EPF Withdrawal Online and Offline

The Employees' Provident Fund is a government-backed savings scheme designed to provide financial security for your retirement. However, under certain circumstances, you might need to access your accumulated EPF balance before you retire.

The EPFO allows for both partial and complete withdrawals under specific conditions, and the process can be conveniently done online.

EPF Withdrawals

The EPFO permits three primary types of withdrawals:

Complete Withdrawal (Form 19 & Form 10C)

This entails withdrawing your entire EPF balance.

Eligibility:

- Retirement at or after the age of 58.

- Early retirement at 55 years or older.

- Unemployment lasting over two months.

- Permanent disability.

- Emigration from India.

- Death of the member (claim by nominee/legal heir).

Partial Withdrawal (Form 31)

This allows you to withdraw a portion of your EPF savings for specific reasons.

Eligibility:

- Specific purposes such as medical treatment, education, marriage, home purchase/construction/renovation, or home loan repayment.

- Fulfilment of the minimum service tenure requirement for the respective withdrawal reason. (Refer to the EPFO website or your employer for details.)

| Purpose of Withdrawal | Minimum Years of Service | Maximum Amount Allowed | Additional Conditions |

|---|---|---|---|

| Medical treatment (self, family) | None | 6 times monthly basic salary + DA or employee’s share with interest, whichever is less | No service requirement |

| Marriage (self, children, siblings) | 7 | 50% of employee’s share with interest | |

| Education (self or children, post-matric) | 7 | 50% of employee’s share with interest | |

| Home purchase/construction | 5 | 36 times monthly basic salary + DA or total cost, whichever is lower | Property must be in member’s name or jointly with spouse |

| Home Renovation | 5 | 12 times monthly basic salary + DA or employee’s share with interest, whichever is less | Property must be in member’s name or jointly with spouse; availed twice during service |

| Home loan repayment | 10 | Lower of: 36 times monthly basic salary + DA, total outstanding loan, or employee’s share with interest | Property must be in member’s name or jointly with spouse |

| One year before retirement | None | Up to 90% of accumulated balance |

Prerequisites

- Activated UAN (Universal Account Number): Your UAN must be active on the UAN Member e-Sewa portal.

- Verified KYC: Your Aadhaar and bank account details should be linked and verified in your UAN profile. This ensures that the withdrawn amount is credited to the correct bank account.

- Updated Date of Exit: Your previous employer should have updated your date of exit in the EPFO records. This is necessary for final settlement claims.

Withdrawal Process

- Step 1: Visit the EPFO e-SEWA portal - unifiedportal-mem.epfindia.gov.in.

- Step 2: Log in to the UAN Member e-Sewa Portal using your UAN and password.

- Step 2: Verify the KYC details under the Manager section.

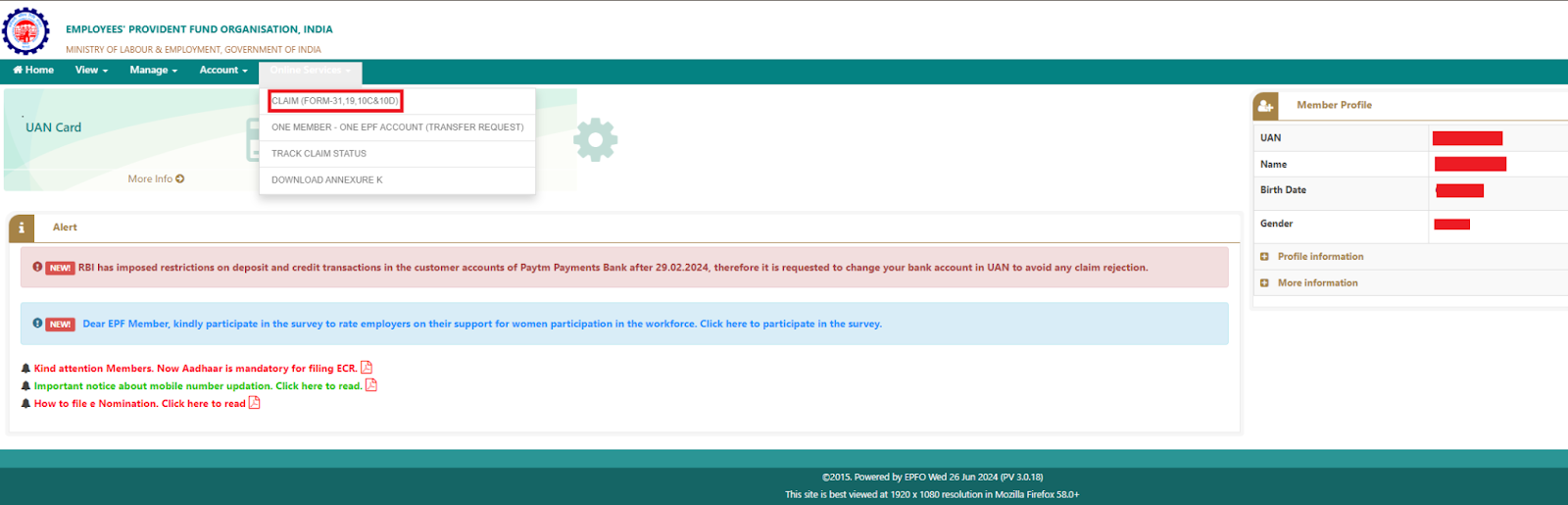

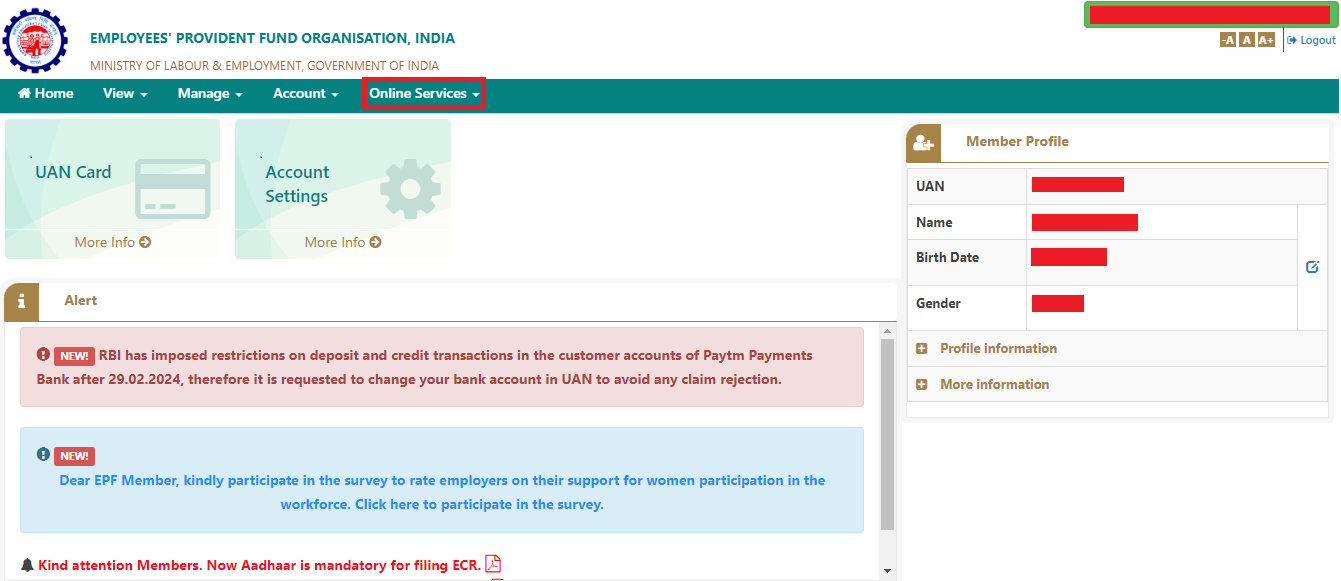

- Step 3: Go to the "Online Services" tab. Select "Claim (Form-31, 19, 10C & 10D)" from the dropdown menu.

- Step 4: Enter the correct bank account number that is seeded with your UAN. Click on "Verify."

- Step 5: Read the terms and conditions carefully and click on "Yes" to proceed.

- Step 6: Choose the reason for your withdrawal from the dropdown menu. The options available will depend on your eligibility.

- Step 7: Enter Details and Upload Documents (if applicable):

- Enter your complete address.

- If you are applying for an advance, you may need to upload your cheque/passbook details.

- Accept the terms and conditions.

- Request a one-time password (OTP) for verification.

- Step 8: An OTP will be sent to the mobile number linked with your Aadhaar. Enter the OTP and submit your claim application.

- Step 9: After submitting, you can track your claim status by logging into your member e-SEWA portal account under "Track Claim Status."

Withdrawal Without UAN

If you don't have your UAN, you can still withdraw your EPF offline by:

- Step 1: Download the Composite Claim Form (Aadhaar/ Non-Aadhaar) from the EPFO website.

- Step 2: Fill out the form with accurate details.

- Step 3: Submitting the form to your Regional Provident Fund Office. You can determine the jurisdiction of your PF office using the information on your salary slip.

EPF Withdrawal Forms

When withdrawing funds from your PF account, specific forms are required based on the type of withdrawal. Each form serves a unique purpose. Below is a table outlining each form and its intended use:

| Form | Purpose |

|---|---|

| Form 19 | Full withdrawal upon retirement or leaving service |

| Form 31 | Partial withdrawals or advances |

| Form 10C | Claiming benefits or obtaining a scheme certificate from EPS for members with <10 years service |

| Form 10D | Monthly pension benefits after retirement for members with ≥10 years service |

| Form 20 | Benefits claim for nominees or legal heirs upon member's death |

| Form 5(IF) | Insurance benefits under EDLI (The Employees Deposit Linked Insurance Scheme) in case of death during service |

Tax Implications on Withdrawal

- Tax-Free: If you have contributed to your EPF account for five continuous years, your withdrawal is usually tax-free.

- Taxable: Withdrawals before five years of continuous service are taxable. If the withdrawn amount exceeds ₹50,000, TDS (Tax Deducted at Source) will be applied at 10% if you have a PAN, and 20% otherwise. You can submit Form 15G/15H to avoid TDS if you meet the eligibility criteria.

EPF Claim Status

Once you have initiated the withdrawal, you need to check the claim. You can do it by following the whole claim status process below.

Online Methods

- UAN Member e-Sewa Portal:

This is the most convenient and widely used method for online tracking.

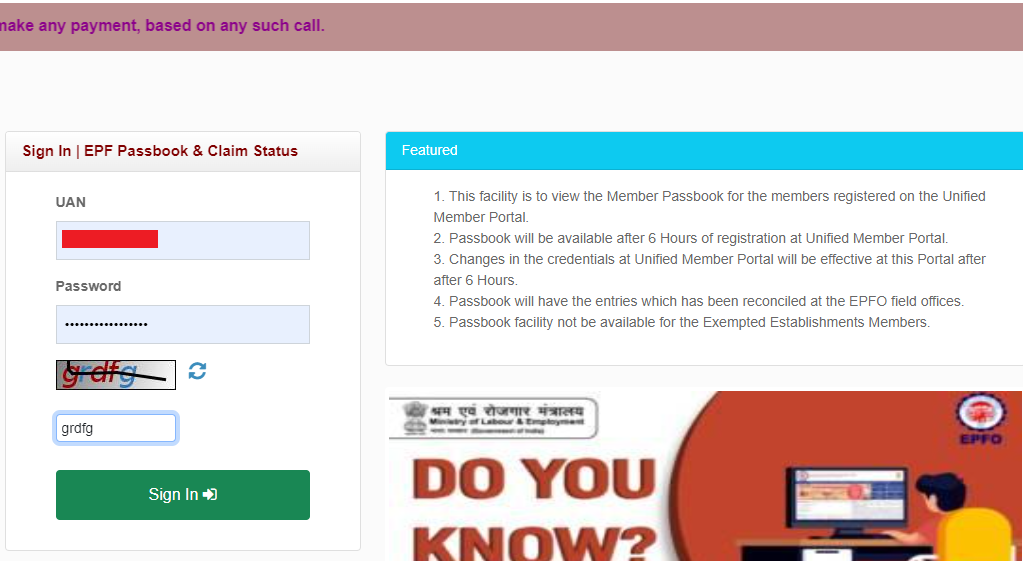

- Step 1: Go to the UAN Member e-Sewa portal.

- Step 2: On the homepage, login using your Universal Account Number (UAN) and password.

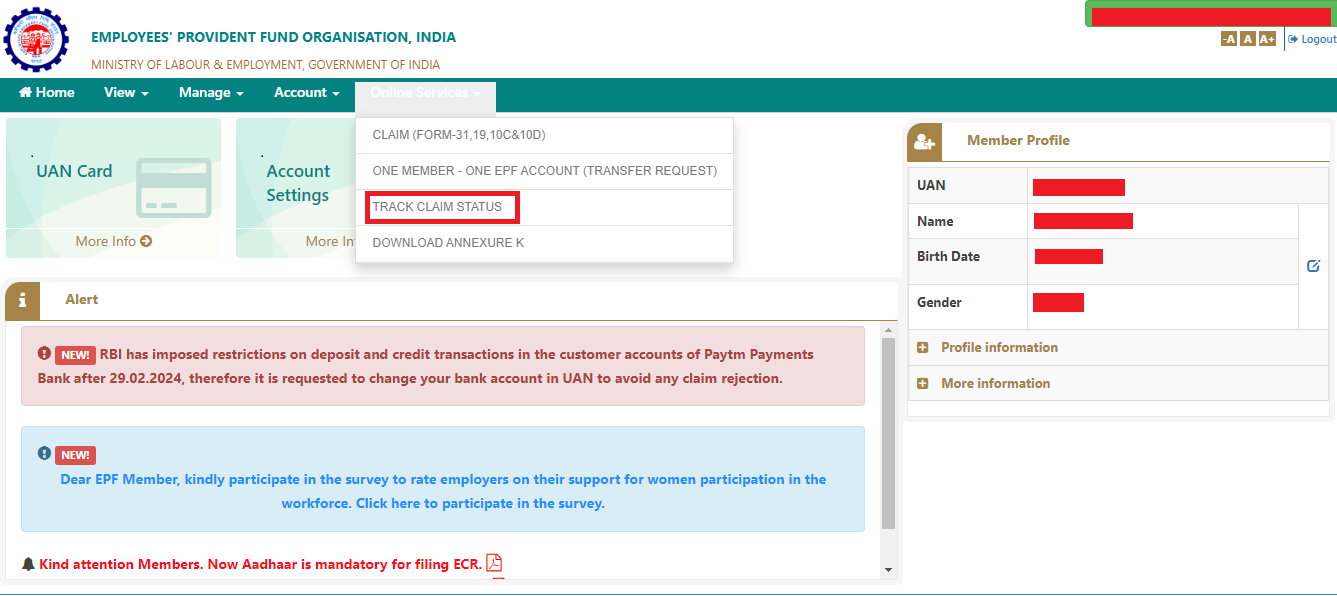

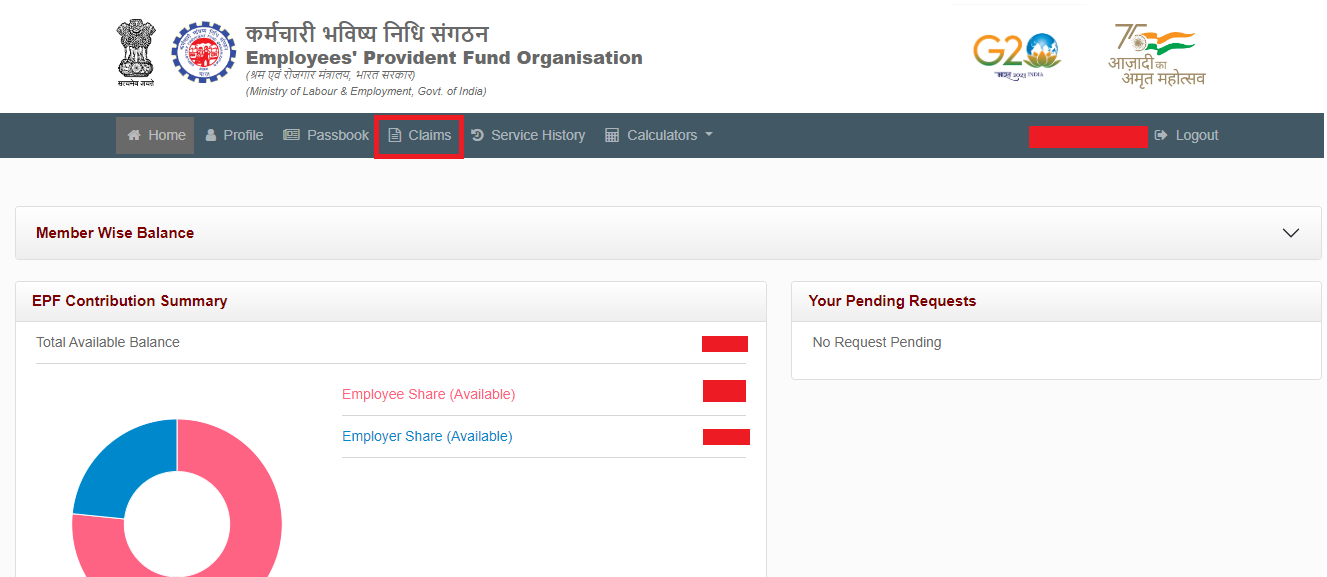

- Step 3: As the next step, go to the "Online Services" tab and select "Track Claim Status."

- Step 4: Your claim details, including the status, will be displayed. This option is available only for online claims.

- EPFO Website:

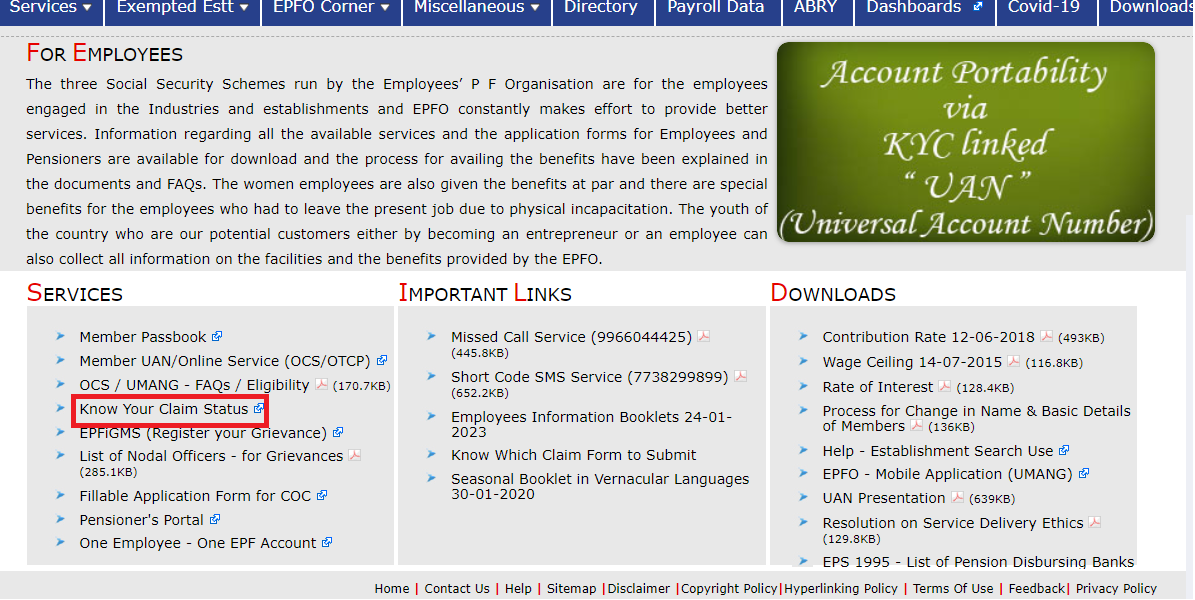

If you filed your claim offline or don't have access to the UAN portal, you can use the EPFO website.

- Step 1: Go to the EPFO website: epfindia.gov.in.

- Step 2: Click on "Our Services", on the main page and then click "For employees"

- Step 3: On the new page that opens, click on "Know your Claim Status."

- Step 4: You will be redirected to the EPF Passbook & Claim Track page.

- Step 5: Next, you need to input your UAN and captcha code and click on "Sign in."

- Step 6: Select the Member ID for the relevant EPF account.

- Step 7: Click on "Claims" on the header bar to see your claim details.

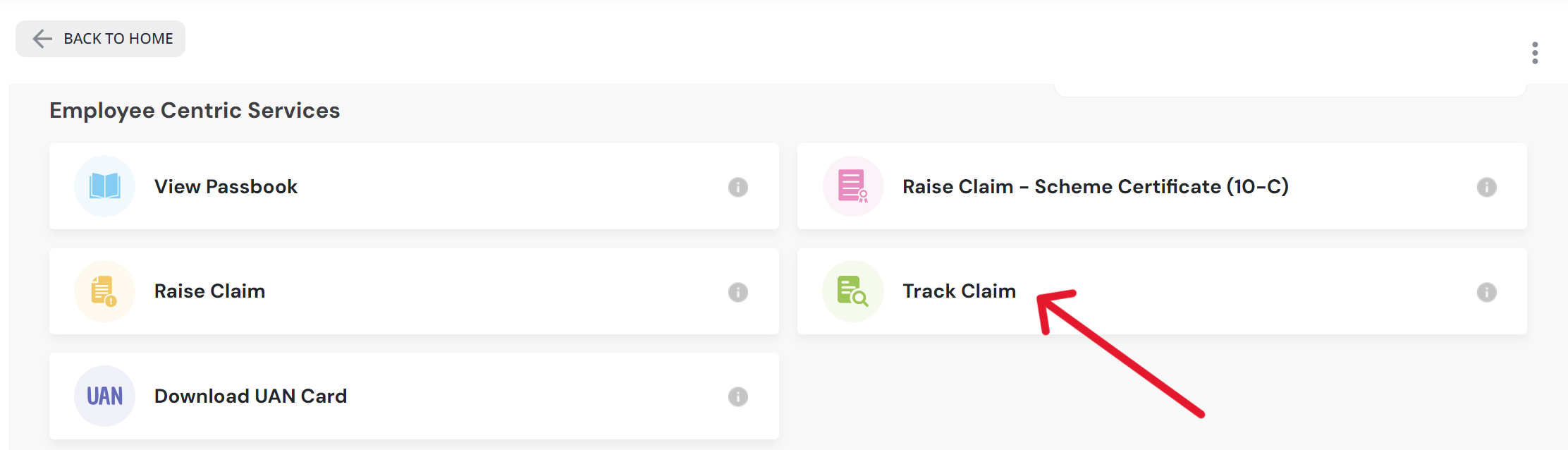

- UMANG App:

The UMANG app offers a mobile-friendly way to track your claim.

- Step 1: Download and install the UMANG app on your smartphone.

- Step 2: Log in using your registered mobile number and OTP.

- Step 3: Go to the EPFO section and then select "Track Claim."

- Step 4: Enter your UAN and the OTP sent to your registered mobile number.

- Step 5: Status will be displayed along with other details.

Offline Methods

- EPFO Helpline: Call the 24x7 customer care number 1800-118-005 or 13611 (between 7 am to 9 pm) and provide your PF account number or UAN to the helpline officer.

- SMS: Send an SMS to 7738299899 in the format "EPFOHO UAN LAN" (e.g., EPFOHO UAN ENG for English) from your registered mobile number.

- Missed Call: Give a missed call to 011-22901406 from your registered mobile number. You will receive an SMS with your claim status.

Types of PF Claim Status

The process of PF withdrawal involves several stages:

- Payment Under Process/Pending/In-Process: Your claim is currently being processed by EPFO.

- Settled: Your claim has been approved, and the funds have been transferred or are in the process of being transferred to your bank account.

- Rejected: Your claim has been rejected. Check the reason for rejection and resubmit if needed.

- Not Available: Your claim is either not yet processed or there might be an issue with the information provided. You may need to contact the EPFO for clarification.