Pradhan Mantri Mudra Yojana

Pradhan Mantri Mudra Yojana (PMMY) is a scheme launched by the Government of India on April 8, 2015. The objective of this scheme is to provide financial support to small and micro businesses.

PMMY aims to facilitate micro units and provide them with sufficient funds to grow their businesses and create employment opportunities.

Online Application

The primary mode of application for MUDRA loans is through the Udyamimitra portal: udyamimitra.in. Before filling out the application form, first one needs to register for the same.

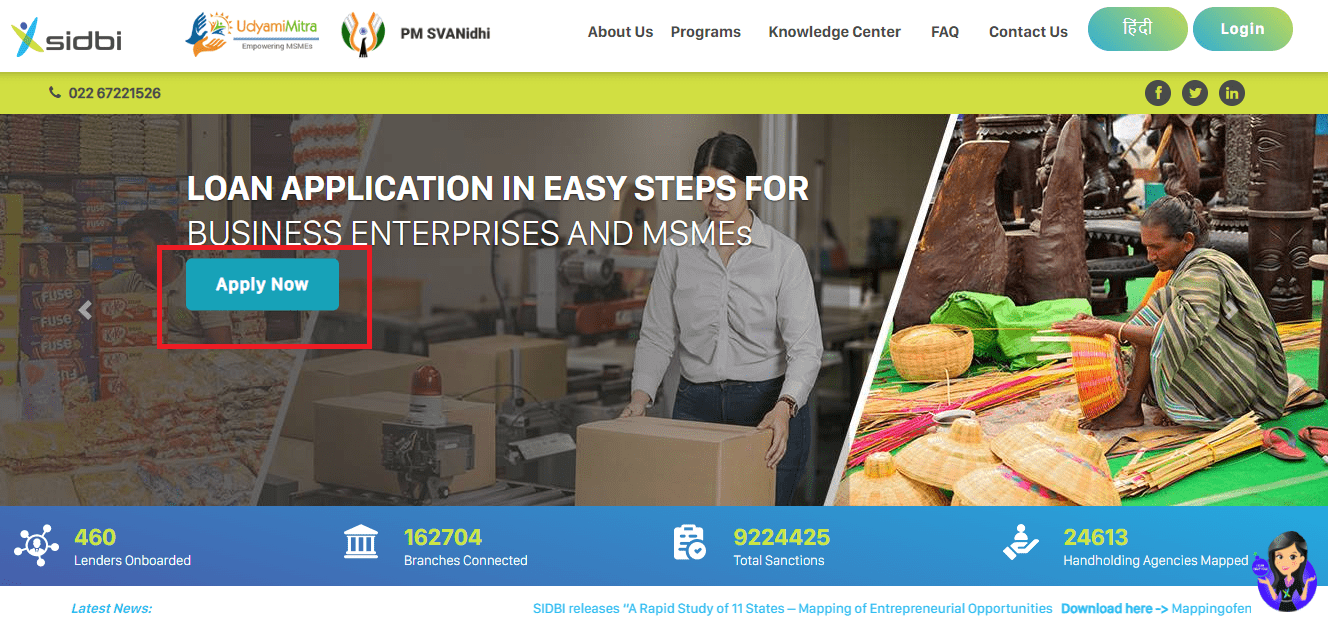

- Step 1: Open the Udyamimitra portal website in your web browser. Click on Apply now.

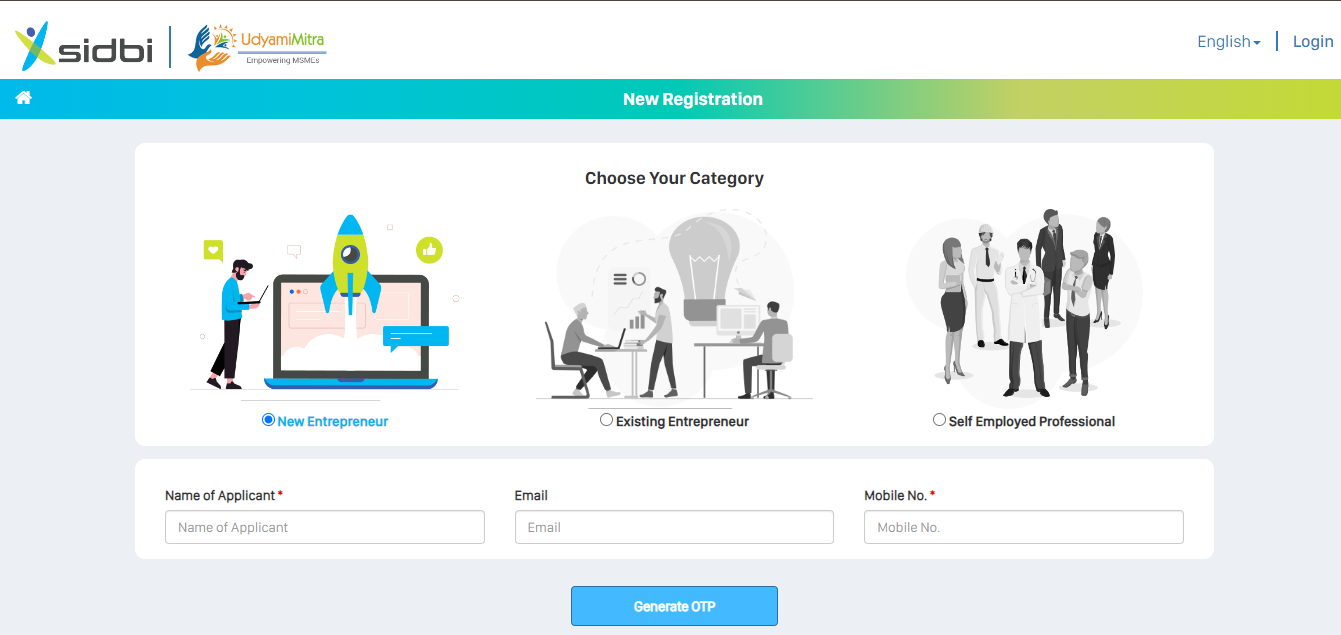

- Step 2: Click on "New Entrepreneur," "Existing Entrepreneur," or "Self-employed Professional" depending on your situation. Follow the on-screen instructions to complete the registration process.

- Step 3: Once registered, log in to the portal using your credentials.

Filling the Online Application Form

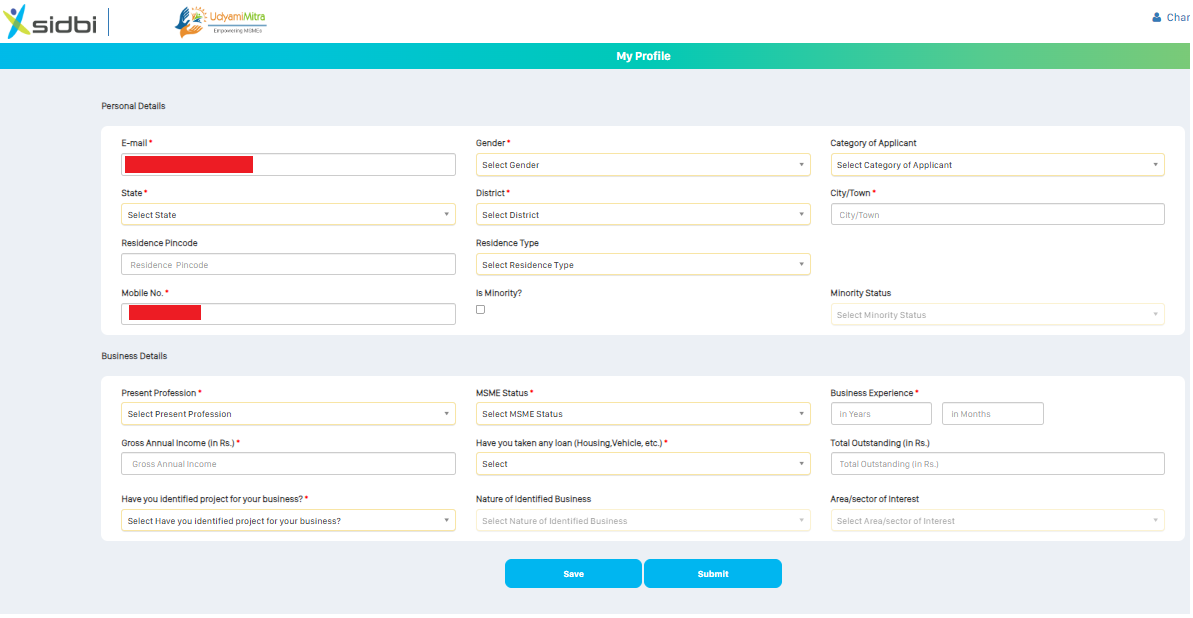

After successful registration, you will be able to access the online application form. Here's what you need to do:

- Step 1: Fill in your details like name, address, contact information, and professional details like your business experience and skills relevant to your proposed activity.

- Step 2: Select the MUDRA loan category that best suits your funding needs – Shishu (up to ₹50,000), Kishore (₹50,000 to ₹5 lakh), or Tarun (₹5 lakh to ₹10 lakh).

- Step 3: Provide details about your business, including its name, activity, industry type (manufacturing, service, trading, etc.), and nature of operations.

- Step 4: Fill in details like owner details, existing banking facilities (if any), the amount of credit you're applying for, and your preferred lending institution (if any).

- Step 5: Upload scanned copies of all the required documents mentioned earlier. Ensure the scanned copies are clear and legible.

- Step 6: Upon successful submission, you will receive an application reference number for future reference.

Documents Required

Before initiating the online application, ensure you have all the necessary documents readily available. The specific documents required will vary depending on the loan category (Shishu, Kishore, or Tarun). Here's a general list:

- For All Loan Categories

- Identity Proof: Self-attested copy of any valid government-issued ID like Voter ID, Driving License, PAN Card, Aadhaar Card, or Passport.

- Proof of Residence: Recent utility bill (electricity bill, telephone bill) not older than two months, or Voter ID, Aadhaar Card, or Passport (self-attested copy).

- Applicant Photograph: Two recent coloured passport-sized photographs.

- Applicant Signature: A signed document with your signature.

- Business Details: Copies of relevant licenses, registration certificates, or other documents about the ownership, identity, and address of your business unit (if applicable).

- Additional Documents (Depending on Loan Category)

- Shishu Loan (Up to ₹50,000)

- Quotation for machinery/items to be purchased (if applicable).

- Details of suppliers (if applicable).

- Kishore and Tarun Loans (Above ₹50,000):

- Bank statements for the past six months (if you have an existing bank account).

- Last two years' balance sheets and income tax/sales tax returns (applicable for loans above ₹2 lakh).

- Projected balance sheets for one year in case of working capital limits and for the period of the loan in case of term loans (applicable for loans above ₹2 lakh).

- Sales achieved during the current financial year up to the date of application submission.

- Project report for the proposed project (for loans above a certain amount, as specified by the lender).

- Company documents (Memorandum & Articles of Association/Partnership Deed) for companies/firms.

- In the absence of a third-party guarantee, some lenders may ask for an Asset & Liability statement from the borrower, including Directors & Partners, to assess net worth.

Interest Rates and Processing Charges

- Interest Rates: Interest rates for MUDRA loans are determined by the lending institutions based on Reserve Bank of India (RBI) guidelines. These rates are generally competitive and lower than those offered by informal lenders.

- Processing Charges: Banks may levy processing charges as per their internal policies. However, upfront fees for Shishu loans (up to ₹50,000) are often waived by most institutions.

MUDRA Card

The MUDRA Card is like a debit card you get when you take a MUDRA loan. It helps you manage the money you borrow for your business expenses. With this card, you can withdraw cash or make payments easily.

You can use it as many times as needed, helping you manage your loan in a smart and cost-effective way, keeping your interest low.

The card also promotes digital transactions, making it easier to keep track of your spending and build a good credit history. You can use the MUDRA Card at any ATM, micro ATM, or at stores with 'Point of Sale' machines across the country.

Understanding Micro and Small Enterprises (MSEs)

Micro and small businesses that are not corporate or farm-related are the primary focus of the PMMY program. However, exactly what are these entities?

- Micro Enterprises: These are small businesses with an investment in plant & machinery (excluding land & building) not exceeding ₹1 crore and a turnover of up to ₹5 crore.

- Small Enterprises: These are businesses with an investment in plant & machinery (excluding land & building) not exceeding ₹10 crore and a turnover of up to ₹50 crore.

Objectives of PMMY

The PMMY program attempts to solve the key problem of small and micro companies' lack of access to financing.

They frequently lack the credit history or collateral needed to get loans from conventional lenders. This is how PMMY fills the gap:

- Provides Easy Access to Credit: By establishing MUDRA (Micro Units Development & Refinance Agency Ltd.), the scheme facilitates loans up to ₹10 lakh for eligible businesses.

- Simplified Loan Categories: MUDRA loans are categorized into three based on the growth stage and funding needs of the enterprise:

- Shishu: Covering loans up to ₹50,000/- (Suitable for new or small businesses)

- Kishore: Covering loans above ₹50,000/- and up to ₹5 lakhs (Suitable for growing businesses)

- Tarun: Covering loans above ₹5 lakhs and up to ₹10 lakhs (Suitable for established businesses)

- Financial Inclusion: PMMY encourages participation from a wider range of financial institutions beyond traditional banks, such as Micro Finance Institutions (MFIs), Small Finance Banks (SFBs), and Non-Banking Finance Companies (NBFCs). This expands the reach of the scheme and caters to diverse financial needs.

Benefits

The PMMY scheme offers a wide-range of benefits for micro and small businesses:

| Benefit | Description |

|---|---|

| Easy Access to Finance | Provides financial help to small businesses that find it hard to get loans from regular banks. |

| No Collateral Needed | Loans are given without needing to offer any security or collateral. |

| Encourages Entrepreneurship | Supports people in starting their own businesses. |

| Employment Generation | Helps create new jobs by supporting small businesses. |

| Flexible Repayment Terms | Offers easy and flexible terms for paying back the loan. |

| Boosts Economic Growth | Contributes to the country's economic development. |

| Promotes Financial Inclusion | Brings more small businesses into the formal banking system. |

| Focus on Women and Weaker Sections | Gives special attention to women and weaker sections, helping them improve their status. |

| Covers Various Activities | Supports a wide range of business activities like manufacturing, trading, and services. |

| Supports Startups | Provides necessary funds to new businesses to help them get started. |

Eligibility Criteria

A wide range of micro and small enterprises can benefit from PMMY loans. Below are the eligibility criteria:

| Criteria | Details |

|---|---|

| Age | Applicant must be at least 18 years old. |

| Business Type | Small and micro enterprises engaged in manufacturing, trading, or services. |

| Existing Business or Startup | Both existing businesses and new startups are eligible. |

| Indian Citizenship | Applicant must be an Indian citizen. |

| Creditworthiness | Applicant should have a good credit history and a viable business plan. |

| No Previous Default | Applicant should not have defaulted on any loans from financial institutions. |

| Business Plan | A clear and viable business plan is required. |

| Non-Agricultural Activities | Business should not be involved in agricultural activities (some exceptions). |

Eligible Borrowers

- Individuals

- Proprietary concerns

- Partnership firms

- Private Ltd. companies

- Public companies

- Any other legal forms