Pradhan Mantri Awas Yojana – Urban (PMAY-U)

The Government of India launched the Pradhan Mantri Awas Yojana-Urban (PMAY-U) in June 2015. PM Awas Yojana - Urban is more than just a housing scheme; it's a comprehensive initiative that aims to revolutionize the urban housing sector in India.

As a crucial component of the "Housing for All" mission, PMAY-U has made significant strides in bridging the gap between aspiration and reality for millions of urban dwellers.

How Pradhan Mantri Awas Yojana (Urban) Works?

PMAY-U operates through four distinct verticals, each designed to address specific aspects of the urban housing challenge:

- In-Situ Slum Redevelopment (ISSR): This vertical focuses on transforming existing slums into planned housing areas with improved infrastructure and amenities. It aims to provide slum dwellers with a better quality of life while ensuring their participation in the redevelopment process.

- Credit Linked Subsidy Scheme (CLSS): This is perhaps the most well-known aspect of PMAY-U. CLSS offers interest subsidies on home loans to eligible beneficiaries, making homeownership more affordable by reducing the financial burden of interest payments.

- Affordable Housing in Partnership (AHP): Under this vertical, the government partners with private and public entities to develop affordable housing projects. This increases the supply of affordable homes in urban areas, making them more accessible to those in need.

- Beneficiary-led Construction (BLC): This component empowers individuals from Economically Weaker Sections (EWS) by providing financial assistance for constructing their own houses on their land. It gives them the autonomy to build homes that meet their specific needs and preferences.

Benefits of PMAY-U

PMAY-U provides numerous benefits to eligible beneficiaries:

- Central Assistance: Central assistance of ₹1.5 lakh per Economically Weaker Section (EWS) house under Affordable Housing in Partnership (AHP) projects.

- Credit Linked Subsidy Scheme (CLSS):

- EWS/LIG: Interest subsidy of 6.5% on housing loans up to ₹6 lakh. Beneficiaries can build houses with a larger area, but the subsidy is limited to the first ₹6 lakh of the loan.

- MIG-I: Interest subsidy of 4% on housing loans up to ₹9 lakh. Eligible for houses up to 160 sq.m carpet area.

- MIG-II: Interest subsidy of 3% on housing loans up to ₹12 lakh. Eligible for houses up to 200 sq.m carpet area.

The subsidy is credited upfront to the loan account of beneficiaries through Primary Lending Institutions (PLIs).

- Beneficiary-Led Individual House Construction or Enhancement (BLC): Assistance of ₹1.5 lakh per family for constructing new houses or enhancing existing houses.

Implementation

- The subsidy is provided upfront by crediting the beneficiary’s loan account, reducing the effective loan burden and monthly installments.

- The Net Present Value (NPV) of the interest subsidy is calculated discounted rate of 9%.

- Primary Lending Institutions (PLIs):

- PLIs including banks, housing finance companies, and other financial institutions facilitate the housing loans.

- PLIs submit claims for the subsidy to the Central Nodal Agencies (CNAs) after due diligence.

- CNAs ensure proper implementation and monitoring of the scheme.

- Central Nodal Agencies (CNAs):

- Housing and Urban Development Corporation (HUDCO), National Housing Bank (NHB), and State Bank of India (SBI) are identified as CNAs.

- CNAs channelize the subsidy to PLIs and monitor the progress of the CLSS component.

Eligibility Criteria

PMAY-U aims to cater to a wide range of urban dwellers who aspire to own a home. The eligibility criteria are designed to be inclusive and focus on those who are most in need. Here's a breakdown of the eligibility requirements:

- Income Category: Applicants must fall under one of the following categories based on their annual household income:

- Economically Weaker Section (EWS): Annual household income up to ₹3 lakhs

- Low-Income Group (LIG): Annual household income between ₹3 lakhs and ₹6 lakhs

- Middle Income Group I (MIG I): Annual household income between ₹6 lakhs and ₹12 lakhs

- Middle Income Group II (MIG II): Annual household income between ₹12 lakhs and ₹18 lakhs

- Property Ownership: Applicants must not own a pucca (permanent) house in their name or in the name of any member of their family in any part of India.

- First-time Homebuyer: Applicants must not have availed of any central assistance under any housing scheme from the Government of India in the past.

- Age and Citizenship: Applicants must be at least 18 years old and citizens of India.

Exclusion Criteria

- Pucca House Ownership:

- The beneficiary family should not own a pucca house (an all-weather dwelling unit) either in their name or in the name of any member of the family in any part of India.

- An adult earning member, irrespective of marital status, can be treated as a separate household provided that he/she does not own a pucca house in their name in any part of India.

- In the case of a married couple, either of the spouses or both together in joint ownership will be eligible for a single house, subject to income eligibility of the household under the scheme.

- Enhancement of Existing Dwelling Units:

- A person with a pucca house having a built-up area of less than 21 sq.m may be included for the enhancement of existing dwelling units up to 30 sq.m.

- If enhancement is not possible due to lack of availability of land/space or any other reason, they may get a house under PMAY(U) elsewhere.

Application Process

The application process for the Pradhan Mantri Awas Yojana (Urban), is outlined below:

- Demand Assessment and Survey:

- Cities conduct a demand survey to assess the housing needs.

- States/UTs prepare a Housing for All Plan of Action (HFAPoA) based on the survey.

- Application Submission:

- Potential beneficiaries can apply directly or through Urban Local Bodies (ULBs) or other designated agencies.

- Applications should include necessary documents such as Aadhaar/Virtual ID, income proof, and details of the current housing situation.

- Eligibility Verification:

- The applicant's details are verified against the scheme's eligibility criteria.

- Aadhaar or Virtual ID is used to avoid duplication of benefits.

- Beneficiary Identification and Approval:

- Eligible beneficiaries are identified, and their details are uploaded to the PMAY (U) Management Information System (MIS).

- An Application ID is generated for tracking purposes.

- Project Sanctioning:

- States/UTs prepare Detailed Project Reports (DPRs) which are appraised and approved by State Level Sanctioning and Monitoring Committees (SLSMCs).

- Approved projects receive central assistance and state/UT contributions as per the scheme guidelines.

- Funding and Loan Processing:

- For Credit-Linked Subsidy Scheme (CLSS), beneficiaries approach Primary Lending Institutions (PLIs) for home loans.

- PLIs submit the claims to Central Nodal Agencies (CNAs) after due diligence.

- Subsidy is credited upfront to the loan account of the beneficiary, reducing the principal loan amount.

- Implementation and Monitoring:

- Projects are implemented by designated agencies.

- Regular monitoring and reporting are conducted through geo-tagging and Management Information System (MIS).

- Beneficiary-led Construction:

- Beneficiaries opting for individual house construction or enhancement receive assistance directly in their bank accounts.

- States/UTs facilitate the process and ensure proper utilization of funds.

This process ensures transparency and efficient delivery of housing benefits to eligible urban poor families under the PMAY-U scheme.

Online Application Submission Process

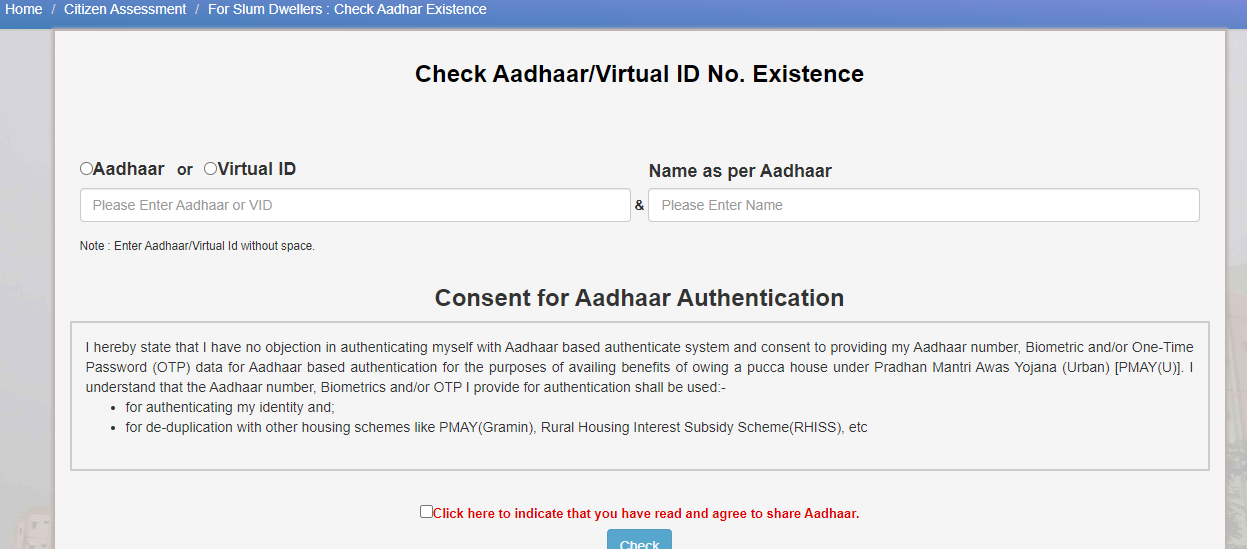

- Step 1: Visit the official website - pmay-urban.gov.in and click on "Citizen Assessment."

- Step 2: Enter your Aadhaar card number/virtual ID details and click "Check."

- Step 3: You will be redirected to the online application form. Fill in all mandatory details and upload the required documents.

- Step 4: Save the application and enter the captcha code. Your application is complete.

- Step 5: Take a printout of the acknowledgment for future reference.

Documents Required

- Aadhaar Number: (or Aadhaar Enrollment ID)

- Proof of Income: Self-certificate or affidavit

- Identity and Residential Proof: PAN card, Voter ID, Driving License, etc.

- Proof of Minority Community: (if applicable)

- Proof of Nationality

- Income Certificate: EWS, LIG, or MIG certificate as per your category

- Additional Documents: Salary slips, IT return statements, property valuation certificate, bank details, etc.

Search For a Beneficiary

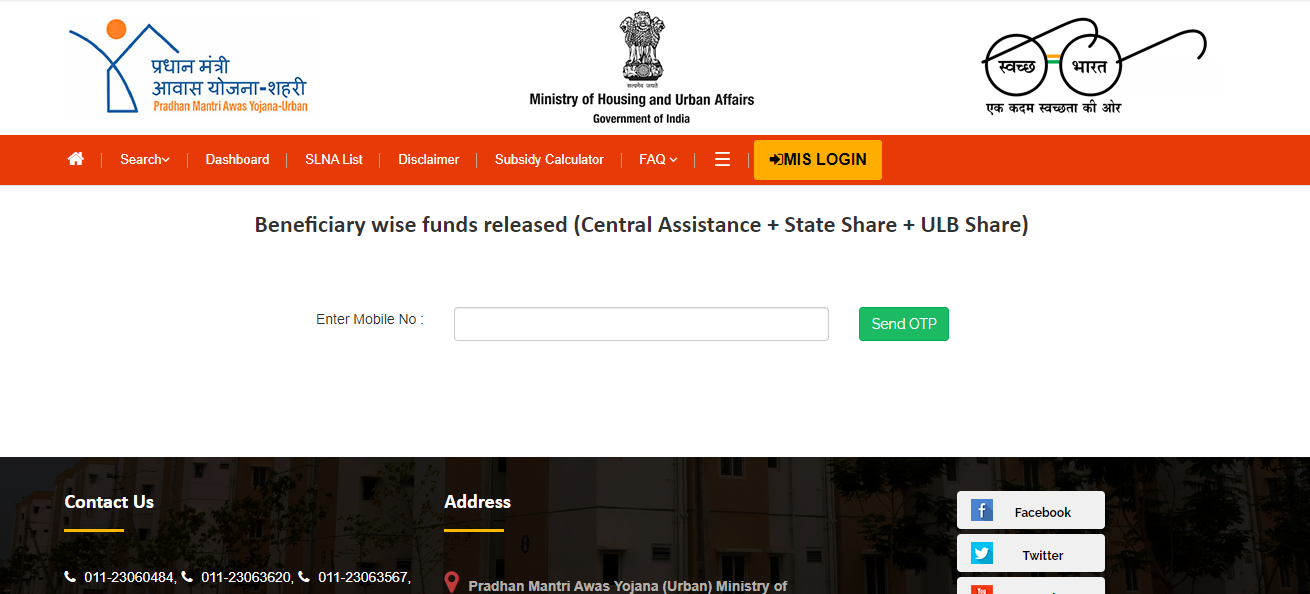

PMAY-U provides convenient online platforms to check beneficiary PMAY(U) MIS is available on the main website.

- Step 1: Go to the main website - pmay-urban.gov.in.

- Step 2: Click on PMAY(U)MIS on the landing page.

- Step 3: After clicking the link, a new window opens, click on the Search Beneficiary option to proceed.

- Step 4: A new window opens, after entering your registered number, to can search for the beneficiary wise funds released.

Track Beneficiary Application Status

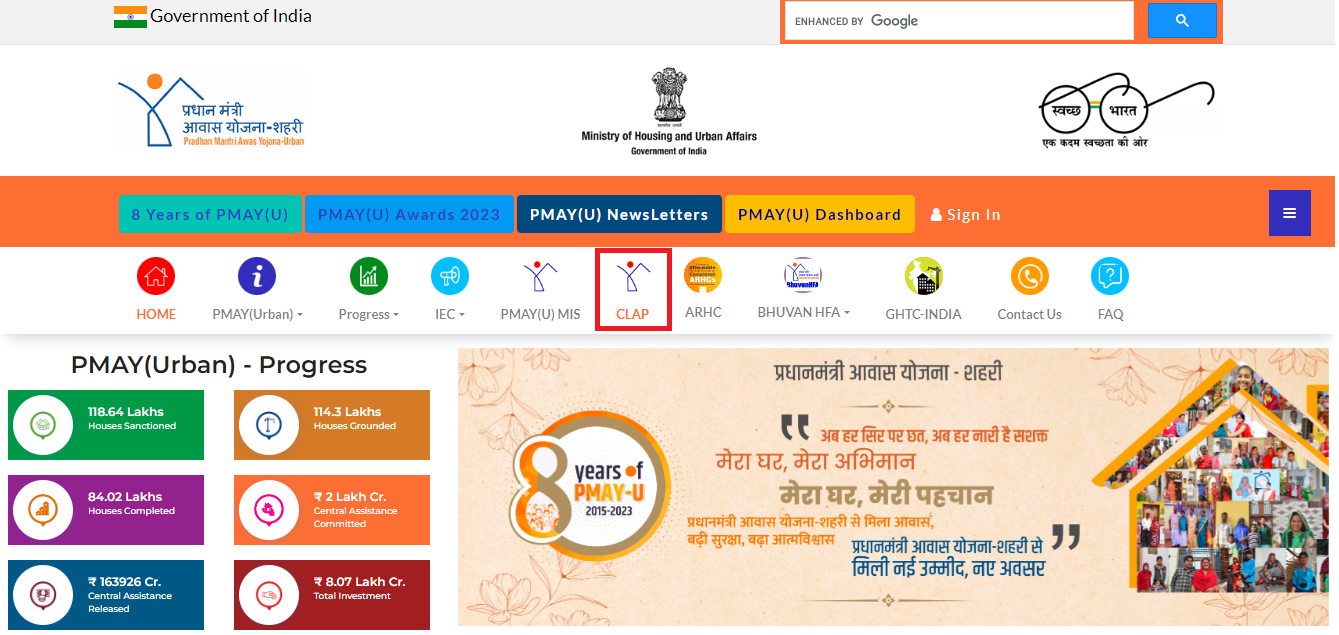

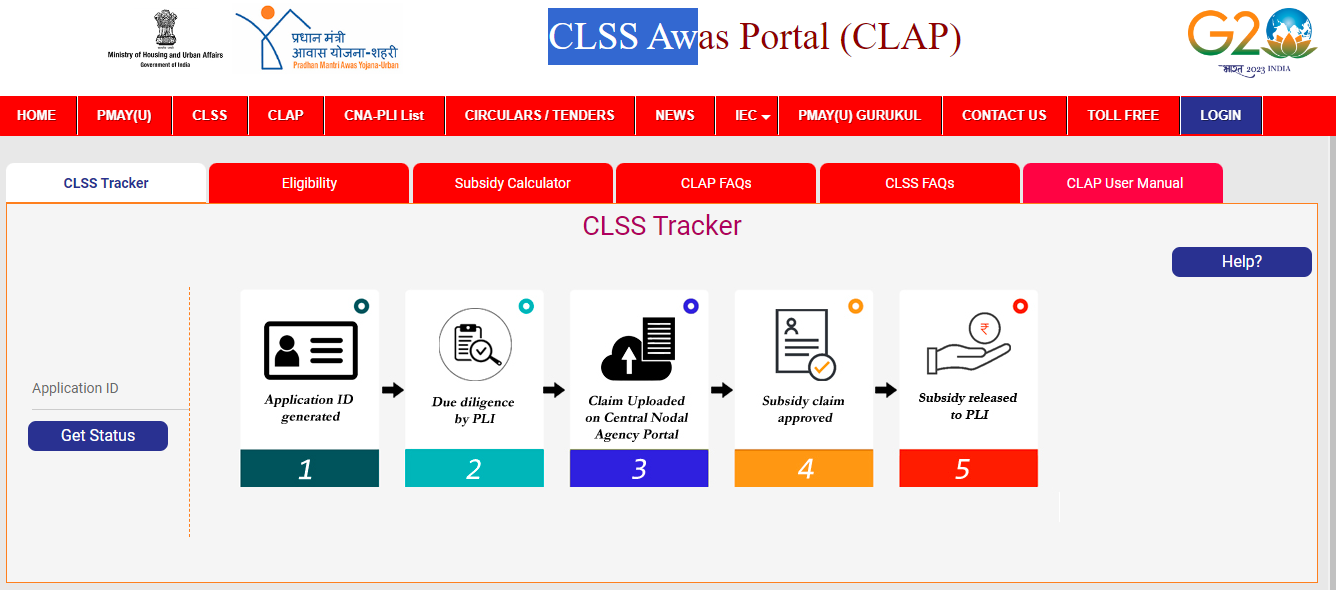

CLAP is the primary online portal for tracking your PMAY-U application status and subsidy details. Follow these steps:

- Step 1: Visit the official website of Pradhan Mantri Awas yojana - Urban.

- Step 2: Click on the CLAP option on the homepage.

- Step 3: On the new window, scroll down and enter the application ID, and then click the Get Status option.

- Step 4: You will receive the application status of the beneficiary.

Helpline

If you face any problem related to the scheme, you can contact us using the details below:

| Address | Landline Number | |

|---|---|---|

| Pradhan Mantri Awas Yojana (Urban) Ministry of Housing and Urban Affairs Nirman Bhawan, New Delhi-110011 | 011-23063285, 011-23060484 | pmaymis-mhupa@gov[Dot]in |