GST Status

ADVERTISEMENT

The Goods and Services Tax (GST) is a comprehensive indirect tax system in India. To operate under this, businesses and individuals need to register for GST. The registration process involves submitting an application and receiving an Application Reference Number (ARN).

This unique number allows you to track the progress of your application and determine your GST ARN status. On this page, I will provide you with information on how to check your GST status.

Check GST Registration Status

There are two primary ways to check your GST registration status, using your ARN:

Before Logging into the GST Portal

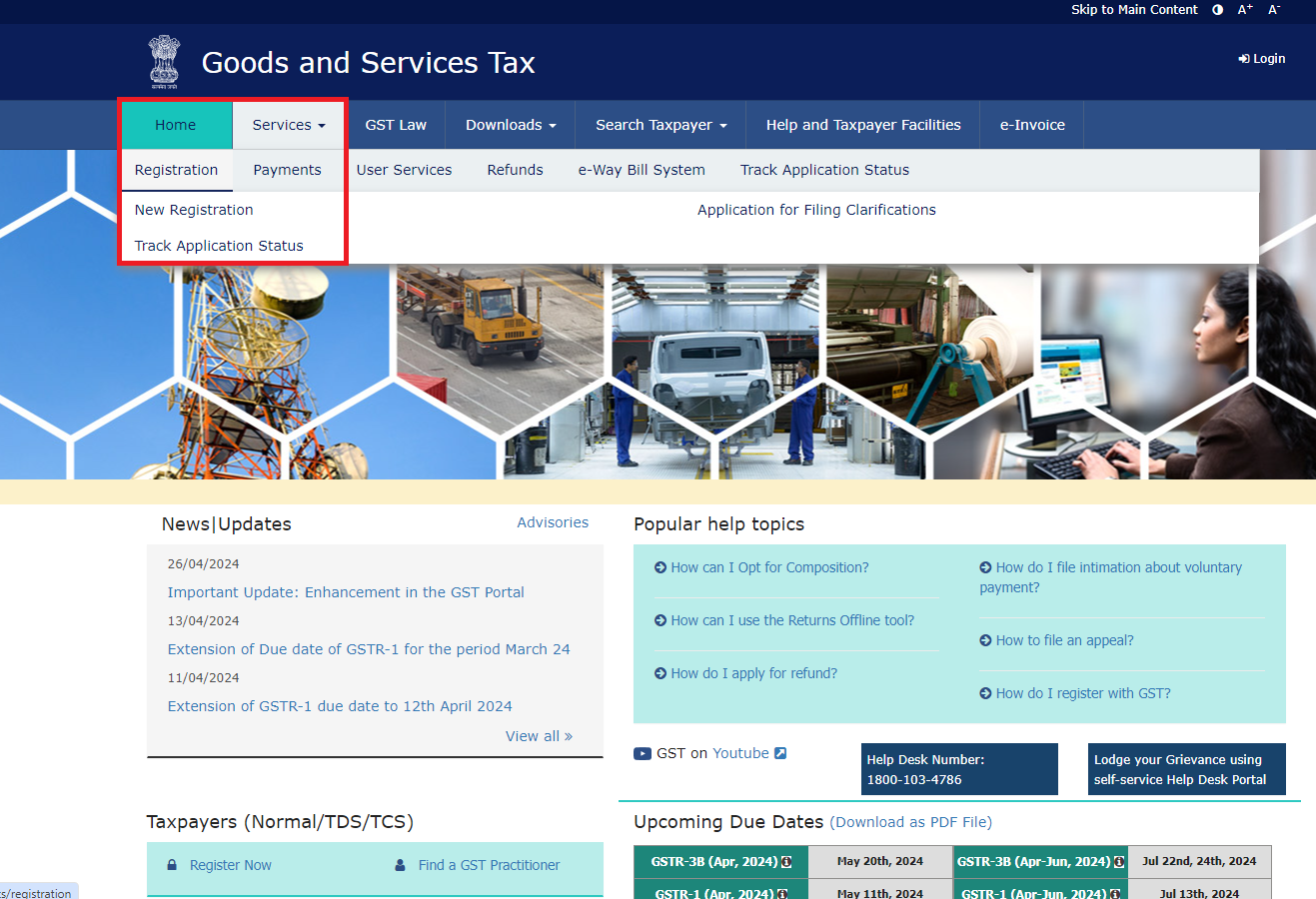

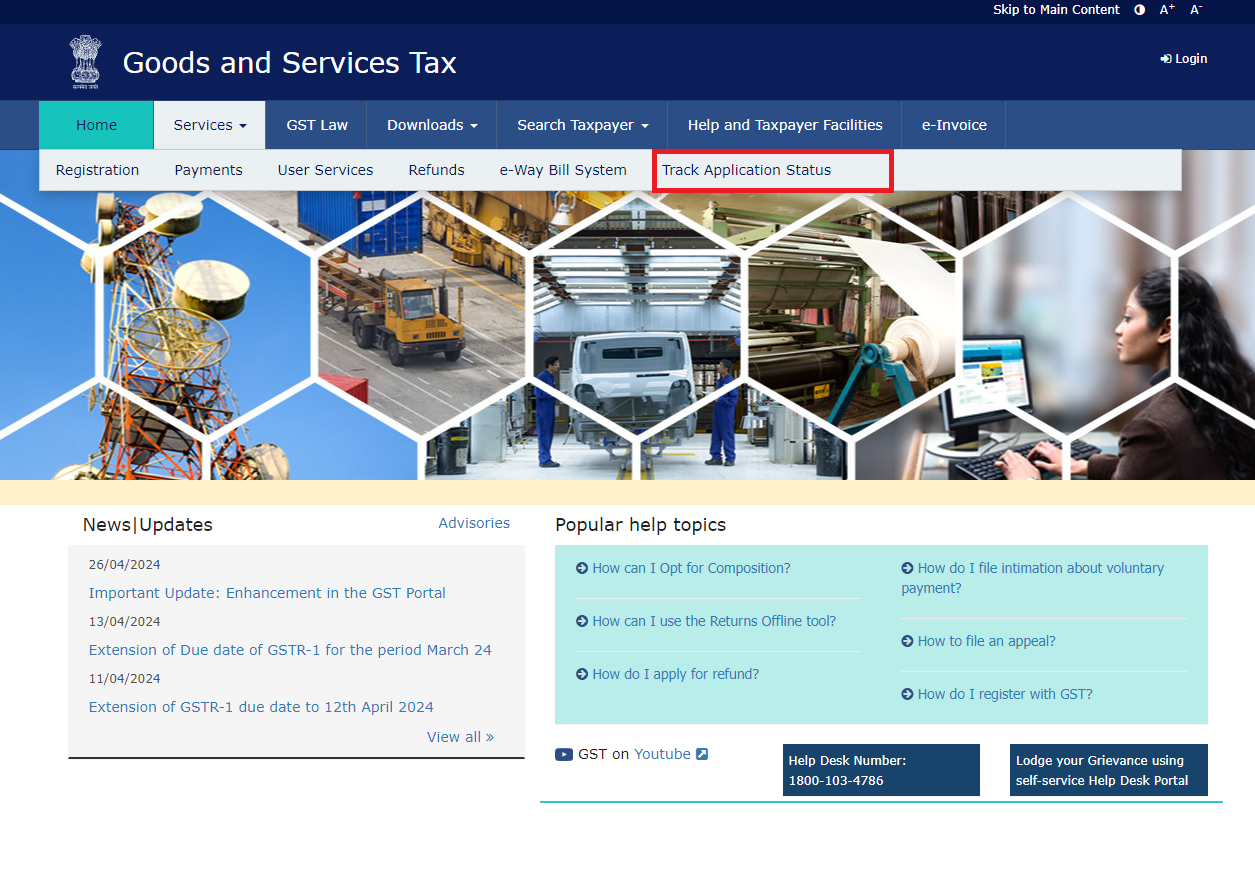

- Step 1: Visit the official GST portal on the link gst.gov.in.

- Step 2: On the homepage, go to the "Services" tab, then click on "Track Payment Status."

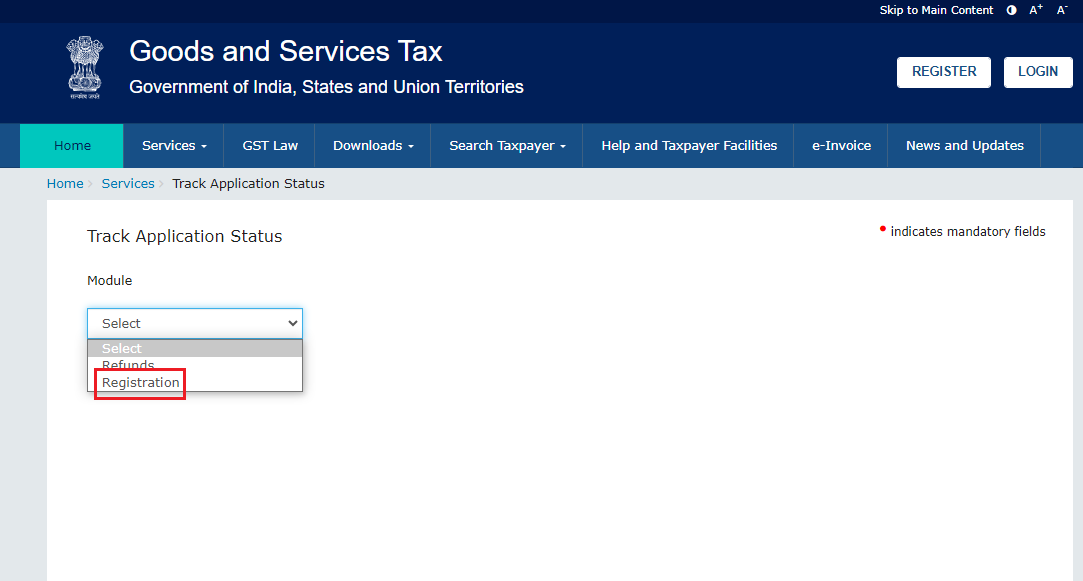

- Step 3: A new window opens, from it click on registration from the drop down menu.

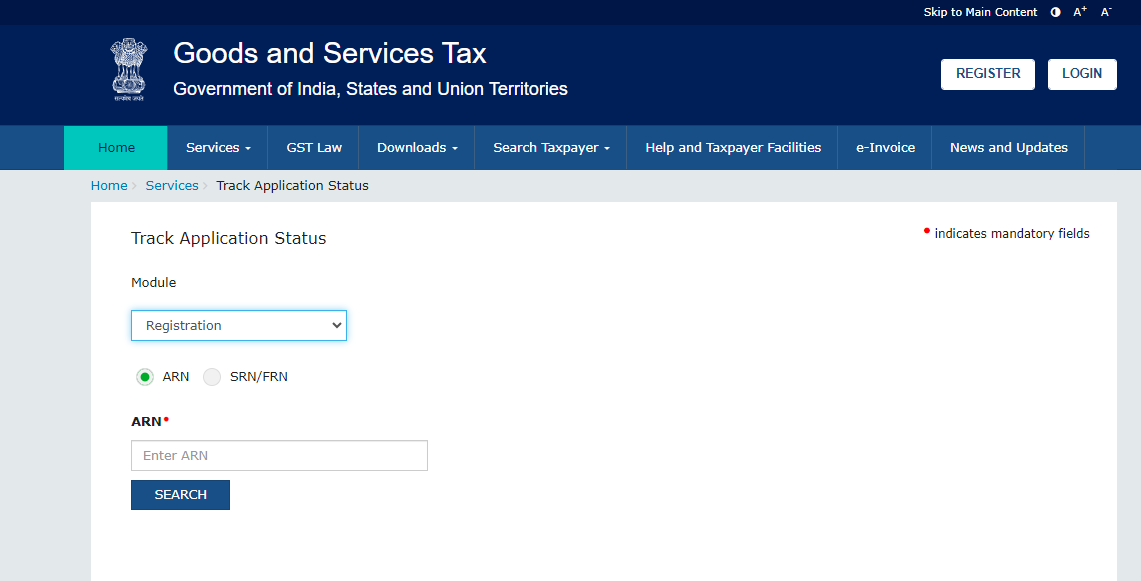

- Step 4: Enter your ARN received upon submitting your application.

- Step 5: The portal will display the status of your application – whether it's pending, approved, or rejected.

💡

Businesses and individuals can check their GST registration status online via the GST Portal (gst.gov.in) using their GSTIN (Goods and Services Tax Identification Number).

After Logging into the GST Portal

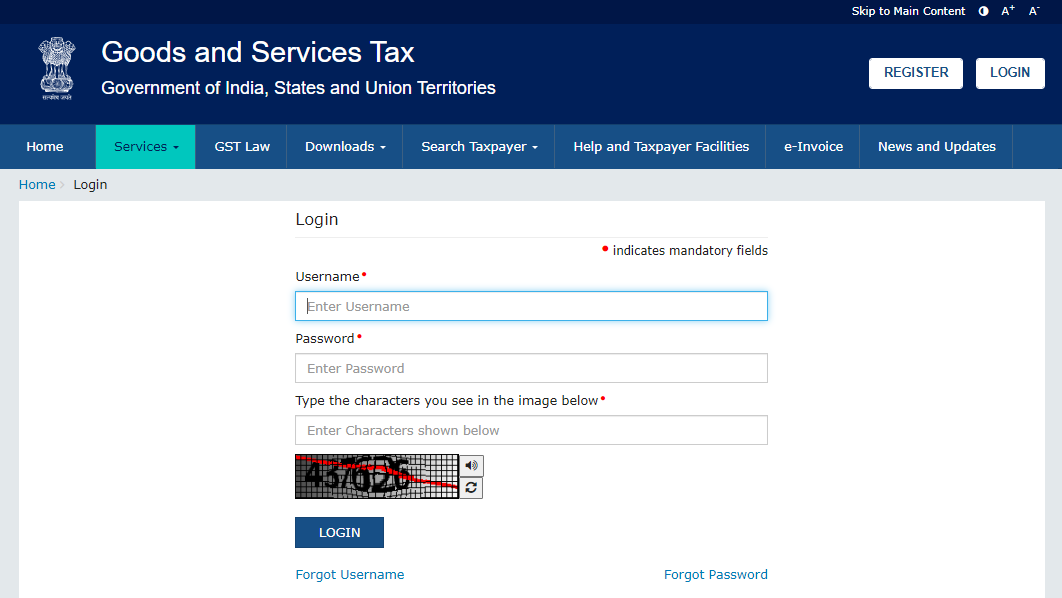

- Step 1: Login and access the GST portal with your login credentials.

- Step 2: Click on the "Services" tab, then select "Track Application Status."

- Step 3: You can search for your application by entering the ARN or selecting the date range when you submitted the application.

- Step 4: The portal will display the status of your application, along with other relevant details.

💡

When you apply for GST registration through the online portal, a unique 15-digit code called the Application Reference Number (ARN) is generated.

Understand GST Registration Status

| GST Registration Status | Description |

|---|---|

| Provisional | Your application has been submitted but not yet processed. A provisional ID may have been issued. |

| Pending for Verification | Your application is being reviewed and verified by the GSTN. |

| Validation Against Error | There are errors in your application that need to be corrected before it can be processed further. |

| Migrated | Your application for migration from an earlier tax regime to GST has been successful. |

| Canceled | Your application has been rejected due to incorrect or incomplete information. You can reapply after rectifying the errors. |

| Approved | Your application has been approved, and you have been assigned a unique GSTIN. |

💡

Regularly checking GST registration status helps businesses ensure compliance and avoid penalties due to inactive or cancelled GST status.