Kisan Credit Card (KCC) Scheme

The Kisan Credit Card (KCC) Scheme is a government-backed initiative in India designed to empower farmers by providing them with timely and affordable credit for their agricultural needs.

Indian banks introduced the Kisan Credit Card scheme in August 1998, based on a model prepared by NABARD as per RV Gupta Committee recommendations. The KCC is available at all Indian banks, regional rural banks, and cooperative banks, offering short-term credit limits for crops and term loans.

Application Process

There are two main ways to apply for the Kisan Credit Card scheme: online and offline. Here's a detailed guide for both methods:

Online Application Process

- Step 1: Go to the official website of the bank you wish to apply with for the KCC scheme.

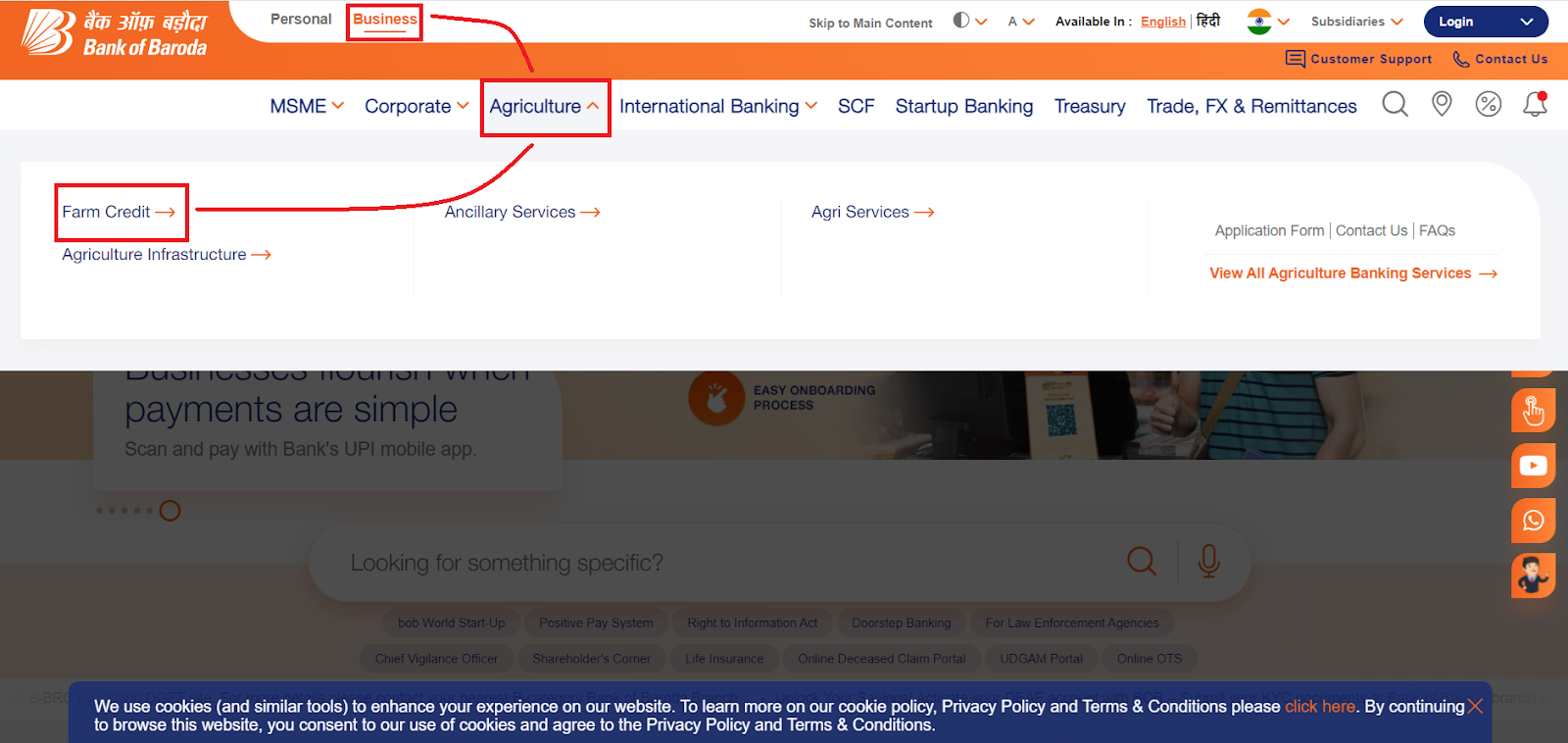

- Step 2: Let's take the example of Bank of Baroda, here first click on business, then under the Agriculture drop down click on Farm Credit.

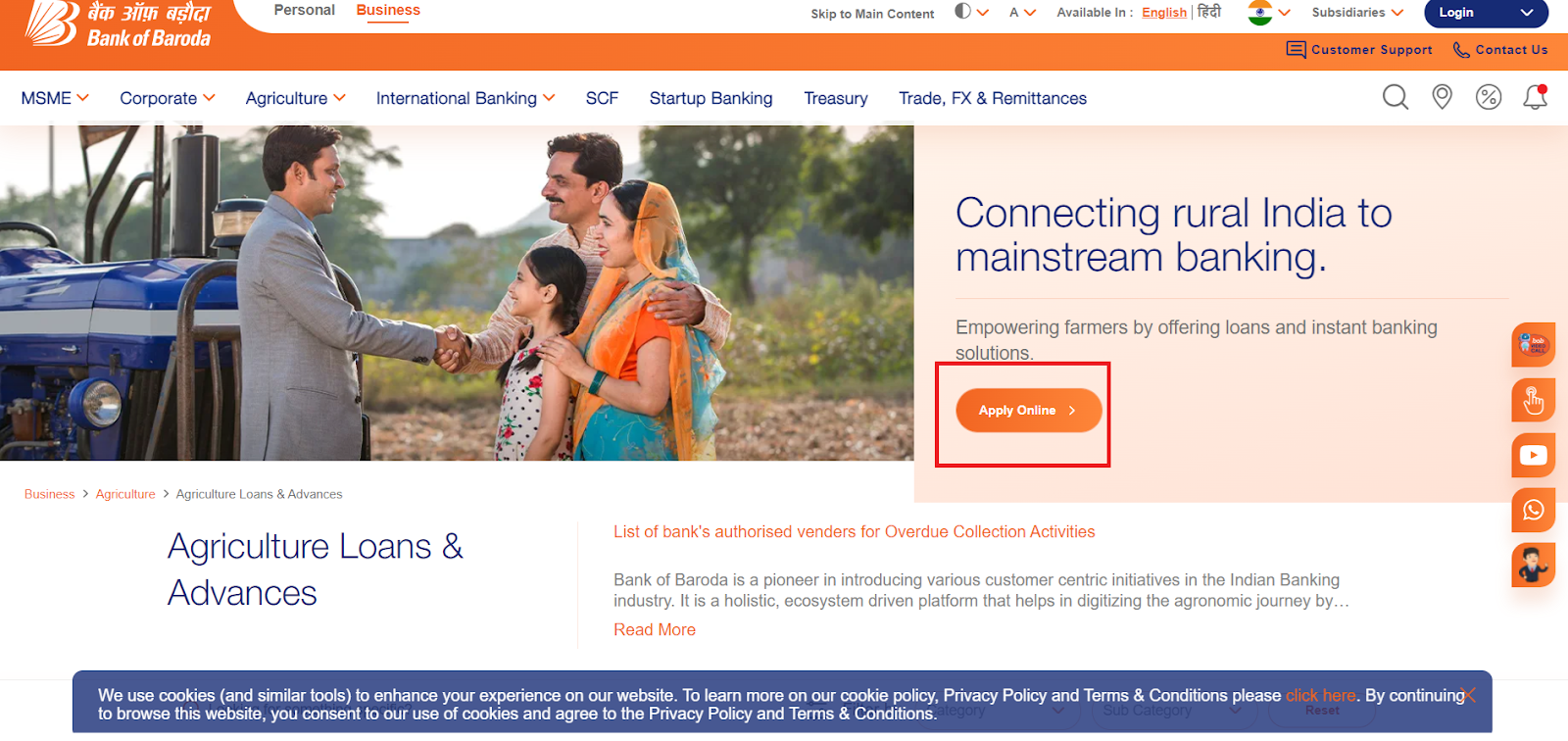

- Step 4: Click on the "Apply Online" option. This will redirect you to the application page specifically designed for the scheme.

- Step 3: Carefully fill out the online application form, providing all the required details accurately.

- Step 4: Once you have completed the form, thoroughly review all the information you've entered to ensure accuracy and completeness. Once satisfied, click the "Submit" button to electronically submit your application.

- Step 5: Upon submission, you'll receive an application reference number as confirmation that the bank has received your application. Keep this number for future reference and tracking purposes.

- Step 6: The bank will process your application, and if you meet the eligibility criteria, they will contact you within 3-4 working days for further steps. This may involve document verification, creditworthiness assessment, and final approval of your KCC.

Offline Application Process

Option 1: Visiting a Bank Branch

- Step 1: Select a convenient branch of the bank you want to apply with for the KCC scheme. Consider factors like proximity and familiarity.

- Step 2: Go to the chosen bank branch during their operating hours. You might want to call beforehand to confirm their hours and avoid unnecessary visits.

- Step 3: Upon arrival, approach a bank representative or customer service desk and inform them of your intention to apply for the Kisan Credit Card scheme.

- Step 4: Ask the bank representative for assistance with the KCC application process. They will guide you through the necessary steps and provide you with the required forms and documents.

- Step 5: With the bank representative's help, carefully fill out the application forms with all the required information, including personal details, contact details, landholding details, and any other relevant information.

- Step 6: Compile all the required documents like ID proof, address proof, proof of landholding, and any other supporting documents as specified by the bank. Submit the completed application forms along with these documents.

- Step 7: Before submitting, double-check all the information on the forms and documents for accuracy. Confirm with the bank representative that your application is complete.

- Step 8: The bank will process your application. They may provide you with an application reference number for tracking purposes. It is advisable to follow up with the bank within the specified timeframe to check the application status.

Option 2: Downloading Application Form

- Step 1: Visit the official website of the bank you wish to apply with for the KCC scheme.

- Step 2: Find the section dedicated to the Kisan Credit Card scheme and look for a link or option to download the application form.

- Step 3: Click on the provided link to download the application form. Make sure you download the correct form specifically designed for the scheme. Print the downloaded form on A4 size paper.

- Step 4: Carefully fill out the printed form with all the required details accurately. Provide information such as personal details, contact details, landholding details, and any other relevant information as specified on the form.

- Step 5: Along with the filled-out application form, collect all the required documents like ID proof, address proof, proof of landholding, and other supporting documents as specified by the bank.

- Step 6: Once the form is filled out and the documents are ready, visit the nearest branch of the bank during its operating hours.

- Step 7: Approach a bank representative or customer service desk and submit the completed application form along with the required documents. Inform them that you're applying for the Kisan Credit Card scheme.

- Step 8: After submitting the form and documents, confirm with the bank representative that they have received your application. They may provide you with an application reference number for tracking purposes. Follow up with the bank within the specified timeframe to check the application status.

Here's a list of major banks where you can find the KCC form:

| Bank Name | Form Download Link |

|---|---|

| State Bank of India (SBI) | SBI KCC Form |

| Punjab National Bank (PNB) | PNB KCC Form |

| Bank of Baroda (BoB) | BoB KCC Form |

| HDFC Bank | HDFC KCC Form |

| ICICI Bank | ICICI KCC Form |

| Axis Bank | Axis KCC Form |

| Canara Bank | Canara KCC Form |

| Union Bank of India | Union Bank KCC Form |

Please visit the respective links to download the KCC forms.

Eligibility Criteria

- Individuals aged 18 to 75 years.

- Possession of land for agricultural purposes (or rented land for those without land ownership).

- Savings bank account.

- Well-structured plan for crop production.

- Senior citizens may require a co-borrower.

Eligible Individuals

- Individual/joint cultivators (owner cultivators)

- Tenant farmers, oral lessees, and sharecroppers

- SHGs or JLGs of farmers (including tenant farmers and sharecroppers)

Documents Required

- Filled application form

- Passport photos (2)

- ID proof (Aadhaar, Voter ID, etc.)

- Address proof (utility bill, etc.)

- Landholding proof (certified by revenue authority)

- Cropping pattern details

- Security documents (land ownership, mortgage deeds)

- Land records

- Income tax returns

- Project reports (allied activities)

- Additional (Bank Specific) For Higher Loan Amounts

Key Objectives

The key objectives of this scheme are as follows:

- Simplified Credit Access: The KCC scheme streamlines the loan application process, making it easier for farmers to obtain credit compared to traditional loans.

- Subsidized Interest Rates: The government offers interest subvention on KCC loans, significantly reducing the interest burden on farmers.

- Flexible Repayment Options: Farmers can repay their KCC loans in convenient installments, aligned with their harvest cycles.

- Multiple Uses: KCC loans cater to a wide range of agricultural needs, including:

- Cultivation expenses (seeds, fertilizers, pesticides)

- Post-harvest expenses (storage, transportation)

- Purchase of agricultural equipment

- Investment in allied activities (dairy, fisheries)

- Household consumption needs (limited extent)

Features

- KCC comes with an ATM-cum-debit card for easy cash withdrawals.

- Credit limits are determined based on factors like landholding, crops cultivated, and financial history.

- Repayment can be made after harvest.

- Conversion or rescheduling of repayment is allowed in case of natural calamities.

- The credit limit increases annually based on repayment performance.

- Hassle-free documentation process.

Benefits

- Farmers can access credit up to Rs. 1.60 lakh and Rs. 3 lakh with and without collateral, respectively.

- KCC loans come with subsidized interest rates, making credit more affordable for farmers.

- Farmers can repay loans in small installments, easing the financial burden.

- KCC cardholders can avail benefits from government subsidies for agricultural supplies.

- KCC offers personal accident insurance coverage for farmers, providing financial protection.

Loan Aspects

- Loan amount is based on factors like crop type, cultivated area, post-harvest/household expenses, farm asset maintenance, and crop insurance.

- Term loans are available for investments in land development, irrigation, farm equipment, and allied activities.

- Repayment period is fixed by banks based on anticipated harvesting and marketing cycles for short-term loans.

Interest Rates and Other Charges

- KCC interest rates typically range from 2% to 4%.

- The government offers interest subsidies and incentives for prompt repayment.

- Banks may charge additional fees like processing costs, insurance premiums, etc.

Factors affecting KCC Interest Rates

- Loan amount: Smaller loans attract lower interest rates.

- Interest subsidy: Banks offer subsidies on loans up to Rs. 3 lakhs.

- Prompt repayment history: Banks may offer additional subsidies for timely repayments.

- Simple vs. Compound Interest: Timely repayments ensure simple interest calculations, reducing overall interest costs.

Frequently Asked Questions (FAQs)

What is the validity period of a Kisan Credit Card?

The validity period of a Kisan Credit Card (KCC) is typically five years, subject to annual reviews.

What is the age requirement to apply for a Kisan Credit Card?

To get a Kisan Credit Card, the applicant must be between 18 and 75 years of age. If the applicant is above 60 years, a co-borrower is required.

What benefits are provided by the Government to improve finance under the KCC scheme?

The Kisan Credit Card (KCC) scheme offers a 2% interest subvention and a 3% prompt repayment incentive on loans up to Rs. 3 lakh per year. For farmers involved only in animal husbandry and fisheries, this benefit is available up to a maximum limit of Rs. 2 lakh per farmer.

What is the interest rate applicable on the KCC (Kisan Credit Card)?

The interest rate on the Kisan Credit Card (KCC) typically ranges from 2% to 4% per annum for loans up to ₹3 lakh, with government subsidies available.

Is there any insurance coverage under the KCC scheme?

Farmers with a KCC are covered by personal accident insurance up to ₹50,000 for permanent disability or death and up to ₹25,000 for other risks. They can also avail collateral-free loans up to ₹1 lakh.

What is the repayment period for KCC loans?

The repayment period for KCC loans is generally aligned with the crop season. Short-term crop loans are usually repayable within 12 months, while term loans for equipment or investment purposes may have longer repayment periods.

What is the maximum loan limit under the KCC scheme?

The loan limit depends on the farmer's landholding, crop type, and credit history. Generally, the maximum limit can go up to ₹3 lakh for short-term crop loans.