PAN Card Download

ADVERTISEMENT

The Permanent Account Number (PAN) is a unique 10-digit alphanumeric code issued by the Indian Income Tax Department. Today, it has become an important need for every citizen of India.

Lost your PAN card or need a digital version? Don’t worry! You don’t need to fill out lengthy forms or wait weeks for a replacement. The Income Tax Department now lets you download or reprint an e-PAN with just a few clicks.

💡

An e-PAN is considered valid proof of a PAN card since it displays all the details found on a physical PAN card.

Prerequisites

Before downloading the PAN online, you must know about what to keep handy. This will make sure that you do not face any difficulty during the process.

- PAN Number: You must know your existing PAN number to proceed.

- Aadhaar Number: Your Aadhaar must be linked with your PAN.

- Mobile Number: The mobile number linked with your Aadhaar will receive an OTP for verification.

Methods

Primarily, there are three main methods (Through NSDL, UTIITSL, e-Filing Portal) available for individuals to download their PAN (Permanent Account Number) card online.

💡

Visit the NSDL, UTIITSL, or Income Tax e-filing portal where you applied for your PAN card to download it.

How To Download a PAN Card using NSDL?

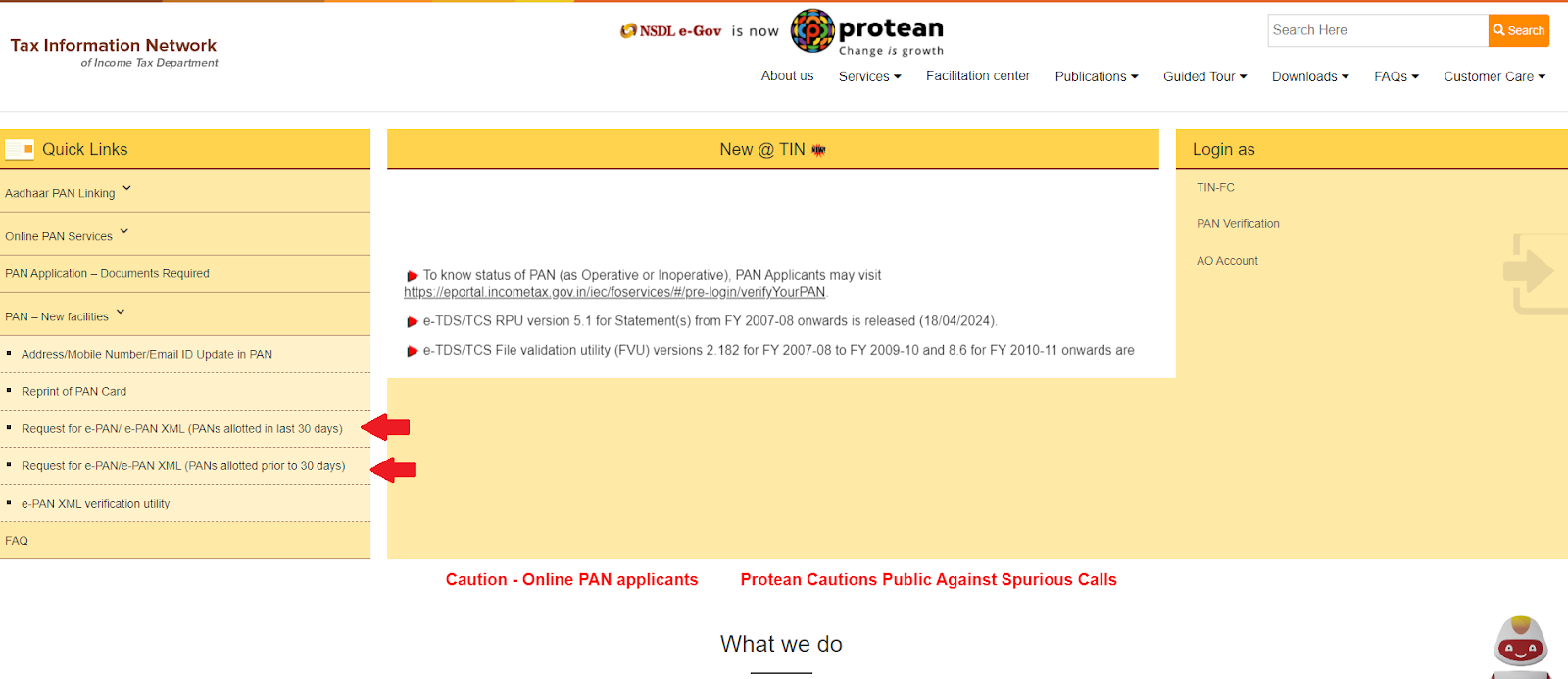

- Step 1: Start the process by going to the official website of NSDL e-Gov - protean-tinpan.com.

- Step 2: On the landing page, go to the “Quick Links” section and click on “PAN-New facilities”, you will get a drop-down menu.

- Step 3: From the drop-down menu, click on ‘Download e-PAN/e-PAN XML (PANs allotted in last 30 days)’ or ‘Download e-PAN/e-PAN XML (PANs allotted prior to 30 days)’, according to your application date. Then you will be directed to a new page.

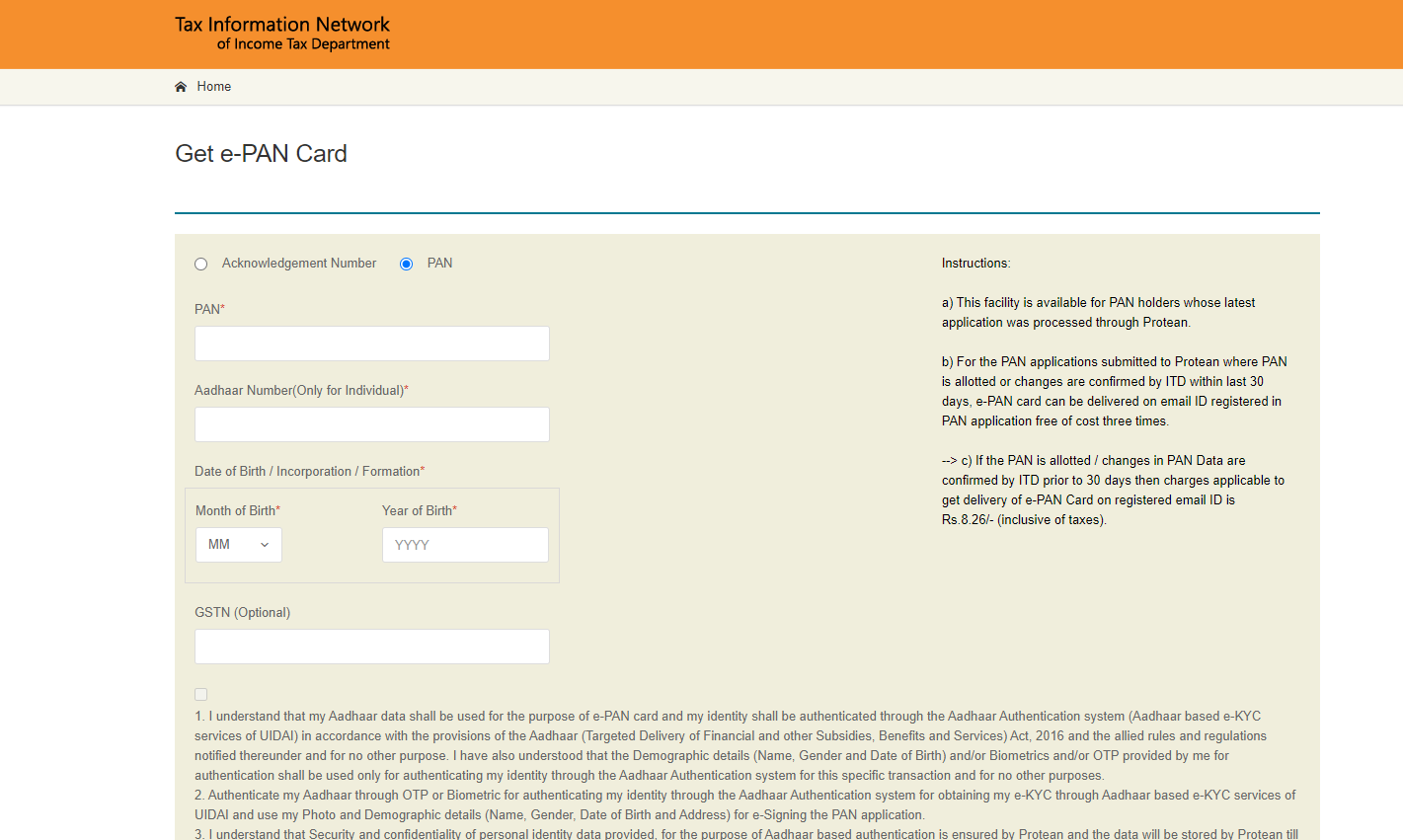

- Step 4: On the new page, you can choose either PAN number, or Acknowledgement number to proceed further. You will be prompted to enter various details such as your PAN number, Aadhaar details, date of birth, and captcha code.

- Step 5: After entering your details, click on the “Generate OTP” button. Shortly after, you will receive a One-Time Password (OTP) on your registered mobile number. This OTP is a crucial security measure to verify your identity and proceed with the download.

- Step 6: Once you’ve received the OTP, enter it into the designated field on the NSDL website and click on the “Submit” button. You will then be able to download your e-PAN card in PDF format.

💡

Note: There may be a small fee if this isn’t your first download.

💡

NSDL Protean (formerly NSDL e-Governance) provides PAN card services, including issuing new PAN cards and processing updates. It partners with the Income Tax Department to offer an efficient online platform for managing PAN applications and ensuring smooth tax-related processes.

How To Download a PAN Card using UTIITSL?

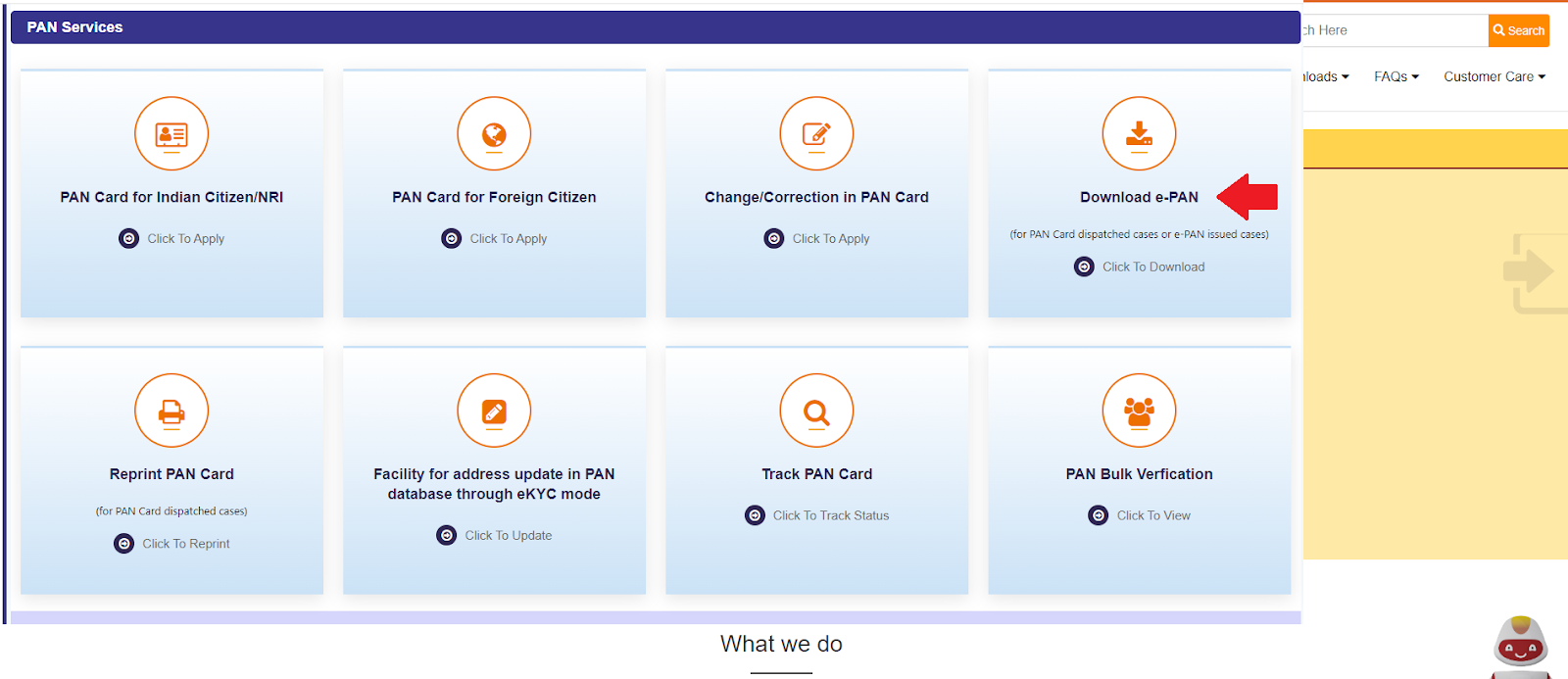

- Step 1: Open your preferred web browser and visit the official UTIITSL website - utiitsl.com.

- Step 2: On the UTIITSL website, locate the section specifically dedicated to PAN services. Now click on the “Download e-PAN” option.

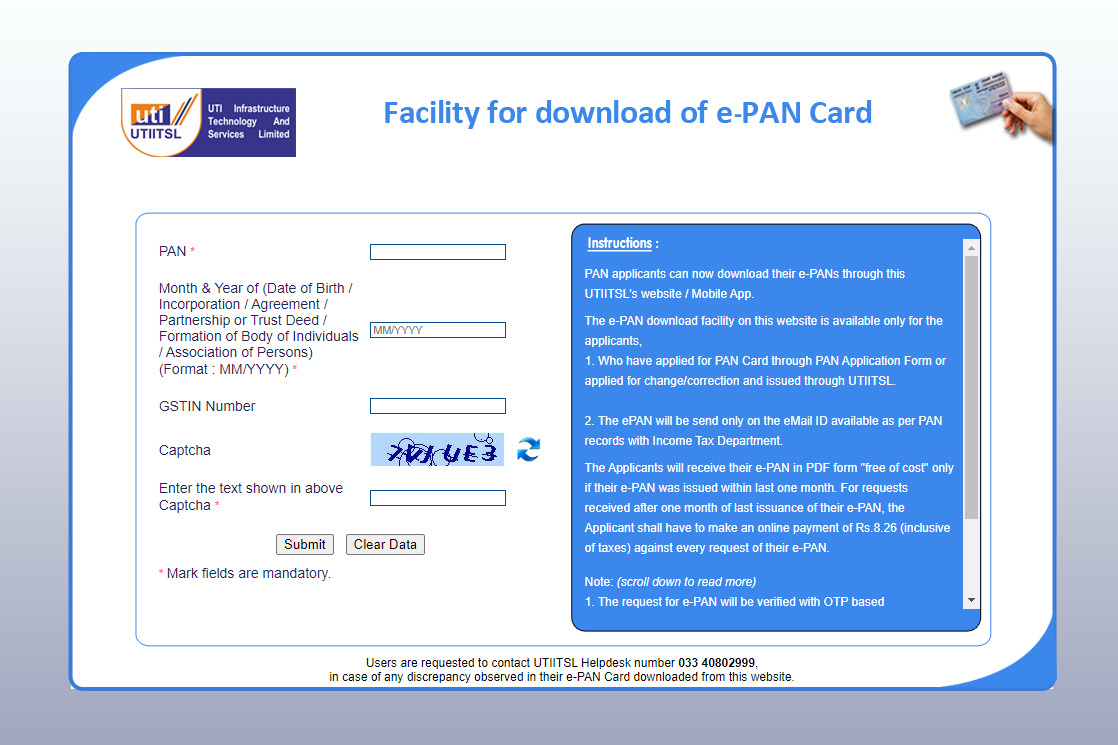

- Step 3: You will be required to input your PAN number, date of birth, and GSTIN (if applicable) into the respective fields. Ensure to double-check the accuracy of the information provided before proceeding.

- Step 4: After entering your details, UTIITSL will send a download link to your registered mobile number or email address. This link will enable you to access your e-PAN card.

- Step 5: Click on the download link received and follow the on-screen instructions to download your e-PAN card.

💡

You can download your e-PAN or Duplicate PAN Card for free if applied within the last 30 days; otherwise, it costs ₹8.26 per download.

💡

UTIITSL (UTI Infrastructure Technology and Services Limited) is a government-owned company that provides PAN card services and various e-governance solutions, along with financial services like mutual fund distribution and IT infrastructure for government and financial institutions.

How To Download a PAN Card using an Income Tax e-Filing Portal?

- Step 1: Pop over to the official Income Tax e-filing website.

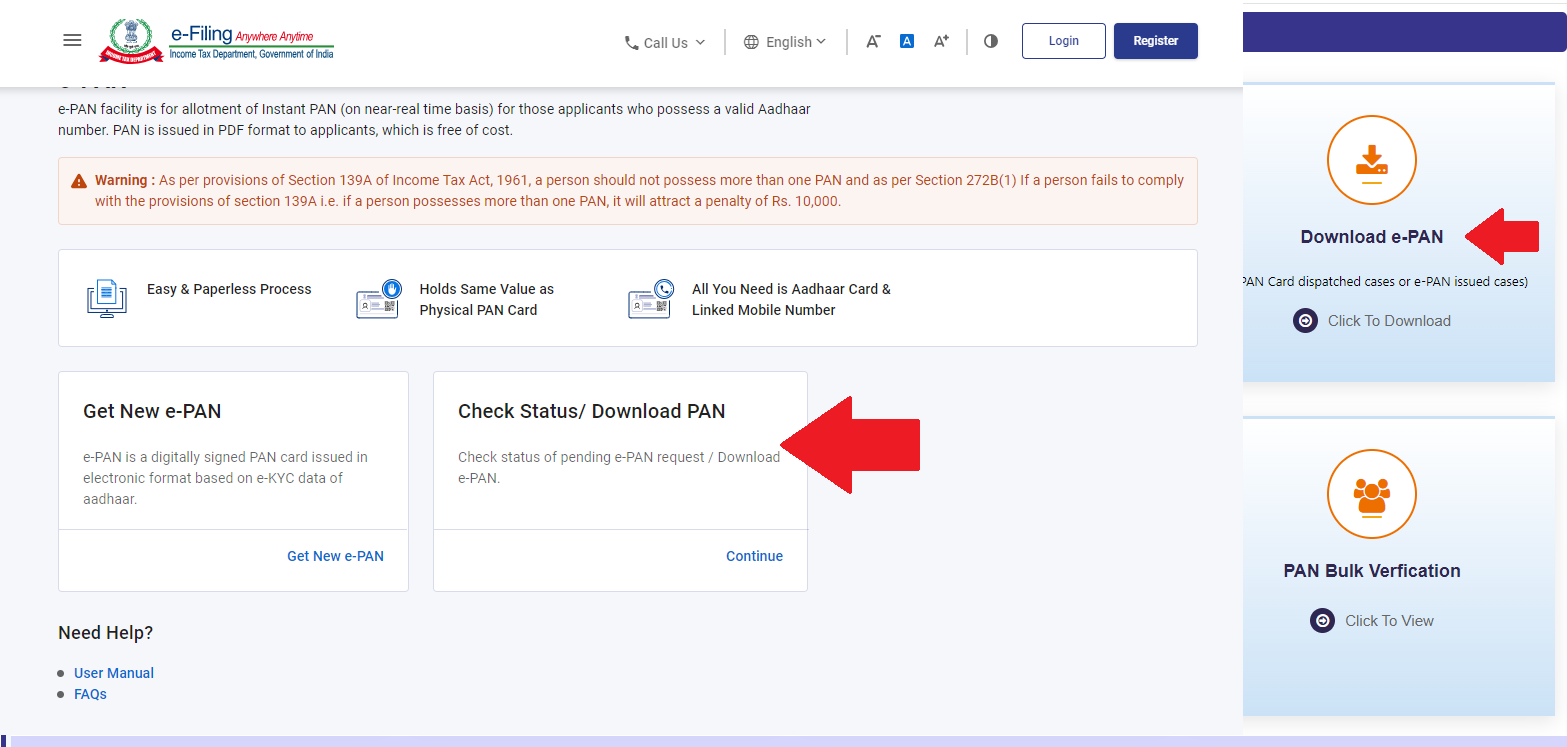

- Step 2: In the Quick Links section, click on the "Instant e-PAN" option.

- Step 3: Look for a tab or section labeled something like “Check Status/Download PAN” and click “Continue.”

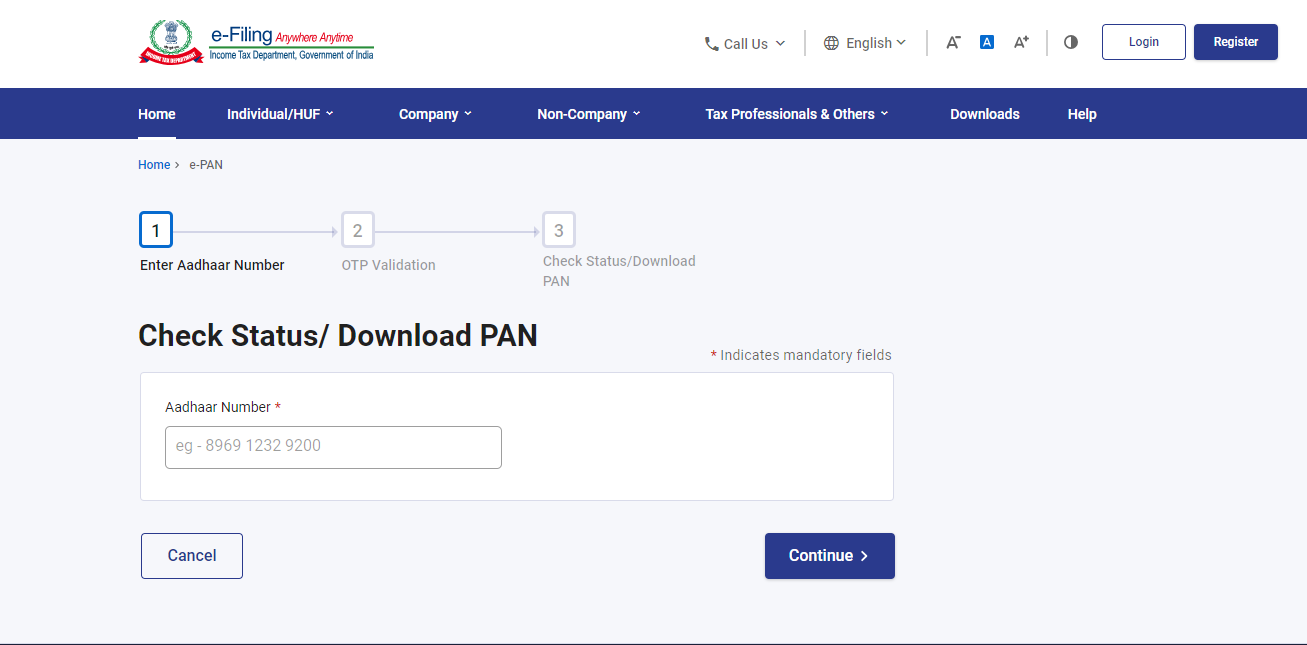

- Step 4: Type in your Aadhaar number and hit that “Continue” button again.

- Step 5: Check your phone! You should have a text with a special one-time code (OTP) from Aadhaar. Enter that code on the website and click “Continue.”

- Step 6: Now you should see the status of your e-PAN. If it’s ready for you, there’ll be a “Download e-PAN” button – give it a click and your e-PAN is yours!

💡

Downloading an instant e-PAN on the e-filing portal is free of charge.

💡

The e-PAN card PDF password is the cardholder's date of birth in the format DDMMYYYY. For example, if the birthdate is March 15, 1990, the password would be 15031990.