EPF - Employees' Provident Fund

The Employees' Provident Fund (EPF) Scheme is a retirement savings plan for salaried employees in India, overseen by the Employees' Provident Fund Organisation (EPFO), under the Ministry of Labour and Employment.

On this webpage, you can get detailed information about EPF, EPF Passbook, Claim Status, KYC, Online Claim (Withdraw PF Amount), UAN Login, etc.

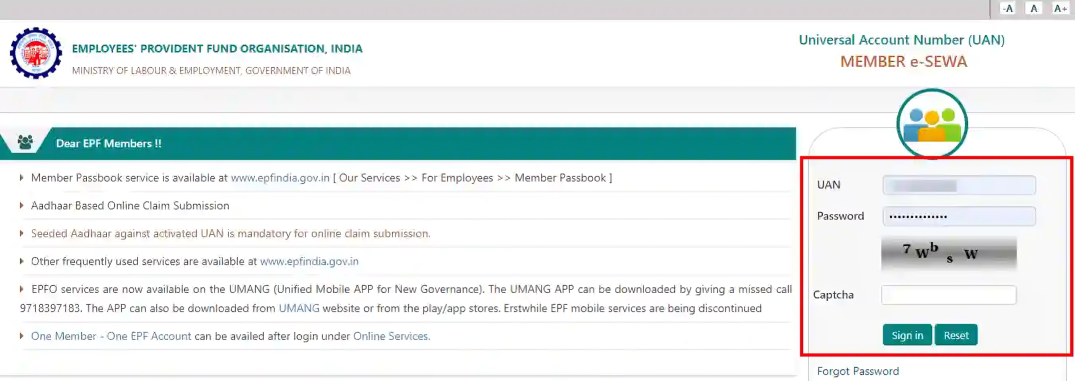

EPFO Login

To access different services on the EPFO website, follow these steps:

- Go to the official website at https://www.epfindia.gov.in.

- On the homepage, locate and click on the “Services” option in the top menu bar. After clicking “Services,” you will be presented with four options:

| For Employers :→ | Log In |

| For Employees :→ | Log In |

| For International Workers :→ | Log In |

| For Pensioners :→ | Log In |

By selecting the appropriate option based on your status, you can log in and access specific services provided by the EPFO.

EPF Passbook & Claim Status

Below is the step-by-step guide about accessing your EPF e-Passbook, Check Balance and Claim Status:

- Visit the EPF Website: Go to the official EPFO website at https://www.epfindia.gov.in/site_en/index.php.

- Select e-Passbook: On the homepage, locate and click the “e-Passbook” option.

- Log In: On the Member Passbook page, input your Universal Account Number (UAN), password, and the captcha code provided, then click on "Sign In".

- View Your Passbook: Once logged in, you can view your EPFO Member Passbook, which includes details of your transactions, contributions, and accrued interest.

- Check Your Balance: In the passbook, you can review the total balance of your EPF account.

- Manage Claims: Utilize the online platform to submit new claims or track the status of existing EPFO claims.

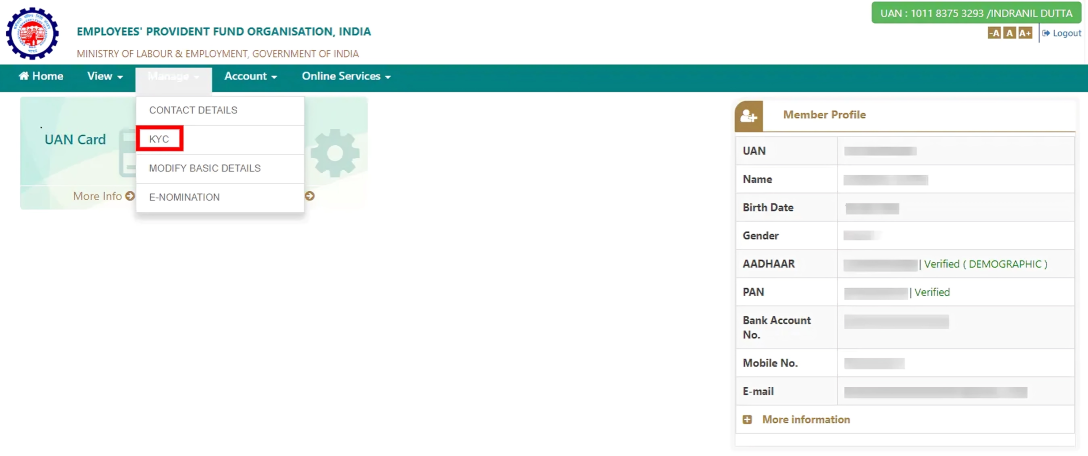

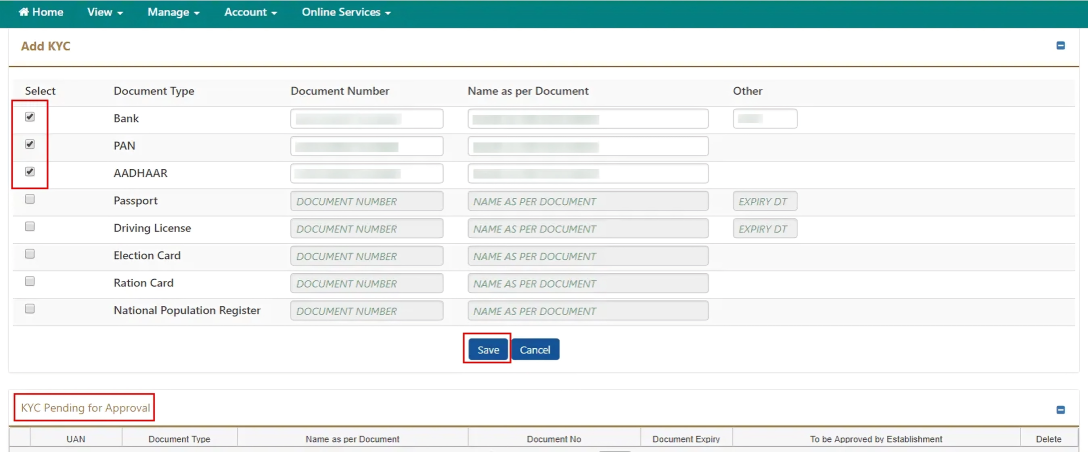

Member KYC

- Visit the EPFO's member portal at https://unifiedportal-mem.epfindia.gov.in/memberinterface/.

- Log in using your UAN, Password, and complete the Captcha verification.

- Navigate to the 'Manage' option in the top menu bar and select 'KYC' from the drop-down menu.

- On the new page, choose the document type you wish to update by clicking the corresponding checkbox.

- Enter the details of the document in the provided fields and click on the 'Save' option after updating the details.

- Your updated details will then appear under 'KYC Pending for Approval'.

- After your employer's approval, the status will change to 'Digitally Approved KYC'.

EPF Online Claim (Online Withdraw PF Amount)

Follow these steps to withdraw your PF online:

- Portal Login: Access the EPFO e-SEWA portal, log in with your UAN and password, and complete the captcha verification.

- Access Online Claims: Once logged in, navigate to the ‘Online Services’ section and select ‘Claim (Form-31, 19, 10C & 10D)’.

- Verify Bank Account: You'll need to enter your bank account number (linked with UAN) for verification.

- Agree to Terms & Conditions: Verify your details, then read and agree to the EPFO's Terms and Conditions before clicking on ‘Proceed for Online Claim’.

- Choose Withdrawal Reason: Select the appropriate reason for your PF withdrawal from the dropdown menu. Only the options you are eligible for will be displayed.

- Input Details and Upload Documents: Fill in your address and, if applying for an Advance Claim, upload necessary documents like your cheque or passbook. Agree to any additional Terms and Conditions and request an OTP for verification.

- Aadhaar OTP Verification: Request an OTP, which will be sent to the mobile number linked to your Aadhaar. Enter this OTP to submit your claim application successfully.

What is EPF (Employees' Provident Fund)?

The Employees' Provident Fund (EPF) is a prominent retirement savings scheme for employees in India, managed under the purview of the Employees' Provident Fund Organisation (EPFO), a statutory body formed by the Government of India.

This scheme is designed to provide financial security and stability to employees from both the public and private sectors upon retirement.

Contributions

PF dues consist of two parts: the employee's contribution, deducted from their salary, and the employer's contribution, added monthly. Both parties contribute 12% of the basic wage according to section 2(b) of the act.

From the employer's 12%, 8.33% goes to the Employee Pension Scheme (EPS) and 3.67% to the Employees' Provident Fund (EPF). Additionally, employers cover 0.50% for EPF administrative charges and 0.50% for EDLI (Employee's Deposit Linked Insurance) charges, totaling a 13% contribution of the basic wage by the employer.

Interest Rate

The interest rate on EPF deposits, varies around 8.15% to 8.25% per annum, subject to change as per government policies. This interest is compounded annually.

| Financial Year | Interest Rate |

|---|---|

| 2016-17 | 8.65% |

| 2017-18 | 8.55% |

| 2018-19 | 8.65% |

| 2019-20 | 8.50% |

| 2020-21 | 8.50% |

| 2021-22 | 8.10% |

| 2022-23 | 8.15% |

| 2023-24 | 8.25% |

Tax Benefits

EPF contributions are tax-deductible under Section 80C, and the interest and withdrawals after five years of service are tax-free. Withdrawals before five years are taxed according to the individual's tax rate.

Eligibility

The EPF scheme is mandatory for all organisations employing 20 or more individuals. All employees of such organisations are then automatically enrolled into the scheme.

Features and Benefits

- Retirement Benefits: Employees receive a lump-sum amount at retirement, including their own contributions, the employer's contributions, and the accumulated interest.

- Pension and Insurance: Apart from the provident fund, the scheme also provides pension (Employees' Pension Scheme) and insurance (Employees' Deposit Linked Insurance Scheme) benefits.

- Emergency Withdrawals: While the primary aim is to provide financial stability post-retirement, the scheme allows for partial withdrawals under specific circumstances like medical emergencies, home purchase, education, and marriage.

- Universal Account Number (UAN): Each member is allotted a UAN, which helps in managing the EPF account online and simplifies the process of transferring funds when changing jobs.

What is EPFO (Employees' Provident Fund Organisation)?

The Employees' Provident Fund Organisation (EPFO) is a statutory body established by the Government of India under the Ministry of Labour and Employment. It administers the Employees' Provident Fund (EPF), which is a premier scheme aimed at promoting retirement savings for workers across India.

Established in 1951, EPFO has grown to become one of the largest social security organizations in the world, catering to the financial well-being of millions of employees in the organized sector.

Currently, there have been 54,922 self generated UAN and over the last year, the Employees' Provident Fund Organisation (EPFO) has seen a significant number of contributing members, totalling 7,79,090. Additionally, the organisation currently provides pensions to a total of 79,60,573 retirees. Check out the EPFO Chart Dashboard to know more.

The head office of the Employees' Provident Fund Organisation is located at Bhavishya Nidhi Bhawan, 14, Bhikaiji Cama Place, New Delhi - 110066.

Schemes

- Employees' Provident Funds Scheme 1952 (EPF): This is the main scheme under EPFO, providing retirement benefits to employees. Both employees and employers contribute a specified percentage of the salary towards this fund.

- Employees' Pension Scheme 1995 (EPS): This scheme provides pension benefits to employees in the organized sector after retirement, ensuring a steady income in their post-retirement life.

- Employees' Deposit Linked Insurance Scheme 1976 (EDLI): This provides life insurance benefits to employees, ensuring financial security for their families in the event of the employee's untimely death.

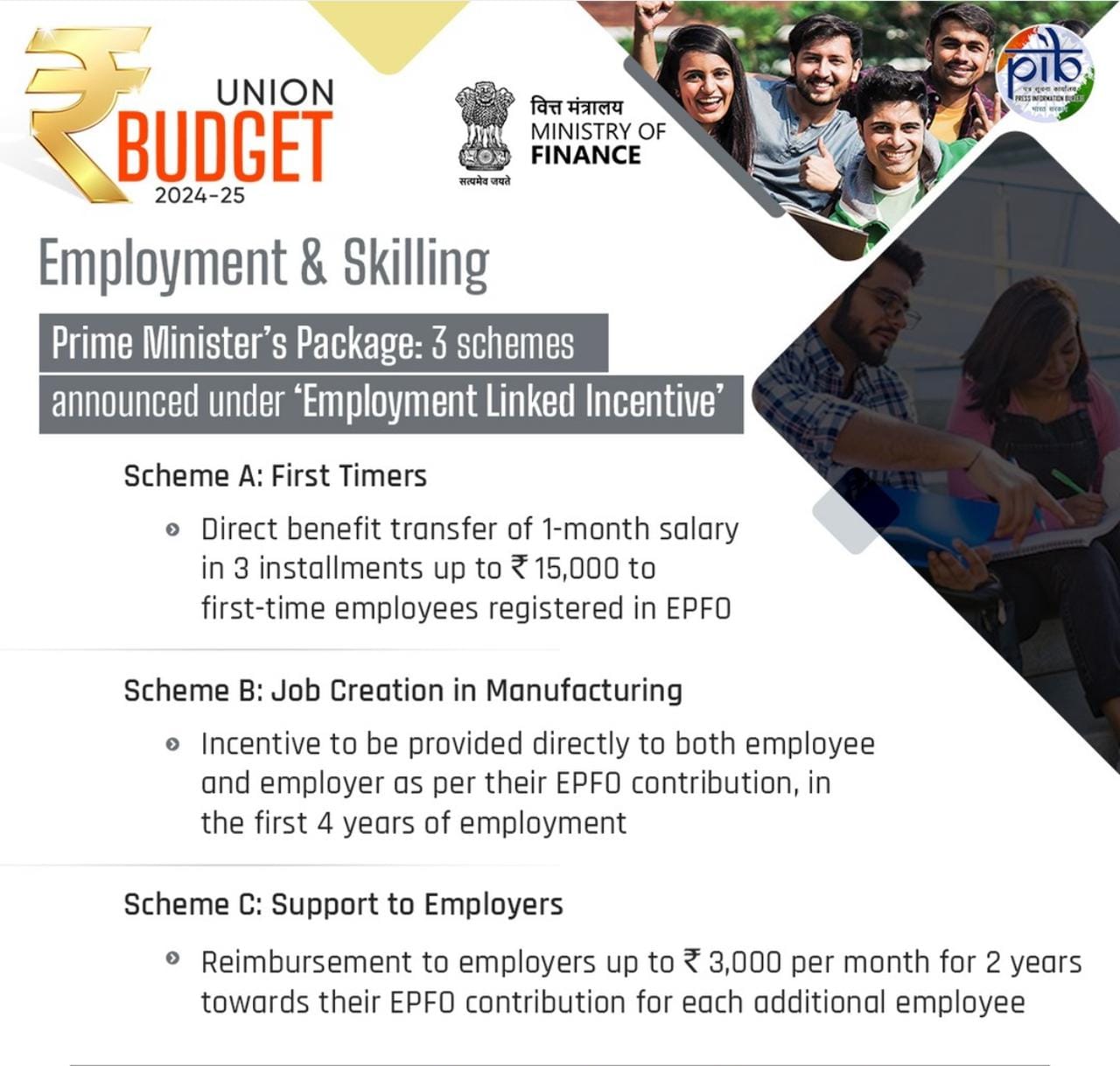

EPFO's Employment Linked Incentive:

On July 23, the government announced three schemes to boost employment for new entrants in the organized sector via the EPFO, with a central outlay of Rs 1.07 lakh crore.

The Union Budget 2024 also introduced the Employment Linked Incentive (ELI) scheme to further support job creation and assist both employers and employees.

These schemes recognize first-time employees and support both employees and employers through the Employees’ Provident Fund Organisation (EPFO).

- Scheme-A: Provides a one-month wage, up to Rs 15,000, for first-time employees in formal sectors. The benefit is given in three installments for those earning up to Rs 1 lakh per month, targeting 210 lakh youth.

- Scheme-B: Incentivizes job creation in manufacturing by providing incentives for the first four years to both employees and employers based on EPFO contributions, benefiting 30 lakh youth and their employers.

- Scheme-C: Supports employers in all sectors by reimbursing up to Rs 3,000 per month for two years for each additional employee earning up to Rs 1 lakh per month, aiming to create 50 lakh new jobs.

Features

- Digital Life Certificate: EPFO enables pensioners to submit their Digital Life Certificate remotely using Facial Authentication Technology, enhancing convenience and ensuring uninterrupted pension receipt.

- Online Profile Updates: Members and employers can now update profiles online through the Unified Portal, eliminating the need for physical visits to EPFO offices.

- Establishment e-Report Card: This online feature provides transparency regarding establishments' compliance status and contributions, aiding in ease of doing business.

- Pensioners' Portal and Calculators: Dedicated online resources are available for pensioners, including calculators for EDLI and pension benefits, to help understand entitlements.

- International Workers Portal: A specialized portal caters to the needs of international workers under EPF regulations, ensuring compliance and informed decision-making.

- Mobile Life Certificate Submission: A mobile app facilitates the submission of life certificates by pensioners, streamlining the process.

- TRRN Query Search: Employers can track the status of their contributions and filings through the TRRN Query Search feature, promoting transparency.

- Nirbadh Initiative: Aimed at providing seamless service delivery, this initiative focuses on making EPFO's services more accessible and efficient.

Vision & Mission

EPFO aims to be an innovation-driven social security organisation committed to addressing the evolving needs of comprehensive social security in a transparent, contactless, faceless, and paperless manner. It ensures uninterrupted services with a multi-locational and automated claim settlement process for disaster resilience.

Grievance (EPFiGMS)

EPFO provides an online grievance management system called EPF i Grievance Management System (EPFiGMS) where employees can register their complaints and track the status of their grievances. This system ensures accountability and timely resolution of issues faced by EPF members. You can reach out to the toll-free number, 14470 for any kind of help and support.

What is UAN?

The Universal Account Number (UAN) is a unique 12-digit number assigned to every employee participating in the Employees' Provident Fund (EPF) scheme, managed by the Employees' Provident Fund Organisation (EPFO) in India.

The primary purpose of the UAN is to link multiple Employee Provident Fund (EPF) accounts allotted to a single employee under different employers.

Helpline

You can contact the EPF helpdesk at the toll-free number 1800118005 between 9:15 AM and 5:45 PM, available daily for support with UAN/KYC services.