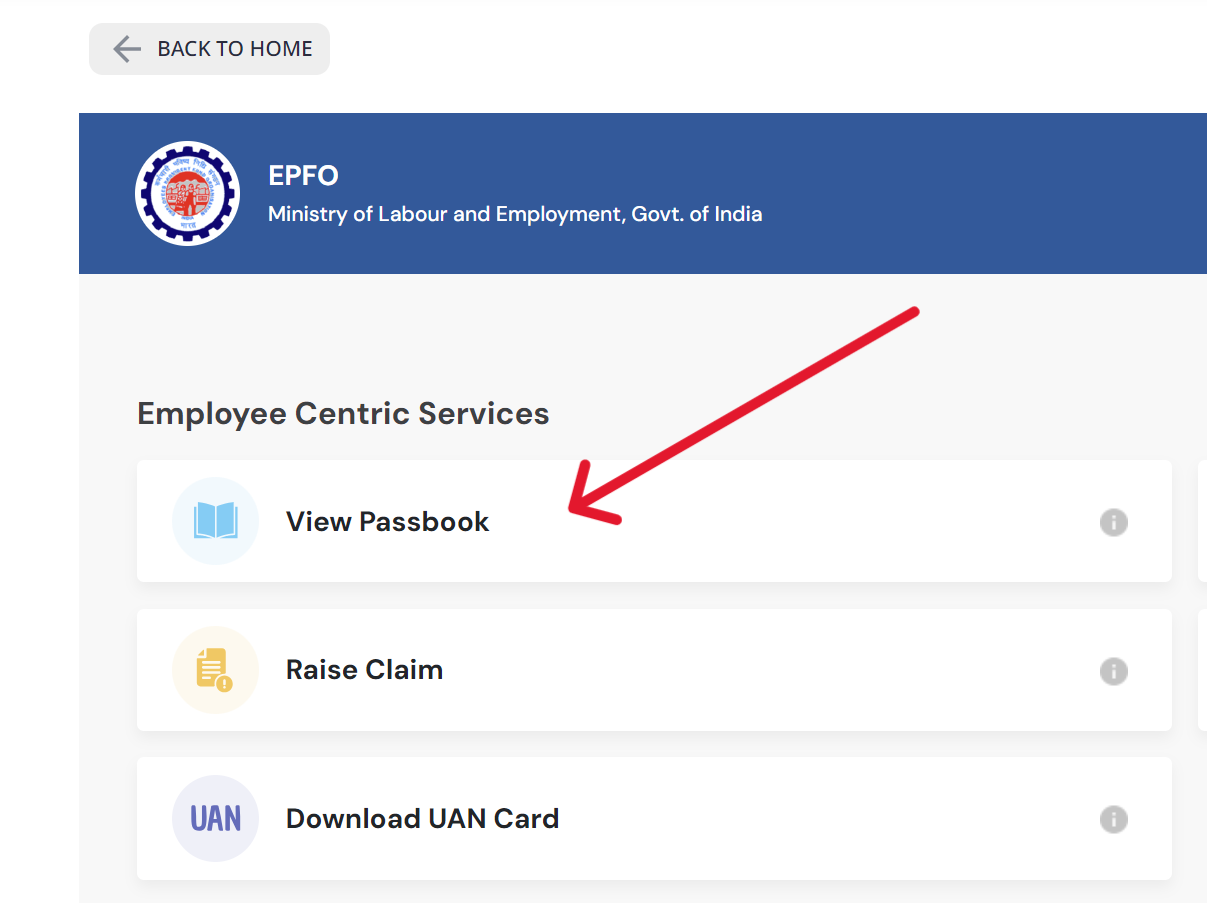

UMANG (App or Web)

- Step 1: Download the UMANG app from the Google Play Store or Apple App Store, or access the web portal by visiting - umang.gov.in.

- Step 2: Register using your mobile number. Complete the verification process.

- Step 3: Now, search for 'EPFO.' in the services section.

- Step 4: Select 'Employee Centric Services' and then choose 'View Passbook.'

- Step 5: Log in with your UAN and the OTP sent to your registered mobile number. You can then access and download your passbook.

SMS and Missed Call Services

To check your EPF details using the SMS service, send "EPFOHO UAN ENG" to 7738299899 to receive your latest contribution and balance.

Alternatively, you can use the missed call service by giving a missed call to 9966044425 from your registered mobile number to receive an SMS with your EPF account balance and details.