PAN - Permanent Account Number

A PAN (Permanent Account Number) is a unique ten-character alphanumeric identifier, issued by the Indian Income Tax Department. It serves as a universal identification key to track financial transactions that might have a taxable component to prevent tax evasion.

On this webpage, you can get detailed information about PAN Application, Track Status, Download e-PAN, Correction, Reprint, etc.

Download e-PAN

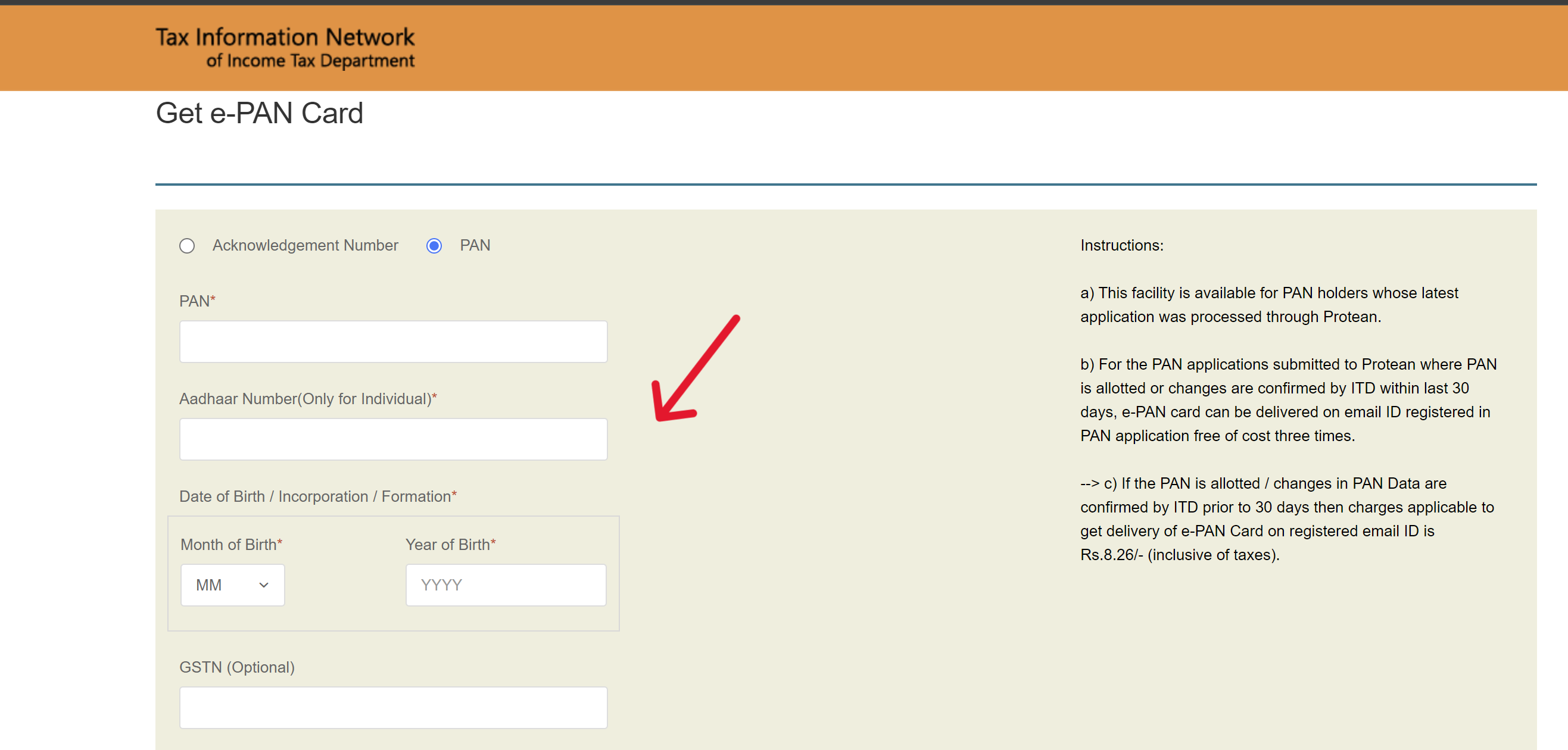

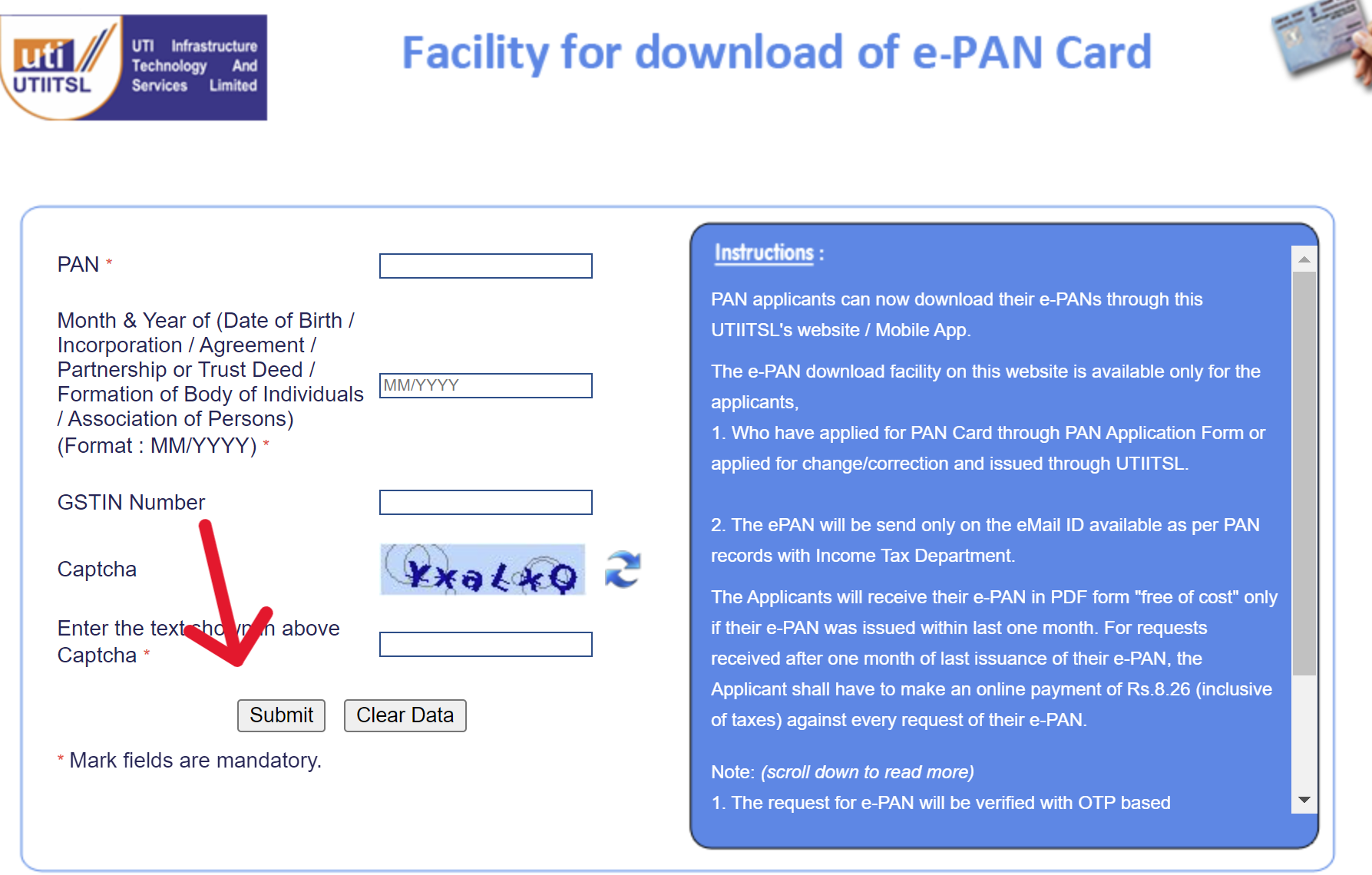

- Click on this link 'Download e-PAN/e-PAN XML' to download your e-PAN.

- Provide Details: Enter your PAN details, date of birth, and GSTIN number (if you have one), then click 'Submit'.

- Access Your Link: After submission, you'll receive a download link either on your registered mobile number or via email.

- Download e-PAN: Click on the received link, verify your identity with the OTP sent to your phone, and proceed to download your e-PAN card.

Check Status

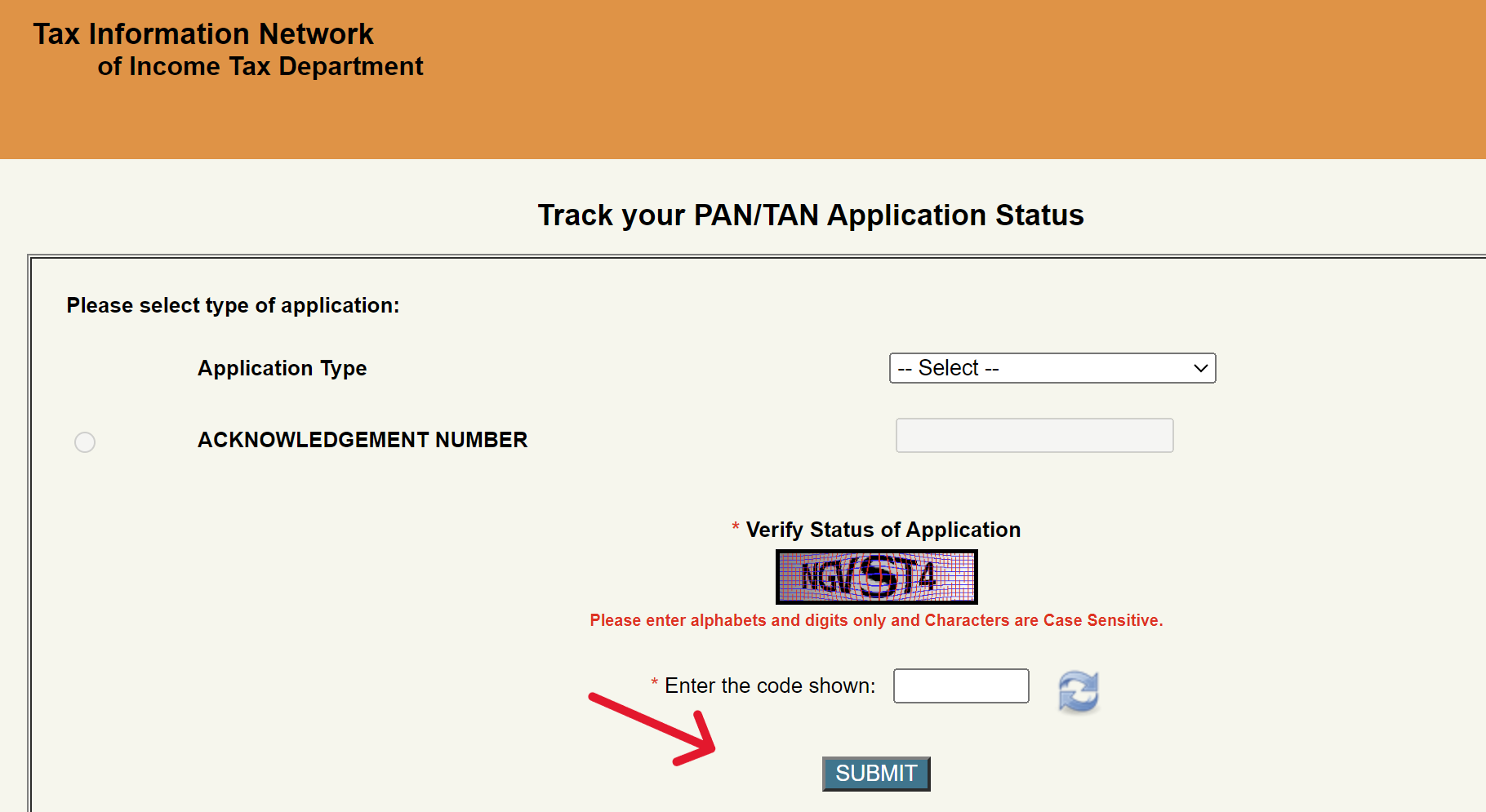

- Click on this link 'Track your PAN/TAN Application Status' to check your PAN status.

- Fill in Application Details: On this page, input the "Application Type" and your "ACKNOWLEDGMENT NUMBER" in the respective fields.

- Complete CAPTCHA Verification: Enter the captcha code displayed on the screen.

- Submit Your Request: Click on the 'Submit' button to view the status of your PAN application.

Apply Online

- Click on this link, 'Online PAN application' to apply for PAN online.

- Choose Application Type: On the website, select the type of application you're filling out from the provided options.

- Select Your Category: Pick the category that best describes you (e.g., individual, company, etc.).

- Fill Out Your Information: Enter necessary details like your name, date of birth, email ID, and mobile number in the designated fields.

- Agree to Terms: Read and agree to the terms and conditions to proceed.

- Acknowledgment Number: After submission, you'll be taken to a new page where you'll receive an acknowledgment number. Make note of this for future reference.

- Provide Additional Details: On the following page, fill in any additional required information.

- Document Upload and Payment: Upload the necessary documents for verification and complete the payment process for your PAN application.

Correction

- Click on this link, 'Online PAN application' to make correction in PAN.

- Select Application Type: From the 'Application Type' dropdown menu, choose 'Changes or correction in existing PAN Data/Reprint of PAN card (No changes in existing PAN data)'.

- Fill in Your Details: Enter all the required information in the form, including your current PAN details and the corrections needed. Also, fill in the captcha verification code, then click on 'Submit'.

- Choose Submission Method: Decide how you want to submit your supporting documents. You have options like mailing them to NSDL, using e-sign, or through e-KYC (the easiest option if you have an Aadhaar card).

- Enter Accurate Details: Make sure all the details you enter match exactly with your Aadhaar card if you're using it for e-KYC or e-sign.

- Pay the Fee: There is a fee for correcting your PAN card. Pay this fee online as part of the application process.

- Authenticate Aadhaar: If you're using Aadhaar for verification, check the box next to 'Authenticate Aadhaar' to give consent, then click on 'Authenticate'.

- Continue with e-Sign/e-KYC: If your Aadhaar details match, you'll be allowed to proceed. Click on 'Continue with e-sign/e-KYC'.

- Generate OTP: Click on the 'Generate OTP' button to receive an OTP on your registered mobile number linked with Aadhaar.

- Confirmation: After successful submission, you'll see a confirmation page indicating that your form has been submitted.

- Download Confirmation: Download the PDF confirmation or save the email confirmation sent by NSDL.

- Wait for Your PAN Card: Once your request is processed, your updated PAN card will be mailed to the address you provided.

Reprint

- Click on this link, 'Request For Reprint Of PAN Card' to apply for PAN online.

- Fill Out the Application: You'll be presented with an application form for requesting a duplicate PAN card. Here, input your PAN number, Aadhaar number (if applicable), and date of birth.

- Review Application Details: Upon submission, the details of your PAN card application will be displayed on a new page for review.

- OTP Verification: Click on "Generate OTP" and select to receive the OTP on either your registered mobile number or email. Enter the received OTP for verification.

- Proceed to Payment: After OTP verification, you'll be taken to the payment page. The fee for PAN card reprint is ₹50, which can be paid through Paytm UPI or card.

What is PAN?

The Permanent Account Number (PAN) is a unique ten-character alphanumeric identifier, issued by the Income Tax Department - India. The PAN Card is a laminated physical document issued by the Indian Income Tax Department.

The PAN is a unique identifier for judicial entities identifiable under the Indian tax laws and is managed by the Central Board for Direct Taxes (CBDT). It also acts as an important proof of identification.

Additionally, the PAN is increasingly becoming a mandatory document for opening new bank accounts, demat accounts, purchasing foreign currency, and for transactions involving high-value purchases and sales.

Benefits and Importance

- Financial Identity: PAN card acts as a proof of identity in India, recognized by all financial institutions and government departments.

- Taxation: It simplifies the process of filing income tax returns, tracking tax payments, and ensuring that one pays the necessary taxes on time.

- Financial Transactions: Mandatory for many financial transactions, such as opening a bank account, receiving taxable income, and making high-value transactions, ensuring transparency in financial dealings.

- Prevention of Tax Evasion: By linking all financial transactions to a single identity, it aids in preventing tax evasion and detecting fraudulent activities.

- Ease of Use: The PAN is unique to an individual or entity and remains unaffected by changes in address or other personal details, making it a stable financial identifier.

- Loan Applications: Necessary for loan applications, as it provides a quick reference to the applicant’s financial history and credibility.

Types

PAN cards are issued to different tax-paying entities. Based on that, the types of PAN are:

- Individuals (Indian)

- Companies (Indian)

- Foreign Citizens

- Foreign Companies

Structure

The structure of the Permanent Account Number (PAN) is a meticulously designed ten-character long alphanumeric unique identifier, which serves multiple purposes beyond mere identification. Here's a breakdown of its structure:

- First Three Characters (AAA-ZZZ): These are three letters forming a sequence of alphabetical letters which can range from AAA to ZZZ, setting the initial part of the PAN's unique identity.

- Fourth Character (Holder Type): This character identifies the type of holder of the card, with each holder type uniquely defined by a letter. The categories include:

- A — Association of Persons (AOP)

- B — Body of Individuals (BOI)

- C — Company

- F — Firm

- G — Government

- H — Hindu Undivided Family (HUF)

- L — Local Authority

- J — Artificial Juridical Person

- P — Individual Person

- T — Trust (AOP)

- Fifth Character (Surname/Entity Name): This is the first character of either the surname or last name of the person (in case of a "personal" PAN card where the fourth character is "P") or the name of the entity, trust, society, or organization (in cases where the fourth character is any other than "P").

- Next Four Characters (Numerals): These are four numbers running from 0001 to 9999, contributing to the uniqueness of the PAN.

- Last Character (Check Digit): The tenth and final character is an alphabetical check digit, used to verify the validity of the PAN.

Required Documents

To apply for a PAN Card, applicants need to provide a set of documents for identity, address proof, and date of birth verification. The requirements vary slightly depending on the applicant's category (individual, company, HUF, etc.). Here's a summary of the documents required:

For Individual Applicants:

- Proof of Identity: Aadhaar Card, Voter ID, Driving License, etc.

- Proof of Address: Utility Bill, Bank Account Statement, Passport, Aadhaar card, Voter ID, Driving License, Domicile Certificate issued by the Government, etc.

- Date of Birth Proof: Birth Certificate, Aadhaar card, Voter ID, Driving License, Matriculation Certificate, Passport, etc.

For Hindu Undivided Family (HUF):

- An affidavit issued by the Karta of the HUF stating the name, address, and father’s name of all coparceners on the date of application.

- Individual members applying for PAN need to submit their proof of identity, address, and date of birth.

For Companies Registered in India:

- A copy of the Registration Certificate issued by the Registrar of Companies.

For Firms/Partnerships/Limited Liability Partnerships Registered in India:

- A copy of the Registration Certificate issued by the Registrar of Firms or LLPs.

- A copy of the Partnership Deed.

For Trusts Registered in India:

- A copy of the Registration Certificate Number issued by a Charity Commissioner.

For Association of Persons (AOPs):

- A copy of the agreement or a certificate of registration number issued by the Registrar of Co-operative Society or Charity Commissioner, or any relevant document from the Central or State Government.

For Applicants Not Being Indian Citizens:

- Proof of Identity: Passport, Person of Indian Origin (PIO) card, Overseas Citizen of India (OCI) card, etc.

- Proof of Address: Bank statement from the country of residence, NRE bank account statement, registration certificate issued by FRO, etc.

Applying for a PAN Card involves filling out Form 49A (for Indian citizens) or Form 49AA (for foreign citizens) and submitting it along with the required documents to the designated PAN application centers or online through the official portals of NSDL or UTIITSL.

Helpline

For any inquiries or issues regarding your PAN card, you can reach out to the dedicated helpline numbers below:

| Service | Contact Numbers | Timings | |

|---|---|---|---|

| UTIITSL Helpline | +91 33 40802999, 033 40802999 | 9:00 AM to 8:00 PM (Open all days) | utiitsl.gsd@utiitsl.com |

| NSDL Helpline | (020) 272 18080 | Not Available | Not Available |