GST - Goods and Services Tax

The Goods and Services Tax (GST) is a landmark indirect tax reform that has reshaped India's economic landscape. Introduced in 2017, it replaced a complex patchwork of central and state taxes, creating a unified national market for goods and services.

On this webpage, you can find detailed information about GST, including the login and registration process, track status, as well as how to download certificates, and more.

GST Login Procedures

To manage your Goods and Services Tax obligations in India, you will need to access the official GST portal. Here's how to log in:

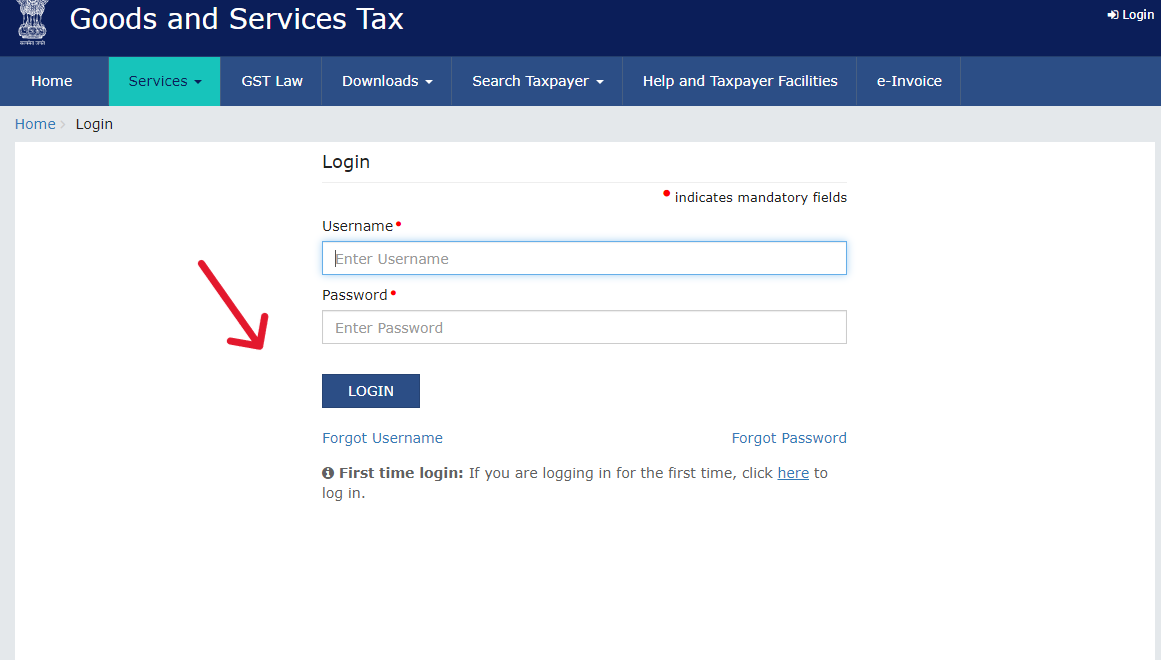

Existing Users

If you are an existing user, you will need to have your unique 15-digit Goods and Services Tax Identification Number. Also, your username and password you created during GST registration.

- Access the official website at gst.gov.in.

- Locate and click the "Login" button, found in the top-right corner of the homepage.

- Carefully input the following information:

- Username: Your 15-digit GSTIN

- Password: The password you created during registration

- CAPTCHA Code: The visual verification code displayed.

- Click the "LOGIN" button to proceed.

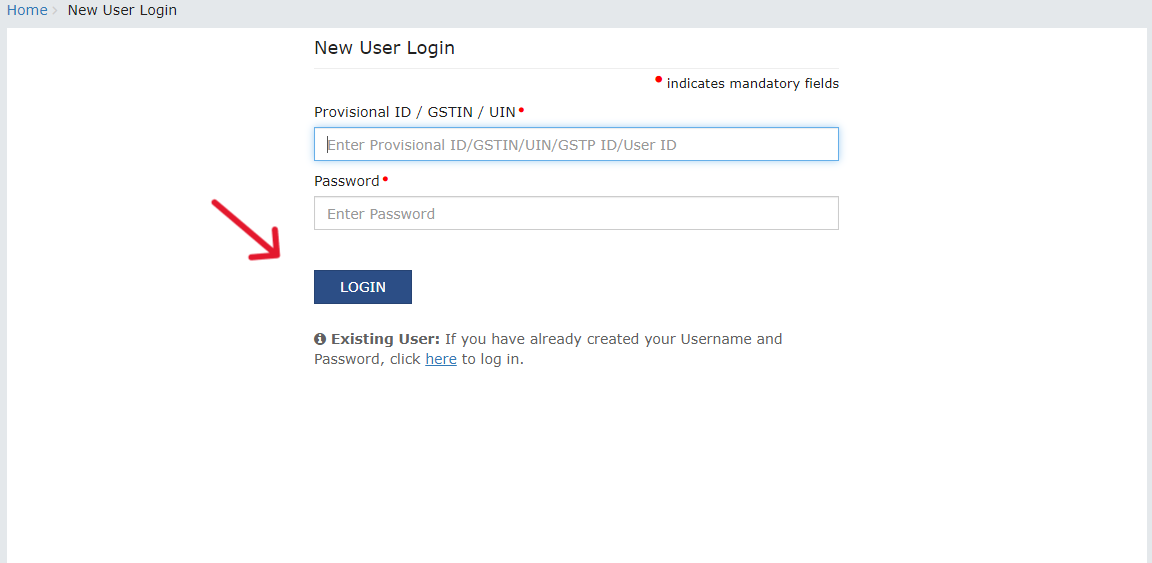

First-Time Users

You are logging in for the first time for GST, do not worry, the below steps will help you log in properly:

- Go to the GST Portal.

- Find the "Login" button in the top-right corner.

- Then look for the instruction stating "First time login: If you are logging in for the first time, click here to login". Click on the "here" link.

- Provide the following:

- Provisional ID/GSTIN/UIN: This was sent to your registered email address.

- Provisional Password: This was also sent to your email.

- CAPTCHA Code: Enter the displayed verification code.

- Next, you will be required to create new credentials:

- Choose Username: Create a username of your preference.

- Set Password: Choose a secure password and re-enter it for confirmation.

- Click "Submit" to submit your new credentials. You should see a message confirming your new login details. You can now use them to log in to the GST portal.

- On your first login, you will be asked to file a non-core amendment application. This allows you to add your essential bank account details to your GST profile.

GST Registration

GST registration is an important step for individuals and entities supplying goods or services in India. Introduced by the Ministry of Finance (MoF), the process has been simplified to ease tax compliance.

Eligibility

registration applies to:

- Individuals and entities with an aggregate turnover exceeding Rs. 40 lakh (Rs. 20 lakh for special category states).

- Inter-state businesses, regardless of turnover.

- E-commerce sellers, irrespective of turnover.

- Casual taxable persons operating seasonally.

- Entities opting for voluntary registration.

Types of Registration

- Normal Taxpayer: For businesses operating in India, with no deposit requirement and unlimited validity.

- Composition Taxpayer: Enrolment under the GST Composition Scheme, allowing payment of a flat GST rate with no input tax credit.

- Casual Taxable Person: For those operating temporary stalls or shops, requiring a deposit equal to the GST liability.

- Non-Resident Taxable Person: Applies to individuals outside India supplying taxable goods/services to Indian residents, with a deposit equal to liability.

Documents Required

Before proceeding with the registration, ensure you have the following documents:

- Proof of Constitution of Business (e.g., Certificate of Incorporation)

- Passport-sized photos of the applicant and authorized signatory

- Proof of appointment of authorized signatory

- Proof of principal place of business (e.g., Electricity Bill)

- Details of bank accounts (e.g., First page of Pass Book)

- Additional documents may be required based on the nature of business.

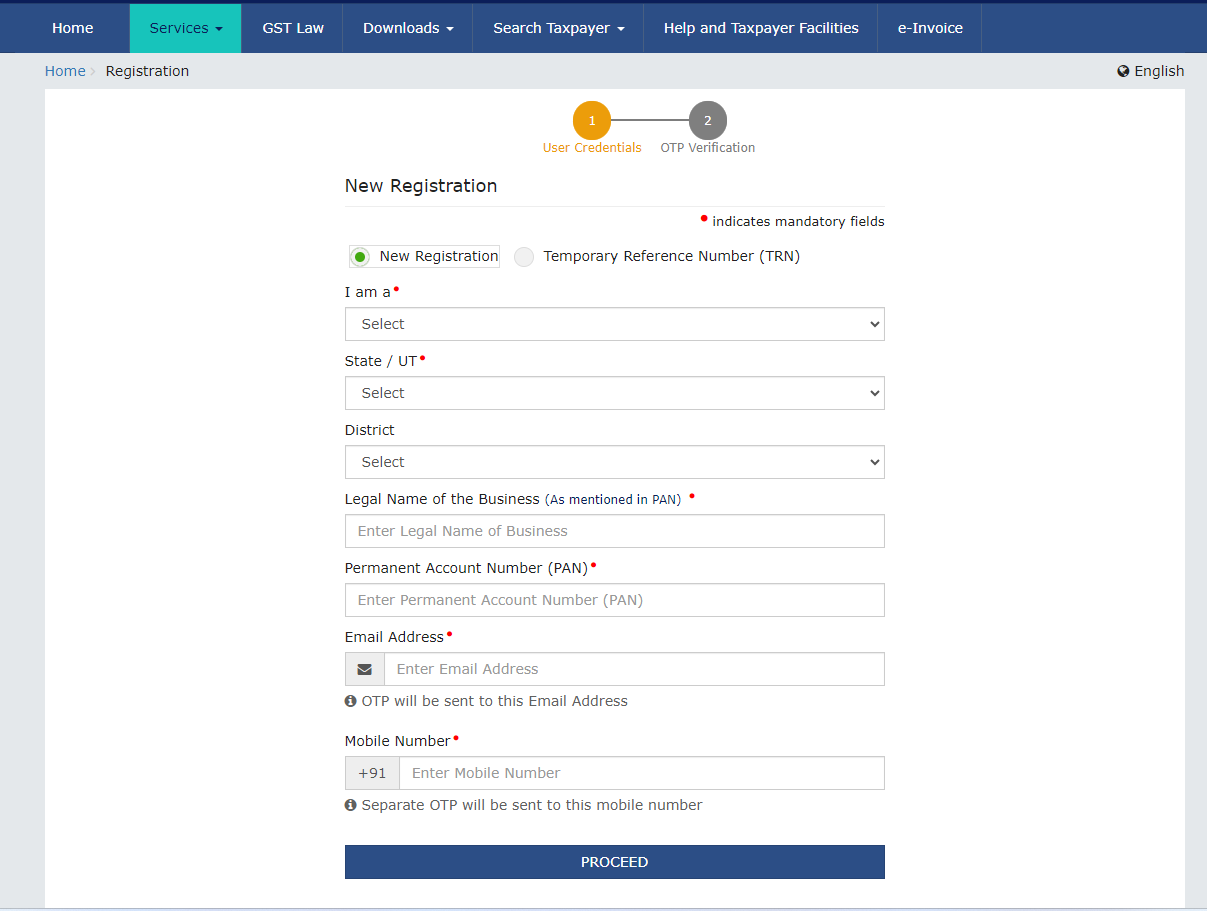

Registration Process

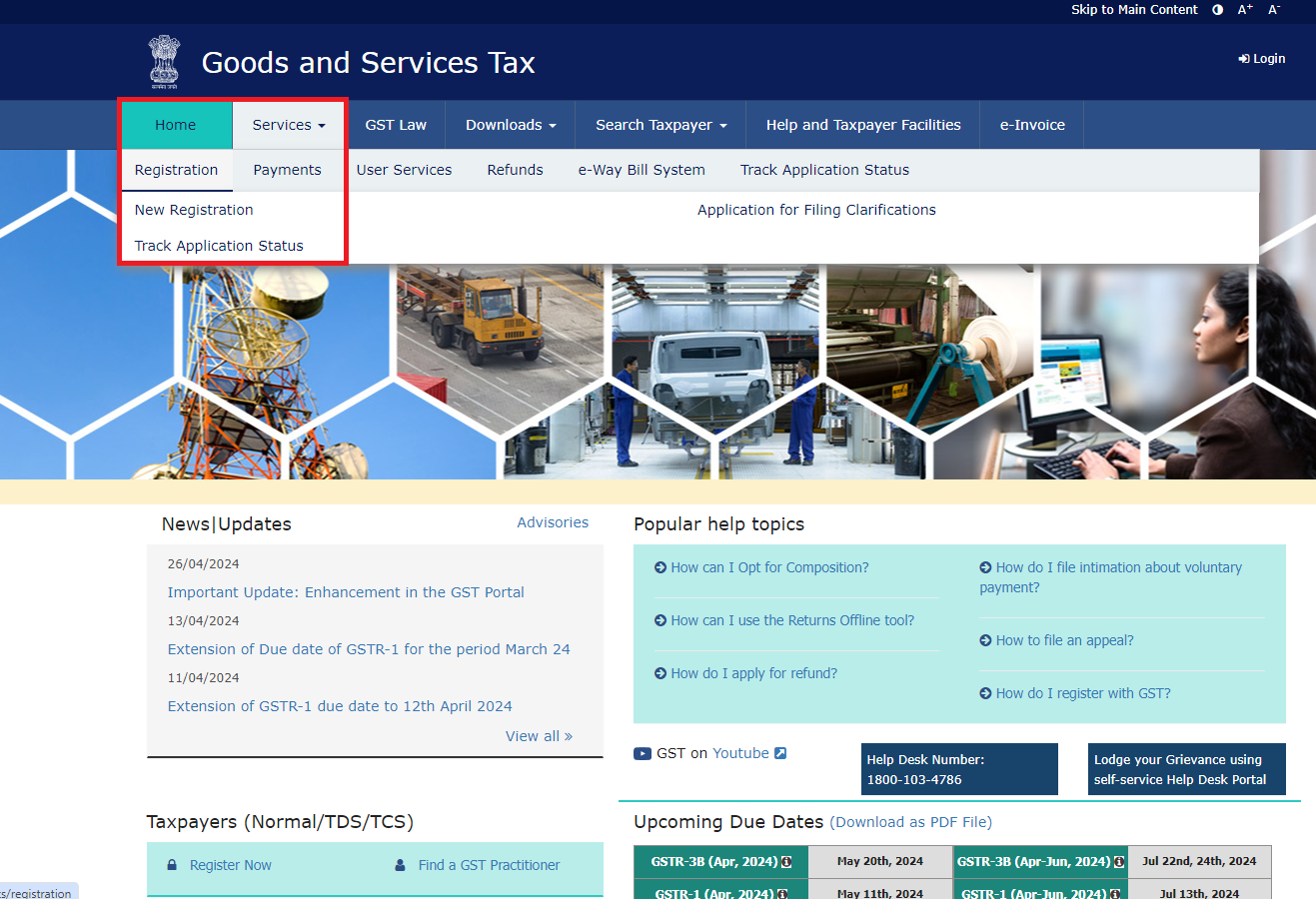

- Visit the GST Portal (gst.gov.in) and go to Services → Registration → New Registration option.

- Generate a TRN by Completing OTP Validation

- Select the taxpayer type and state.

- Enter the legal name of the business/entity as per PAN database.

- Provide PAN details and primary authorized signatory's email address.

- Proceed and complete OTP validation for mobile and email.

- Log in with TRN

- Use the Temporary Reference Number (TRN) generated to log in.

- Complete OTP verification on mobile and email.

- Submit Business Information

- Provide trade name, constitution of business, and contact details.

- Select composition scheme (if applicable) and commencement date of business.

- Enter details of promoters or partners

- Include personal information and PAN/Aadhaar for each promoter or partner.

- Submit Authorized Signatory Information

- Provide details of the authorized signatory, including personal information and PAN/Aadhaar.

- Provide Principal Place of Business Details

- Enter the address and contact information of the principal place of business.

- Upload proof of ownership or occupancy of the property.

- Enter details of any additional places of business, if applicable.

- Enter details of the top 5 goods and services supplied, along with HSN or SAC codes.

- Provide Bank Account Details

- Enter the number of bank accounts held by the applicant.

- Provide details of each bank account and upload a copy of the bank statement or passbook.

- Verification of Application

- Review and verify the details submitted in the application.

- Select the verification checkbox and digitally sign the application using DSC/E-Signature or EVC.

Upon successful submission, an Application Reference Number (ARN) will be generated. The ARN receipt will be sent to the registered email address and mobile number.

GST Registration Status

To check the status, one needs to have either the ARN or SRN number before proceeding. The Application Reference Number (ARN) is a unique identifier assigned to your registration application.

While, if your business is a company, and you applied via the Ministry of Corporate Affairs (MCA) portal, you would have received a Service Request Number (SRN) instead.

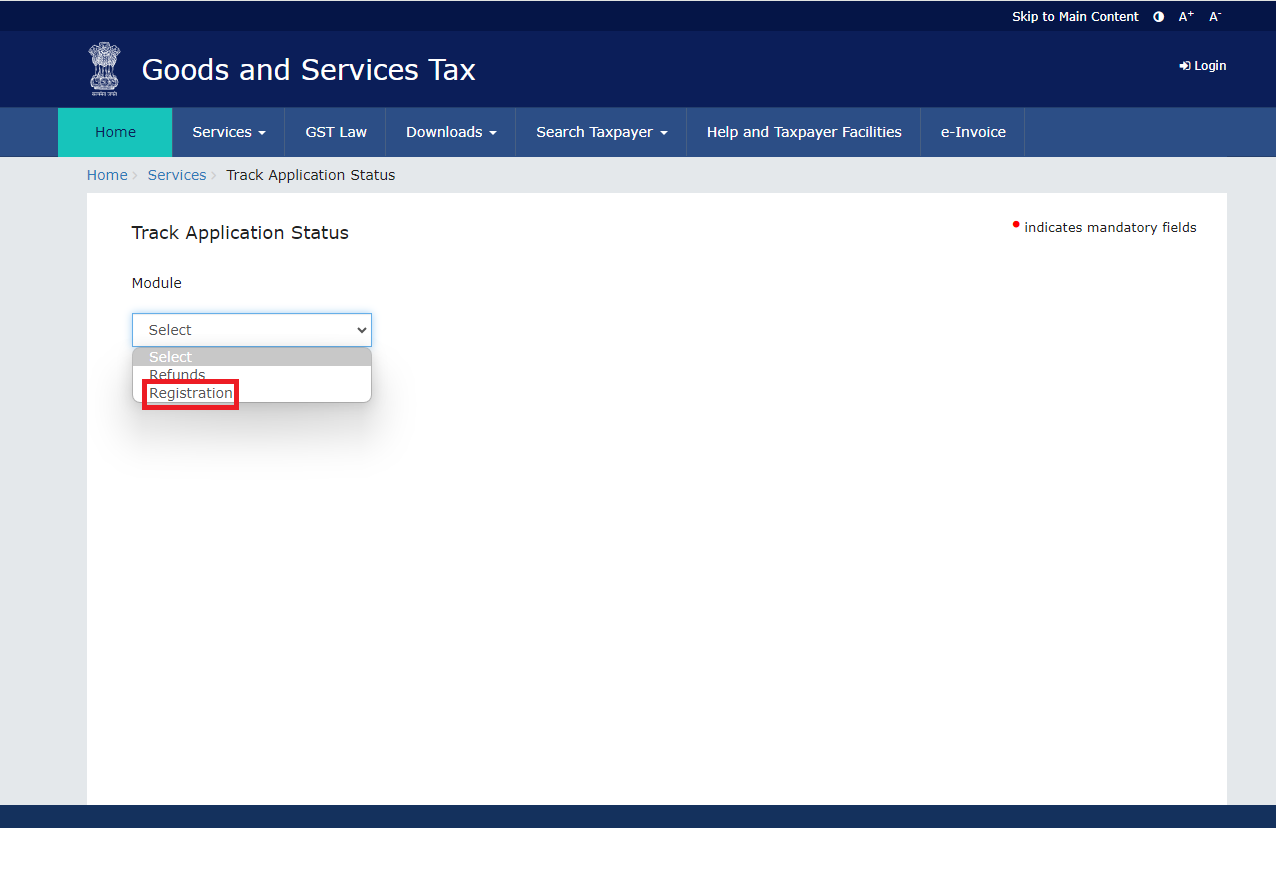

Without Logging In

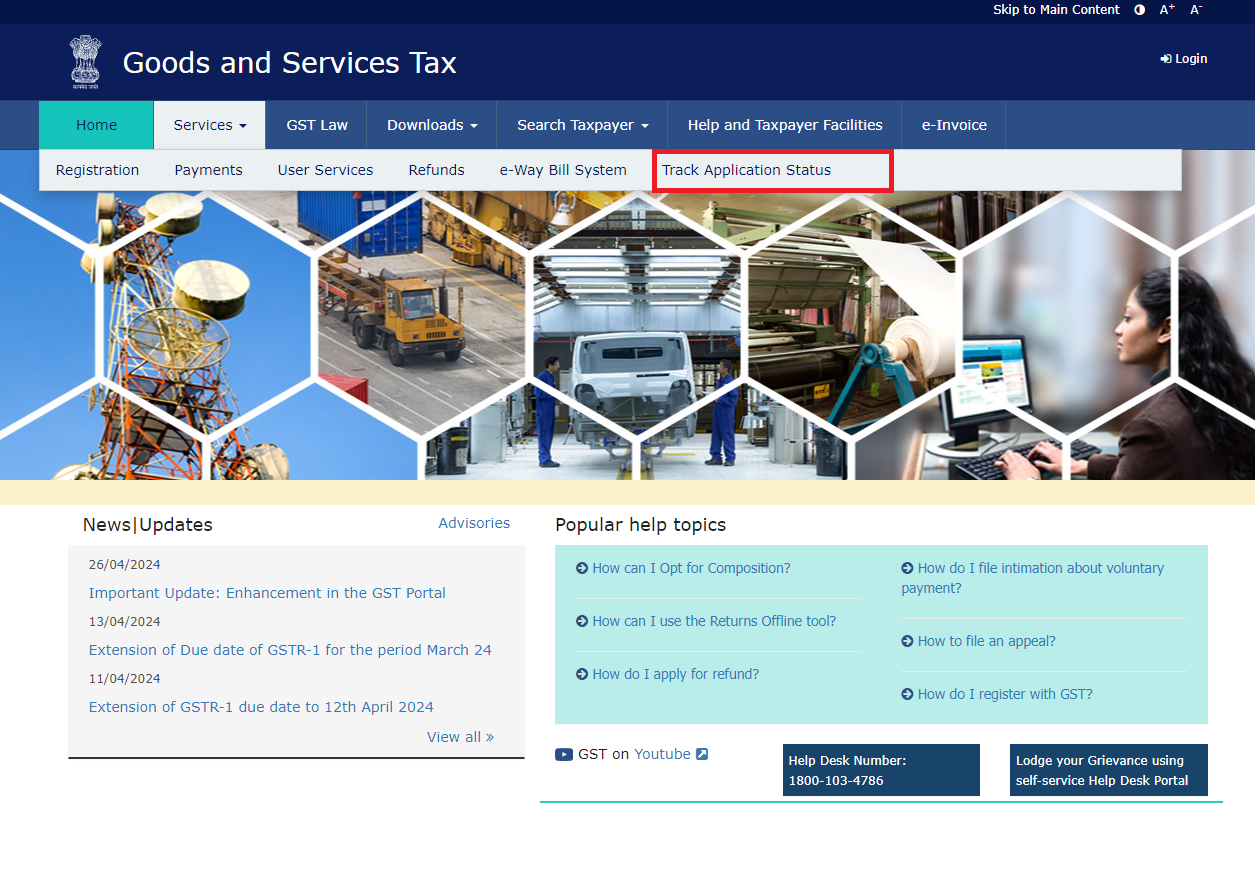

- Visit the official GST Portal

- Click on "Services," then "Registration," and finally, "Track Application Status."

- Select "Registration" from the dropdown menu.

- Enter your ARN or SRN, along with the CAPTCHA security code.

- Click the "SEARCH" button to view your current registration status.

After Logging In

- Log in to the GST Portal using your credentials.

- Locate "Services" and then "Track Application Status."

- Select "Registration" from the dropdown menu.

- Choose whether you want to search by ARN/SRN or the date you submitted your application.

- View the status of your application.

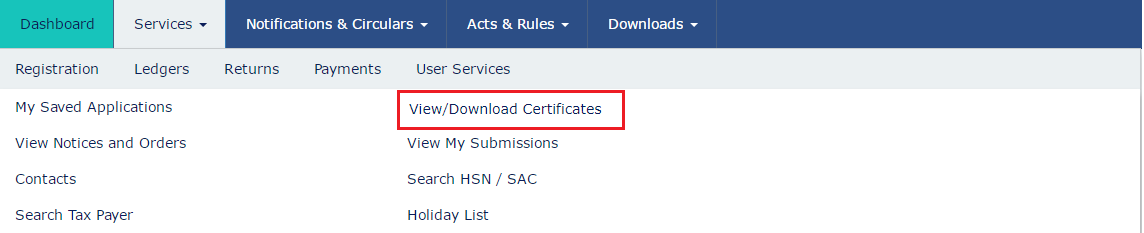

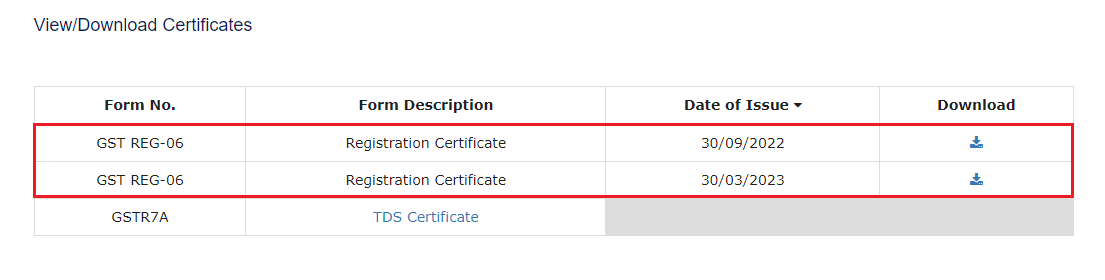

Download GST Certificates

Here is the step-by-step guide to Download GST Certificates:

- Access the GST Website at gst.gov.in.

- Log in to your account by entering your credentials.

- After logging in, go to services, then user services and finally click on "View/Download Certificates"

- You will see a list of all your certificates, arranged chronologically (newest to oldest). From the list, you can download the certificate.

- Locate the desired certificate and click the download icon (a downward arrow) next to it in the "Download" column. The certificate will be downloaded in PDF format.

Note:

- Updated registration certificates will use this address format: Floor No., Building No./Flat No., Name Of Premises/Building, Road/Street, Nearby Landmark, Locality/Sub Locality, City/Town/Village, District, State, PIN Code.

- Changes made to your GST registration will be reflected in the certificates

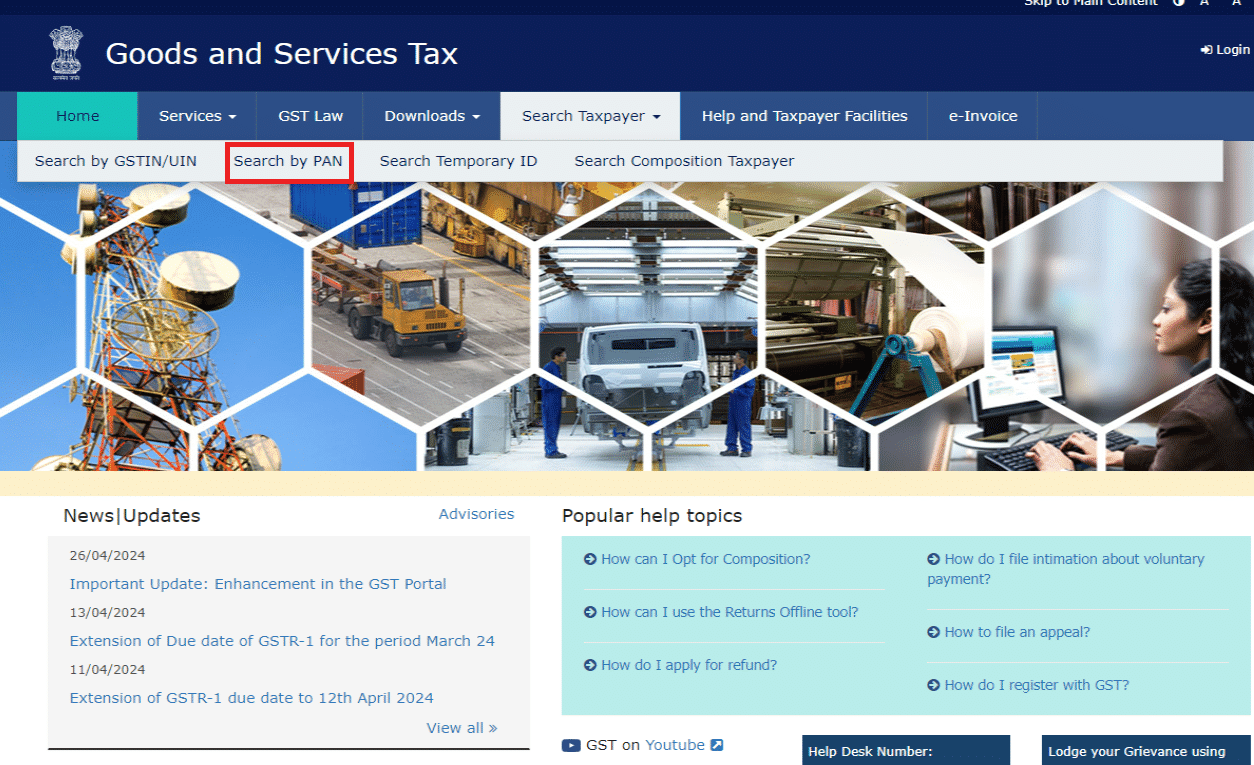

Search Taxpayers on the GST Portal

The GST portal offers several ways to search for registered taxpayers in India:

- Search by GSTIN/UIN: This is the most direct method if you know the business's 15-digit Goods and Services Tax Identification Number.

- Search by PAN: This allows you to find all GSTINs associated with a specific Permanent Account Number.

- Search by Temporary ID: This option is useful if you have a temporary registration ID but not the final GSTIN.

- Search for Composition Taxpayer: This search is specifically designed for businesses registered under the GST Composition Scheme.

Below are the steps for all the methods:

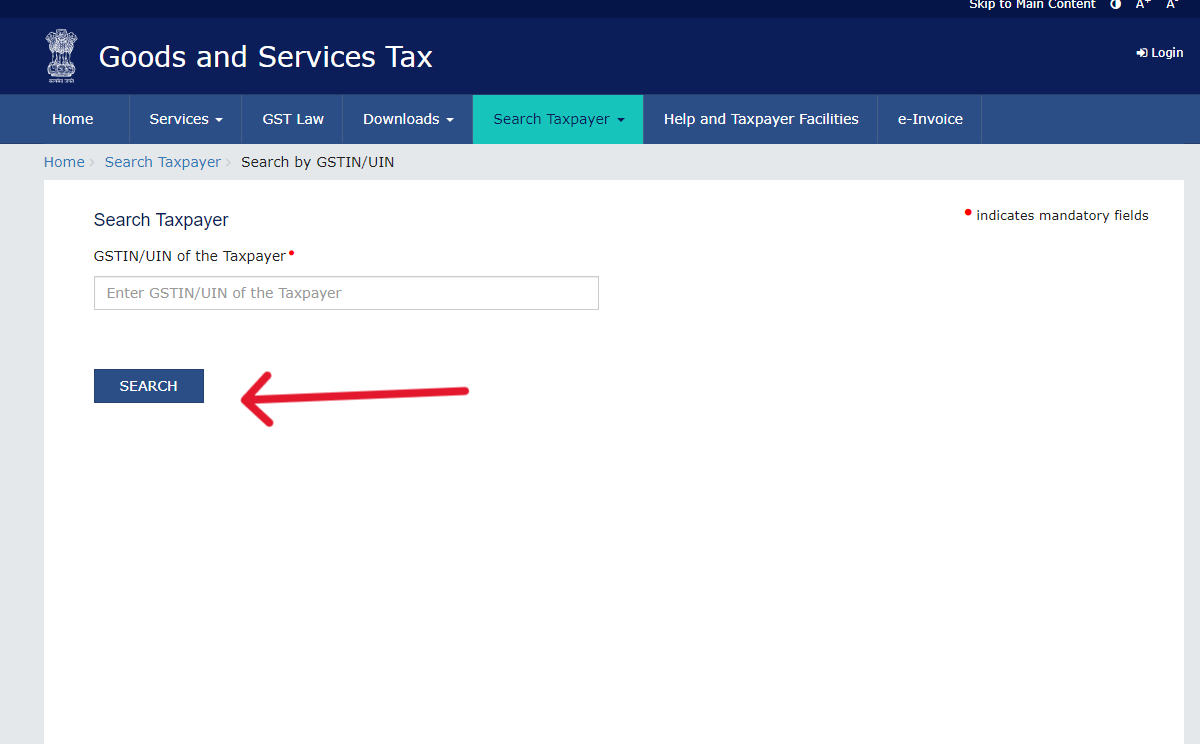

Search by GSTIN/UIN

- Go to the GST portal (gst.gov.in).

- Find the "Search Taxpayer" tab.

- Select "Search by GSTIN/UIN".

- Enter the 15-digit GSTIN and the CAPTCHA code.

- Click "SEARCH".

Search by PAN

- Navigate to the "Search Taxpayer" tab on the portal.

- Choose "Search by PAN".

- Enter the business's PAN and the CAPTCHA code.

- Click "SEARCH".

Search by Temporary ID

- Go to the "Search Taxpayer" section.

- Select "Search Temporary ID".

- Enter the Temporary ID, select the State, provide the registered mobile number, and enter the CAPTCHA code.

- Click "SEARCH."

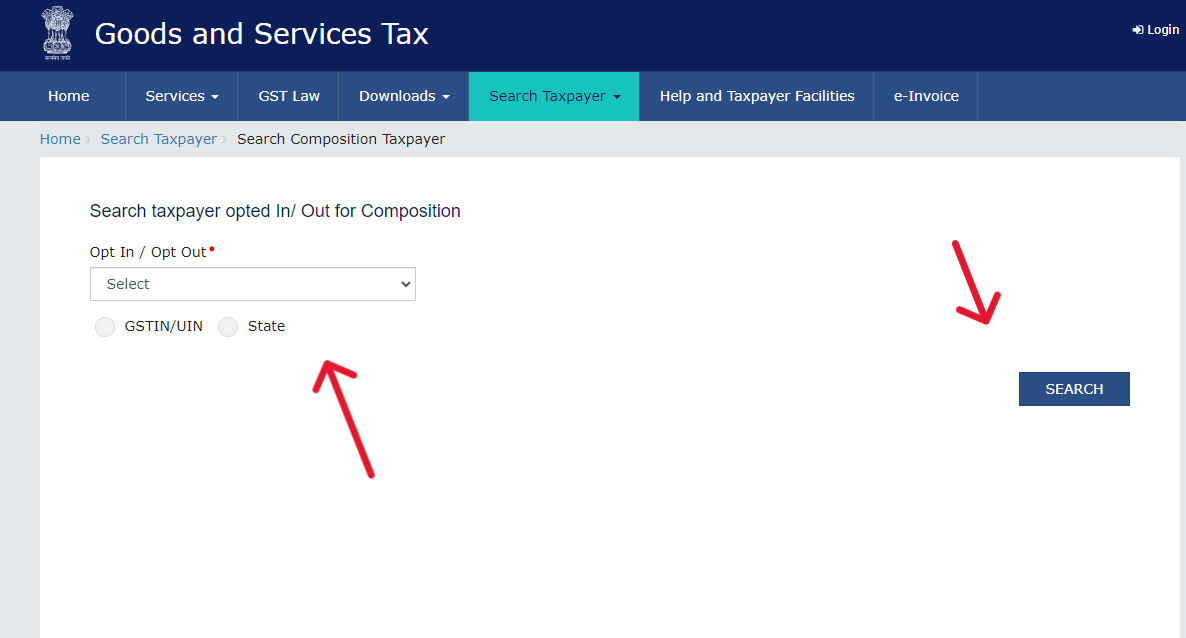

Search for Composition Taxpayer

- Access the "Search Taxpayer" tab.

- Select "Search Composition Taxpayer".

- Enter either an "Opt in GSTIN" or an "Opt out GSTIN" along with the CAPTCHA code.

- Click "SEARCH".

What is GST?

GST (Goods and Services Tax) is a unified indirect tax applied to the sale of goods and services in a country. It replaces multiple taxes and aims to simplify the tax system, making it more efficient and reducing the overall tax burden.

GST is charged at the point of consumption rather than production. Under GST in India, there are five primary tax slabs which are:

| GST Rate | Goods and Services |

|---|---|

| 0% | Essential goods and services, including basic food items, books, and newspapers |

| 5% | Commonly used products and services like apparel under a certain price, packaged food items, and household necessities |

| 12% | Goods and services including processed foods, mobile phones, and business-class air travel |

| 18% | Most goods and services like electronic goods, restaurants, and personal care products |

| 28% | Luxury and sin goods such as luxury cars, tobacco products, and aerated drinks, often with an additional cess on top |

Key Features

The key features are outlined in the table below:

| Key Feature | Description |

|---|---|

| One Nation, One Tax | GST subsumed various indirect taxes, bringing uniformity to the tax structure. |

| Dual Structure | CGST (Central GST), SGST (State GST), and IGST (Integrated GST on interstate transactions) ensure revenue sharing between the center and states. |

| Destination-Based | GST is levied at the point of consumption, fostering a seamless flow of tax credits across the supply chain. |

| Input Tax Credit (ITC) | Businesses can claim credits for taxes paid on inputs, reducing the final tax burden. |

| GSTN | A robust IT backbone manages registration, returns, and payments. |

What is an E-Waybill?

An e-way bill is an electronic document required for transporting goods worth over INR 50,000 within India. It is generated on the GST portal and includes details of the goods, consignor, consignee, and transporter.

The validity of an e-way bill depends on the travel distance, and it helps in tax compliance and real-time tracking of goods movement. Certain goods and transactions are exempt from this requirement.

Uses of an eWay Bill:

| Uses | Description |

|---|---|

| Tracking | Tracks the transport of goods across states, ensuring they're accounted for. |

| Compliance | Ensures goods are transported according to tax laws, helping prevent tax evasion. |

| Efficient Inspections | Makes inspections easier as all details are digitally accessible to authorities. |

| Less Paperwork | Reduces the need for carrying physical documents during transport. |

| Faster Movement | Speeds up the passage through checkpoints with readily available digital information. |

What is HSN Code?

The HSN code (Harmonized System of Nomenclature) is a globally standardized system of names and numbers used to classify traded products. It's essential in GST for categorizing goods, determining tax rates, and ensuring uniform compliance in trade documentation.

The code helps in both national and international trade by simplifying the identification and classification of products.

Uses of HSN codes:

| Uses | Description |

|---|---|

| Standardization | Makes it easier to categorize goods the same way globally and nationally. |

| Tax Calculation | Helps determine the right tax rates for different goods quickly and accurately. |

| International Trade | Assists in aligning with international trade rules and calculating customs duties. |

| GST Filing | Simplifies the GST return process by standardizing product descriptions. |

| Data Analysis | Helps in collecting and analyzing trade data, aiding in economic planning and forecasts. |

What is LUT in GST?

LUT in GST refers to the "Letter of Undertaking." It is a document that exporters can submit to the government, allowing them to export goods or services without having to pay the integrated GST (IGST) at the time of export.

Here are some key points about the LUT in GST:

| Feature | Overview |

|---|---|

| Purpose | Allows exporters to send goods or services abroad without immediate GST payments, boosting cash flow. |

| Eligibility | Exporters need a solid tax compliance history and no major tax evasion issues (over Rs. 250 lakhs) to apply. |

| Validity | Lasts for one fiscal year; requires annual renewal. |

| Benefits | Lowers export costs and simplifies processes, enhancing global competitiveness. |

| Procedure | Easily filed online through the GST portal, accessible for all qualified exporters. |

Helpline

For any queries or assistance regarding GST, please reach out to our help desk at: 1800-103-4786

You can log or track your issues through the Grievance Redressal Portal for GST. This portal ensures that your concerns are addressed promptly and efficiently - Grievance Redressal Portal for GST.